RBI raises repo rate by 50 bps to cool inflation, third hike in a row

- In Reports

- 07:47 PM, Aug 05, 2022

- Myind Staff

The Reserve Bank of India (RBI) on Friday raised the benchmark lending rate by 50 basis points to 5.40 percent to tame inflation.

With the latest hike, the repo rate or the short-term lending rate at which banks borrow has crossed the pre-pandemic level of 5.15 percent.

This is the third consecutive rate hike after a 40-basis point in May and 50 basis point increase in June. In all, the RBI has raised the benchmark rate by 1.40 percent since May this year.

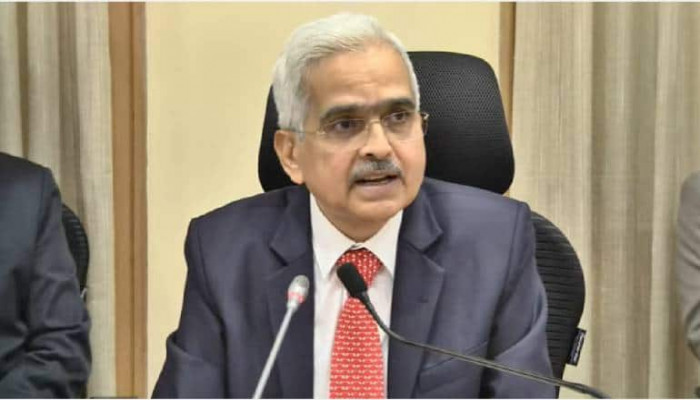

All six members of the Monetary Policy Committee (MPC), headed by RBI Governor Shaktikanta Das, unanimously voted for the rate hike.

The Consumer Price Index (CPI) based inflation, which RBI factors in while fixing its benchmark rate, stood at 7.01 percent in June. Retail inflation has been ruling above the RBI’s comfort level of 6 percent since January this year, news agency PTI reported.

Inflation based on the Wholesale Price Index (WPI) remained double-digit for 15 months in a row. The WPI reading was at 15.18 percent in June.

"The RBI continued to 'front-load' its rate hikes in line with our expectations. The central bank highlighted that while inflation might moderate in the coming months, uncertainty around these pressures continues to remain high, necessitating the need for a 50-bp rate hike. Expect the RBI to take the repo rate to 5.75 percent in this cycle," said Sakshi Gupta, Principal Economist at HDFC Bank.

The latest RBI action follows the Bank of England raising the rate by 50 basis points, the biggest hike in 27 years, to 1.75 percent.

Last month, the US Federal Reserve effected its second consecutive 0.75 percentage point interest rate increase, taking its benchmark rate to a range of 2.25-2.5 percent.

Image courtesy: Money Control

Comments