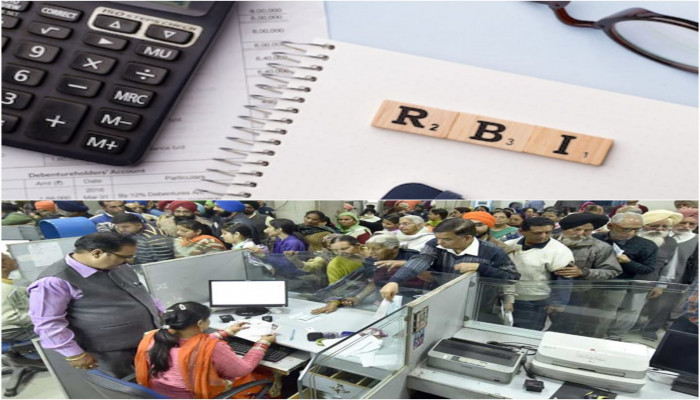

RBI imposes curbs on New India Co-operative Bank

- In Reports

- 07:58 PM, Feb 14, 2025

- Myind Staff

The Reserve Bank of India (RBI) imposed restrictions on the Mumbai-based New India Co-operative Bank over supervisory concerns. Due to liquidity issues, depositors are unable to withdraw their funds.

These restrictions took effect on Thursday, February 13, and will remain in place for six months, with the possibility of review.

The RBI explained that the restrictions were imposed due to recent significant developments impacting the bank. The decision is intended to safeguard depositors and maintain financial stability. The central bank also stated that it will assess the situation and determine the next steps accordingly.

The depositors are panicking about it. According to an ANI report, a crowd gathered outside the New India Co-operative Bank after the RBI announced its decision to suspend all business operations.

A Mumbai resident, Seema Waghmare, a bank customer, voiced her frustration and said to ANI, "We deposited money just yesterday, but they did not say anything... They should have told us that this was going to happen... They are saying that we will get our money within 3 months... We have EMIs to pay; we have no idea how we will do all of that..."

The financial health of New India Co-op Bank was affected by losses. The bank recorded a loss of ₹22.78 crore in FY24, following a loss of ₹30.75 crore in FY23. By the end of FY24, the bank’s total advances amounted to ₹1,175 crore, while its deposits stood at ₹2,436 crore. Out of the total ₹2,436 crore in deposits, ₹671.51 crore was held in savings accounts, ₹103.21 crore in term deposits, and ₹1,652.25 crore also classified as term deposits.

Before the recent restrictions, the bank had introduced several policy changes.

The NICB mPassbook app was discontinued on December 21, 2024. Additionally, the bank stopped issuing Visa and MasterCard on January 15, 2025, replacing them with the RuPay NCMC Platinum Card.

From January 15, 2025, the bank began drilling open lockers that had been inactive for over seven years or had unpaid rent for three years. Customers were encouraged to update their KYC details, adopt digital banking services, and ensure their mobile numbers were registered with the bank. The bank advised customers to nominate beneficiaries to prevent complications in fund transfers.

The latest restrictions imposed by the RBI have significant implications for the bank's affected depositors. Customers cannot withdraw money from their savings, current, or any other type of account until further notice. However, the bank is allowed to offset loans against deposits by RBI guidelines.

Despite the curbs, essential payments such as employee salaries, rent, and utility bills can still be processed. Additionally, the bank is prohibited from issuing new loans, renewing existing ones, making investments, or accepting fresh deposits without prior approval from the RBI. To safeguard depositors, the Deposit Insurance and Credit Guarantee Corporation (DICGC) ensures that eligible customers can claim up to ₹5 lakh in case of financial distress.

Comments