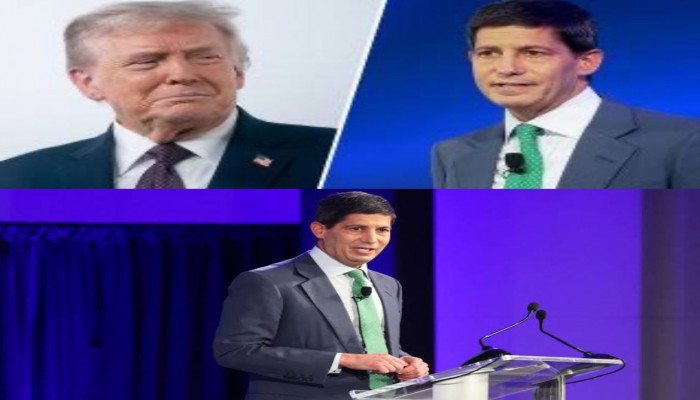

Trump names Kevin Warsh as new Federal Reserve Chair

- In Reports

- 07:14 PM, Jan 30, 2026

- Myind Staff

President Donald Trump has named Kevin Warsh as the next chair of the U.S. Federal Reserve, replacing Jerome Powell after months of tension surrounding the central bank. The announcement ends a five-month period of uncertainty that saw growing political pressure, criticism of the Fed, and debate over its independence.

Trump praised Warsh in a post on Truth Social, saying, “I have known Kevin for a long period of time, and have no doubt that he will go down as one of the GREAT Fed Chairmen, maybe the best.” The nomination marks a significant shift in leadership at a time when the Fed is facing inflation concerns, rising government borrowing, and scrutiny from the Justice Department.

Kevin Warsh, 55, is a former Federal Reserve official with experience in central banking and financial markets. His selection is not expected to cause major disruptions in financial markets because of his background and reputation. David Bahnsen, chief investment officer of The Bahnsen Group, said on CNBC’s Squawk Box, “He has the respect and credibility of the financial markets.” Bahnsen also added, “There was no person who was going to get this job who wasn’t going to be cutting rates in the short term. However, I believe longer term he will be a credible candidate.”

Trump’s relationship with Powell had been strained since Powell took office in 2018. During his first term, Trump repeatedly criticised the Fed and urged it to cut interest rates more aggressively. Even after three rate cuts in late 2025, Trump continued his criticism, pushing for further easing and blaming Powell for cost overruns in the renovation of the Fed’s headquarters in Washington, D.C.

Warsh himself has openly criticised the Fed’s leadership in the past. In a CNBC interview last summer, he called for major changes at the institution, saying, “Regime change” was needed at the Fed. He also stated, “The credibility deficit lies with the incumbents that are at the Fed, in my view.” These remarks suggest that Warsh may take a strong stance within an institution where consensus plays a key role in shaping policy.

Trump’s decision comes at a sensitive moment for the central bank. Inflation has not yet fully returned to the Fed’s 2% target, government debt is increasing, and political pressure on monetary policy has intensified. Recently, the Justice Department subpoenaed Powell over the Fed’s construction project. Powell responded sharply, saying the move was a “pretext” to push the Fed into following Trump’s demands for easier monetary policy.

The nomination has also reignited concerns about the independence of the Federal Reserve. Discussions about tighter White House oversight and possible changes to how interest rates are set have moved beyond theory and into real policy debates. Some proposals even suggest that the Fed chair should consult with the president on rate decisions, raising questions about how much autonomy the central bank will retain.

The process to select the new chair was competitive. At one point, 11 candidates were considered, including former and current Fed officials, economists, and Wall Street professionals. The selection process was led by Treasury Secretary Scott Bessent. Over time, the list was narrowed to five candidates and then four. Trump hinted last week on CNBC that he had made his decision before officially announcing Warsh as his choice.

However, Warsh’s path to becoming chair will not be easy. Republican Senator Thom Tillis has said he will block any Fed nominees until the Justice Department investigation is completed. Beyond political obstacles, economic challenges remain significant. Inflation is still above the Fed’s target, and the labour market has slowed, with the economy facing what has been described as a “no-fire no-hire” environment.

Financial markets do not expect dramatic policy changes under the new leadership. Traders anticipate at most two additional interest rate cuts this year, with the benchmark federal funds rate eventually settling around 3%. Policymakers consider the long-term neutral rate that neither stimulates nor restrains economic growth.

Another key question is what will happen to Jerome Powell. Traditionally, Fed chairs resign from the board after being replaced, but Powell still has two years left in his term as a governor. He could choose to stay on, potentially acting as a counterbalance to political pressure on the Fed. Meanwhile, the Supreme Court is reviewing Trump’s attempt to remove Governor Lisa Cook, a case that could define the limits of presidential authority over the Federal Reserve Board.

Trump’s nomination of Kevin Warsh reflects a turning point in the ongoing debate over monetary policy, political influence, and the future direction of the U.S. central bank. As the confirmation process unfolds, the decision is likely to shape not only the Fed’s leadership but also broader discussions about economic stability and institutional independence in the United States.

Comments