Requirements for a Robust Pension System in Middle-Income Countries

- In Economics

- 05:47 PM, Oct 22, 2020

- Mukul Asher

Motivation

As global economy, including middle-income countries cope with the economic, social, and political challenges of managing the impact of Covid-19 pandemic, geopolitical uncertainties, managing the advent of digital economy, and with possible, disruptive technologies, progressing towards a more robust pension system has become even more urgent public policy priority.

This column discusses key requirements for progressing towards a robust pension system in middle-Income countries, defined by the World Bank (in July 2019) as those with per capita income between USD 1026 to USD 3995 (Lower Middle-Income), and between USD 3996 and USD 12375 (Upper Middle-Income) 1.

What does a “Robust Pension System” Imply?

Public policy goal concerning constructing a robust pension system should be to facilitate ageing with dignity. A pension system comprises several integrated schemes. To measure total impact, they should be evaluated and viewed in a systemic-way and not as isolated schemes.

It implies that a person should be ageing-in-place, staying at home to the maximum number of years as possible, and have access to a bundle of services needed in old age, especially affordable and accessible health care.

The word “robust” in relation to a pension system is meant to convey the following:

- Pension system is embedded in a reasonable stable economic, regulatory, and macroeconomic environment; and when economic or other shocks (such as Covid-19 Pandemic) occur, there is enough flexibility and capability or competence to undertake short-run social assistance programs on an adequate scale

- The pension system has reasonable trade-offs, given a country’s socio-economic context, between longevity, inflation, and survivor’s risks

- There are context-specific trade-offs between adequacy of benefits, individual, employer, and fiscal affordability, types of risks covered, and coverage of the pension system as a whole. Large differences in these areas between different occupations and groups need to be minimized. The pension system should be perceived as fair. The fairness attribute should not be underemphasized.

The focus of a pension system should be on household welfare and accessible bundle of services to the elderly. (Barr,2002). Each society should decide on what is the bundle of services needed in its current context, and be prepared to change as demographic conditions and aspirations change.

The aim of the pension system should be to enable purchases of bundle of goods, services and assets on a life-cycle basis. Covid-19 pandemic has underlined the importance of public and private health care system for economic and national security.

Therefore, an integrated approach to pension and health care has become essential.

Constructing a robust pension system is qualitatively a very different challenge when retirement period after institutional retirement age extends to 25 to 35 years, as is the case now in most middle-income countries.

Demographic Trends and Implications

- Demographic trends pertain to all the persons in the world, and to their characteristics as consumers, workers, savers, and investors.

- It affects income statements, and balance sheets in the world for:

- Individuals

- Households

- Corporations and companies

- Government (Roy, 2018)

- Policy makers should have access to such demographic research as well as more traditional demographic research.

- In international demographic projections, UN Populations projections (latest revision is for 2019) are used.

- But there are wide variations in numbers depending on the fertility trends (low, medium, high) are used. Usually medium variant is used. But the probability that the numbers in a specific country may depart from medium variant projections should be kept in mind.

- Fertility trends are very difficult to predict, but pension planning must be done ahead of time.

- The variability applies even more when projections move from national to province, state, urban and rural areas level.

- This aspect, often ignored, should be taken into account in pension planning.

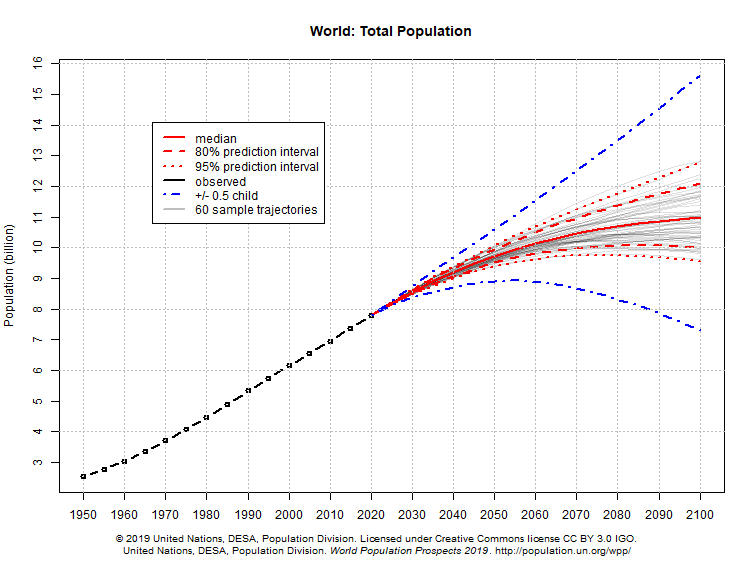

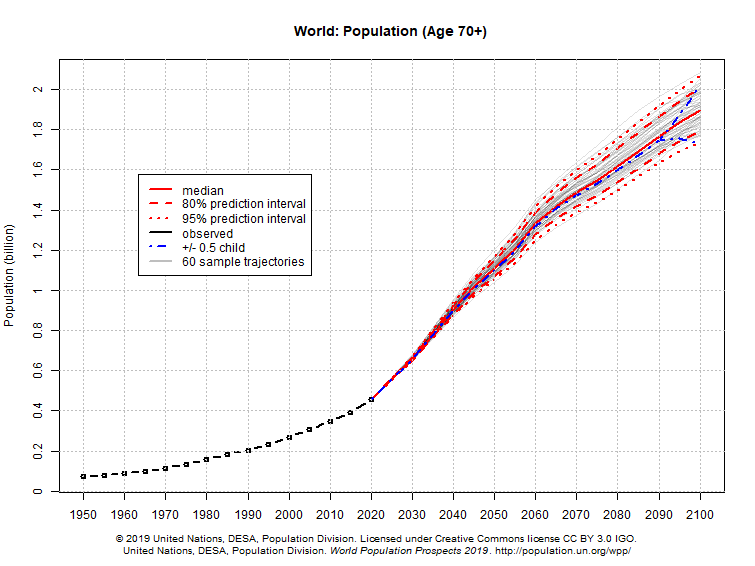

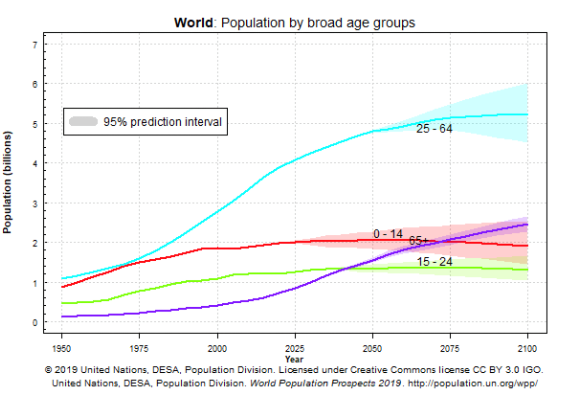

- The next three figures shown the quantitative importance of the variability for 2019 UN projections.

Variations in Global Population Projections

Source: World Population Prospects, 2019 Revision. Accessed on 1 Sept, 2020

Variations in Age 70+ Global Population Projections

Source: World Population Prospects, 2019 Revision. Accessed on 1 Sept, 2020

Demographic Profile Projections

Source: World Population Prospects, 2019 Revision. Accessed on 1 Sept, 2020

Demographic Indicators, Select Middle-Income Countries

Source: World Population Prospects, 2019 Revision. Accessed on 1 Sept, 2020

|

Population (mn) |

Population >65 (mn) |

Population > 80 (mn) |

|||||||

|

2020 |

2040 |

2050 |

2020 |

2040 |

2050 |

2020 |

2040 |

2050 |

|

|

World |

7794.8 |

9198.8 |

9735.0 |

727.6 |

1300.5 |

1548.9 |

145.5 |

305.1 |

426.4 |

|

India |

1380.0 |

1592.7 |

1639.2 |

90.7 |

171.5 |

225.4 |

13.3 |

30.7 |

43.0 |

|

China |

1439.3 |

1449.0 |

1402.4 |

172.3 |

343.8 |

365.6 |

26.6 |

71.9 |

115.3 |

|

Japan |

126.5 |

113.4 |

105.8 |

35.9 |

39.9 |

39.9 |

11.4 |

16.0 |

16.5 |

|

Republic of Korea |

51.3 |

49.8 |

46.8 |

8.1 |

16.4 |

17.8 |

1.9 |

5.0 |

7.1 |

|

Indonesia |

273.5 |

318.6 |

330.9 |

17.1 |

40.3 |

52.5 |

2.4 |

6.5 |

10.8 |

|

Philippines |

109.6 |

135.6 |

144.5 |

6.0 |

13.1 |

17.0 |

0.9 |

2.5 |

3.8 |

|

Singapore |

5.9 |

6.4 |

6.4 |

0.8 |

1.9 |

2.1 |

0.1 |

0.6 |

0.8 |

|

Thailand |

69.8 |

69.0 |

65.9 |

9.0 |

18.1 |

19.5 |

1.9 |

4.9 |

7.1 |

|

Viet Nam |

97.3 |

107.8 |

109.6 |

7.7 |

17.5 |

22.4 |

1.9 |

4.1 |

6.3 |

Demographic Indicators, Select Middle -Income Countries

Source: World Population Prospects, 2019 Revision. Accessed on 1 September, 2020

|

Sex Ratio (Females per 100 males) |

Total Fertility Rate |

|||||

|

Location |

2020 |

2040 |

2050 |

2020 - 2025 |

2040 - 2045 |

2050 - 2055 |

|

World |

101.7 |

101.1 |

100.9 |

2.42 |

2.24 |

2.18 |

|

India |

108.2 |

107.0 |

106.0 |

2.14 |

1.86 |

1.79 |

|

China |

105.3 |

103.7 |

103.5 |

1.70 |

1.74 |

1.75 |

|

Japan |

95.4 |

94.8 |

94.9 |

1.37 |

1.52 |

1.57 |

|

Republic of Korea |

100.2 |

98.9 |

97.9 |

1.08 |

1.32 |

1.44 |

|

Indonesia |

101.4 |

100.4 |

99.9 |

2.22 |

1.95 |

1.88 |

|

Philippines |

100.9 |

99.3 |

98.7 |

2.45 |

2.07 |

1.95 |

|

Singapore |

109.8 |

108.6 |

107.6 |

1.24 |

1.34 |

1.38 |

|

Thailand |

94.8 |

93.2 |

93.5 |

1.46 |

1.48 |

1.54 |

|

Viet Nam |

99.7 |

98.5 |

98.0 |

2.02 |

1.93 |

1.91 |

Key Requirements

Globally, social security and pension arrangements exhibit wide variety of practices and no template or a priori best practices can be relevant for diagnosing what measures are needed to progress towards a robust pension system in a given country.

This increases the need for greater competence in design and implementation of pension policies and initiatives in a context-specific manner.

Key requirements for a robust pension system in a middle-income country, with significant informal sector, may be stated as follows. This task has become even more complicated due to ongoing Covid-19 Pandemic.

Some requirements, such as focusing on bundle of service on a life-cycle basis, and taking a systemic rather than ad-hoc approach focusing on particular schemes, have been mentioned earlier.

- A key requirement, often under emphasized, is that transition and sequencing issues inherent in any pension reform efforts, which alter existing trade-offs, must be explicitly addressed.

- Pension and provident services are provided by government organizations. Without organizational change which is explicitly planned, including in habits and mind-set, and skills-sets with the organization, and its future recruitment practices, progressing towards a more robust pension system becomes difficult.

- Extending social security coverage to the heterogeneous groups comprising the informal sector requires a variety of complementary and integrated initiatives concerning labor market, social assistance involving in-kind (food packages, transport) and cash, and others.

For this, a good data base on informal sector employment and composition of activities are essential.

- Societies as well as households need to rely on multiple sources from which income or receipts in retirement are derived.

- The importance of developing government and corporate bond markets to help provident and pension funds match their longer- term assets and labilities has also been underlined by the covid19 Pandemic

- The importance of innovation and design of pension products and services needs greater recognition. There are several interesting experiments along these lines including micro-pension design and delivery in an environment providing long-term retirement saving security and confidence

- A systemic and integrated approach requires that the focus should be on outcomes and that the following question be asked:

Could the desired objectives-outcomes be achieved in a different (or complementary) way than the standard social protection initiatives

Example: Maternal and child health care indicators can be improved in some countries with less pollution creating indoor cooking material. In that case, health outcomes can improve without standard health programs. Indonesian case study by Imelda, Carlos III, (2020) finds evidence in support of this hypothesis.

India’s Pradhan Mantri Ujjwala Yojana, started in 2016, provides LPG connections to women in lower income households. This has reduced indoor pollution, and freed from the drudgery of fetching wood, cow dung and other indoor polluting fuel (Asher, 2020).

India’s 2014 initiative of Swacch Bharat (Clean Bharat) Abhiyan, by building toilets and ending open defecation, also have private and public health and hygiene benefits, while enhancing security of particularly girls and women.

As of over 0.6 million villages have declared themselves open defecation free, and over 100 million residential toilets have been constructed since 20142.

Concluding Remarks

- It is clear that progressing towards a robust pension system is a PROCESS and not an event. Sustained focus and data-intensive monitoring and evaluation, preferably not just at central but also at decentralized levels of government are needed.

- In this context, each middle-income country is urged to consider setting up a semi-autonomous Centre of Retirement Research or its equivalent, with expertise in large-data analytics and policy research.

- Covid-19 Pandemic has led to the realization of the importance of disaggregated data on labour force, including for informal sector, internal migration trends, and composition of household income and expenditure.

The process of progressing towards a robust pension system is challenging in the current environment. It requires a determined and well-executed departure from “business as usual”. This in turn requires managing political economy, and politics of reform.

Some of the key areas are:

- Change in the purpose of the pension and provident fund organizations, shifting from process to outcome orientation and from welfare-orientation to professionalism.

- Change in the habits and mind-set of stakeholders, including of officials of provident and pension fund organizations, as well as their trustees; and of members, all of whom will need to exhibit greater financial literacy. This is an area deserving much greater attention of the policymakers and regulators.

- There is a need to more effectively and competently leverage emerging technologies for record-keeping, lowering of administrative and compliance costs, and lowering investment management costs.

- The incentive structures of the provident and pension fund organizations, the officials, and the members should be so restructured so as to behave in a manner consistent with their fiduciary responsibilities, and to enhance transparency and accountability

References

- https://blogs.worldbank.org/opendata/new-country-classifications-income-level-2019-2020 -Accessed on 21 October 2020

- https://sbm.gov.in/sbmReport/home.aspx -Accessed on 21 October 2020

- Asher, Mukul (2020).” Innovative Approach to Social protection in India” Presented at Indian Institute of finance (IIF) International Conference, New Delhi, September 27,2020

- Barr, Nicolas (2002), “Reforming Pensions: Myths, Truths, and Policy Choices,” International Social Security Review, 55; pp.3-36

- Imelda, Carlos III. (2020). “Cooking that Kills: Cleaner Energy access, Indoor pollution, and health” The Journal of Development Economics, 147, pp1025-48

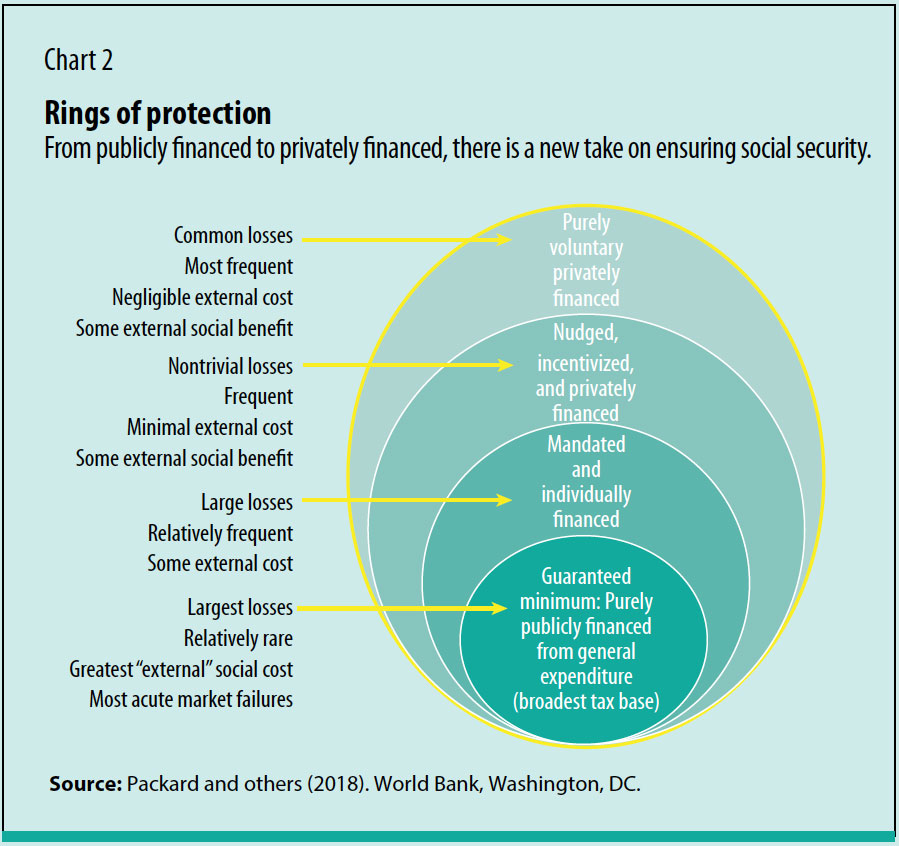

- Packard, Truman, Ugo Gentilini, Margaret Grosh, Philip O’Keefe, Robert Palacios, David Robalino, and Indhira Santos. 2018. "On Risk Sharing in the Diverse and Diversifying World of Work." Social Protection and Jobs White Paper, World Bank, Washington, DC.

- Roy, Amlan (2018). “Global Retirement and Demographics: ASEAN Focus” London: SSGA (State Street Global Advisors). Permission of Dr Roy has been obtained.

Image Credit: World Bank Blogs-World Bank Group https://blogs.worldbank.org/psd/pension-payments-and-pandemics-four-potential-policy-responses

Comments