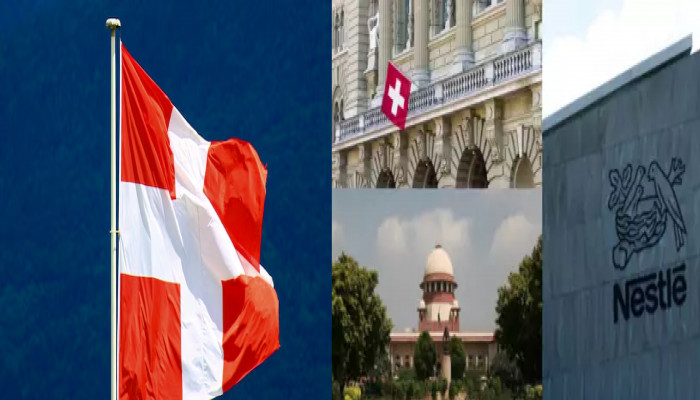

Switzerland revokes 'most favoured nation' status to India following Nestle ruling

- In Reports

- 12:41 PM, Dec 14, 2024

- Myind Staff

The Swiss government has put a hold on the "Most Favoured Nation" (MFN) clause in the tax agreement it has with India, known as the Double Taxation Avoidance Agreement (DTAA). This decision could affect Swiss investments in India and may result in higher taxes for Indian companies doing business in Switzerland.

The Swiss finance department announced this on December 11, explaining that it follows a ruling by India's Supreme Court last year. The court stated that the MFN clause doesn't automatically apply when a country becomes a member of the OECD if India signed a tax treaty with that country before it joined the organisation. India reduced the tax rates on specific forms of income compared to the OECD countries by signing tax treaties with Lithuania and Colombia. Both nations later became members of the OECD. In 2021, Switzerland came to the conclusion that the entry of Colombia and Lithuania into the OECD would result in a dividend rate of 5% under the MFN clause of the India-Switzerland tax treaty, instead of the 10% specified in the agreement.

Starting January 1, 2025, Switzerland will impose a 10% tax on dividends paid to Indian tax residents who claim refunds for Swiss withholding tax, as well as Swiss residents who claim foreign tax credits. This change follows Switzerland's decision to suspend the MFN (Most-Favored-Nation) clause in the tax agreement between Switzerland and India, which helps avoid double taxation on income. The suspension was announced by the Swiss Finance Department. The decision was influenced by a 2023 ruling by India's Supreme Court involving Nestle, a company based in Vevey, Switzerland. As a result, dividends earned by Indian entities in Switzerland will be taxed at 10% starting from January 1, 2025.

The statement claims that after considering the MFN clause in the double taxation avoidance treaty, the Delhi High Court confirmed the validity of the residual tax rates in the Nestle case in 2021. The Indian Supreme Court, however, overturned the lower court's ruling in a decision dated October 19, 2023, concluding that the MFN clause "was not directly applicable in the absence of 'notification' in accordance with Section 90 of the Income Tax Act."

Nangia Andersen M&A Tax Partner Sandeep Jhunjhunwala commented on the Swiss authority's ruling, stating that the unilateral suspension of the MFN clause's application under its tax treaty with India represents a major change in the dynamics of bilateral treaties. "This suspension may lead to increased tax liabilities for Indian entities operating in Switzerland, highlighting the complexities of navigating international tax treaties in an evolving global landscape," he said.

Jhunjhunwala emphasised the importance of aligning treaty partners on how tax treaty clauses are interpreted and applied, to ensure predictability, fairness and stability in the international tax system. Amit Maheshwari, Tax Partner at AKM Global, explained that the key reason for withdrawing the MFN (Most-Favored-Nation) clause is reciprocity, ensuring that taxpayers in both countries are treated equally and fairly. "Swiss authorities announced in August 2021 that based on the MFN clause between Switzerland and India, the tax rate on dividends from qualifying shareholdings would be reduced from 10 per cent to 5 per cent, effective retroactively from July 5, 2018. However, the subsequent Supreme Court ruling in 2023 contradicted the same," Maheshwari said.

This change could affect Swiss investments in India because dividends will now be subject to higher withholding taxes. Starting January 1, 2025, income earned from that date will be taxed according to the original double taxation treaty between Switzerland and India, regardless of the MFN (Most Favoured Nation) clause. Kumarmanglam Vijay, Partner at JSA Advocates & Solicitors, explained that this will particularly impact Indian companies with overseas direct investment (ODI) structures and subsidiaries in Switzerland. The Swiss withholding tax on dividends will increase from 5% to 10% beginning January 1, 2025.

Comments