Observations on India’s Debt Profile: An International Perspective

- In Economics

- 08:54 PM, Nov 21, 2022

- Mukul Asher

This column examines India’s total nominal debt to nominal GDP ratio in the first quarter of 2022 from various segments from an international perspective. The debt analysis is not just confined to the general government sector debt as is often the case, but also includes households, and corporate sector debt as well.

Managing debt is emerging as an important policy issue in the fragile global social and economic environment, with slower growth and tightening of monetary and/or fiscal policies. IMF, in its World Economic Outlook for October 2022 has noted that- “Global economic activity is experiencing a broad-based and sharper-than-expected slowdown, with inflation higher than seen in several decades. The cost-of-living crisis, tightening financial conditions in most regions, Russia’s invasion of Ukraine, and the lingering COVID-19 pandemic all weigh heavily on the outlook”.

Global growth is forecast to slow from 6.0 percent in 2021 to 3.2 percent in 2022 and 2.7 percent in 2023. This is the weakest growth profile since 2001 except for the global financial crisis and the acute phase of the COVID-19 pandemic. Global inflation is forecast to rise from 4.7 percent in 2021 to 8.8 percent in 2022 but to decline to 6.5 percent in 2023 and to 4.1 percent with slower growth, by 2024.

Monetary policy should stay the course to restore price stability, and fiscal policy should aim to alleviate the cost-of-living pressures while maintaining a sufficiently tight stance aligned with monetary policy... Risks to the outlook remain unusually large and to the downside1.

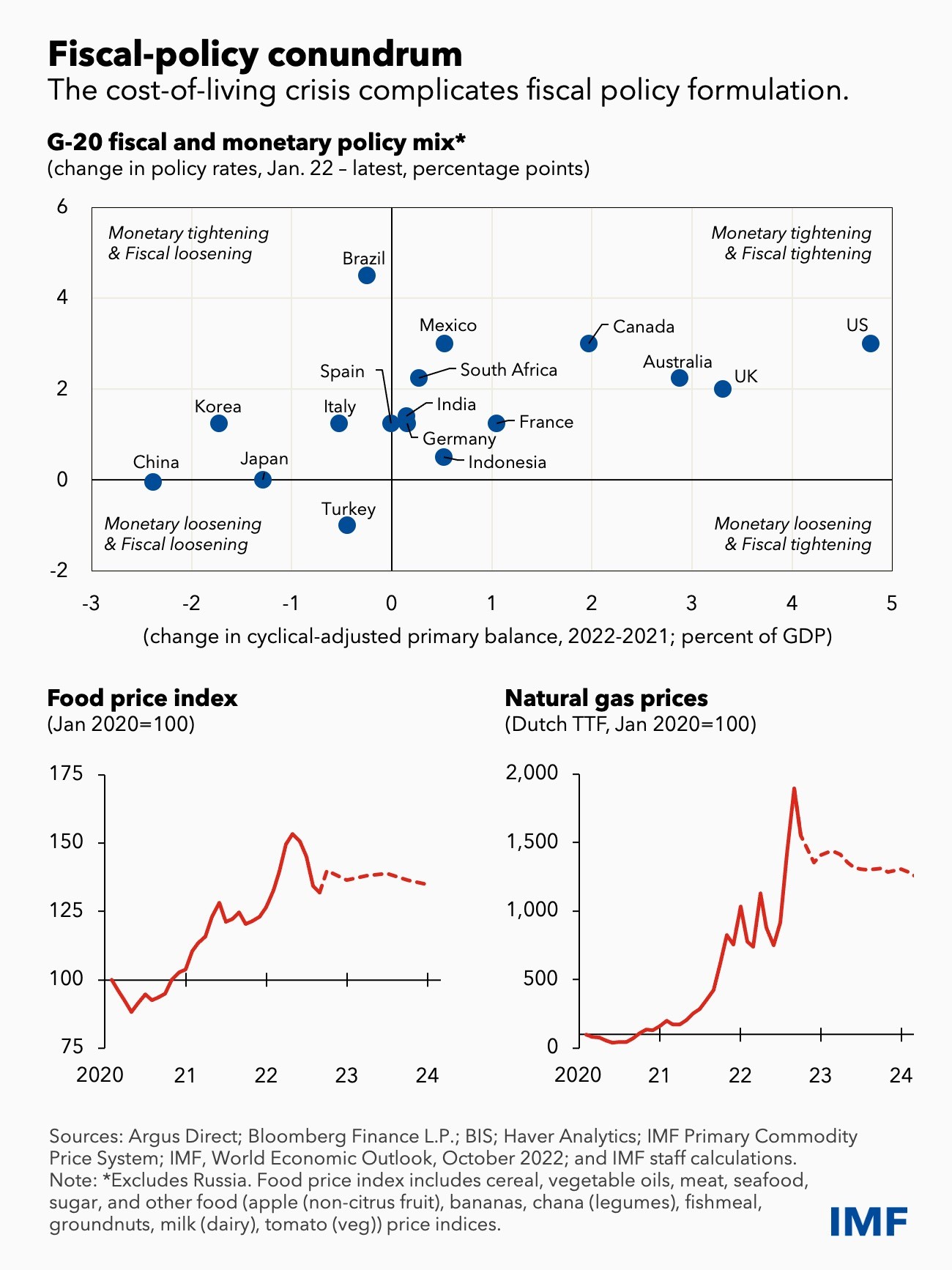

IMF also reports that several G20 countries will tighten both monetary and fiscal policies, while several countries are expected to tighten monetary policy. These policy stances will have implications for interest rates at which debt could be rolled over, complicating debt management, and for inflation. High food and natural gas price inflation, though easing, is expected to have serious adverse impacts on low- and middle-income households in many countries. (See Figure 1)

https://www.imf.org/en/Blogs/Articles/2022/10/11/policymakers-need-steady-hand-as-storm-clouds-gather-over-global-economy -Accessed on 19 November 2022.

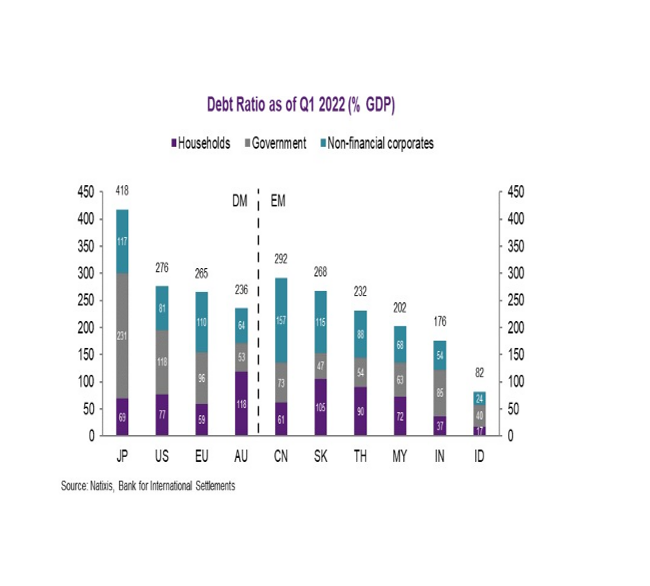

Figure 2 provides total nominal debt to nominal GDP ratios for India and select countries, divided into household, government, and corporate debt for the first quarter of 2022. It should be noted that debt is a stock concept while GDP is a flow concept. Variability in the quality of data among countries suggests a cautious nuanced interpretation of numbers in Figure 2. It should also be noted that debt, particularly government debt, is only one component of the balance sheet. Governments, for example, have various types of physical and monetary assets, as well as tax powers over income and expenditure flows. Thus, debt ratios should not be interpreted mechanically.

Figure 2: Total Debt to GDP Ratios of India and the Selected Countries, 2022, Quarter 1

The data in Figure 2 suggest the following.

(1) Total Debt: Japan at 418 percent of GDP has by far the highest total debt to GDP ratio among the sample countries. As Japan’s medium-term growth prospects are very subdued, such a high ratio in the environment of rising interest rates, and a lower than past average ratio of world GDP growth over the global volume of trade in goods and services, may pose serious policy challenges to all its stakeholders. Indonesia has the lowest ratio at 82 percent, with its relatively less developed capital markets, and its conglomerates relatively more focused abroad among the contributory reasons. India has the second lowest ratio at 178 percent of GDP.

There are several other countries whose total debt to GDP ratio may be regarded as high. These are China (292 percent), the United States (276 percent), South Korea (268 percent), and European Union as group (265 percent). In the current low growth, and rising interest rate environment, stakeholders in these countries will also face complex trade-offs as they adjust to the new global environment. They moved towards both fiscal and monetary tightening. However, as data in Figure 1 suggest, only Spain (part of EU), and South Korea are continuing with fiscal loosening. The others have moved towards both fiscal and monetary tightening.

(2) Household Debt: Since the 2008 financial crisis, several countries, such as Canada. Have introduced macroprudential policies designed to regulate household debt. Overleveraging by households and its negative impact on other sectors and on macroeconomic policies have motivated these policies. More frequently used rules relate to loan-to-value ratios and debt-to-income ratios.

Among the sample countries, Australia exhibits the highest household debt to GDP ratio of 118 percent, closely followed by South Korea at 105 percent. The other countries with high ratios are Thailand (90 percent), and Malaysia (72 percent). Households in these four countries need to begin the process of deleveraging if they are to make an orderly transition to a more manageable household debt profile. The two countries with the lowest household debt to GDP ratio are once again Indonesia (17 percent), and India (37 percent). Households in these two countries should continue to nurture their frugal habits and aversion to excessive debt-financed expenditure.

(3) Government Debt: In debt analysis, the focus usually is on this component. Fiscal Rules often revolve around government debt-to-GDP ratios and fiscal deficit-to-GDP ratios. The Covid-19 Pandemic and heterogeneity of countries and wide variations in development levels and fiscal capacities have made it more difficult to set national level broadly uniform Fiscal Rules across countries.

Data in Figure 2 suggest that the highest general government debt to GDP ratio is by high-income countries, such as Japan (231 percent), the USA (118 percent), and European Union (96 percent). This is due to a combination of significantly loose monetary policy by their central banks over a prolonged period, and aggressively expansionary fiscal policy to manage the Covid-19 pandemic.

India’s government debt comprises the debt of both the central and 28 state governments. India’s government debt at 85 percent of GDP is on the high side. A realistic medium-term target for India is to progress towards a 70 percent ratio. Both the central and state governments in reaching this target is would need to contribute to this target. The most critical factor is to persistently exhibit as wide a gap as possible between the nominal rate of GDP growth and the rate at which borrowing takes place. In the current era of cooperative and competitive federalism, those states unable to perform in this direction will find it difficult to provide needed infrastructure, amenities, and quality governance.

RBI (Reserve Bank of India) has identified a core subset of highly stressed states from among the 10 states identified by the necessary condition i.e., the debt/ GSDP ratio. The highly stressed states are Bihar, Kerala, Punjab, Rajasthan, and West Bengal. If interest payments to revenue receipts of the State’s ratio is used, highly stressed States are Punjab, Tamil Nadu, Haryana, and west Bengal. If Gross Fiscal Deficit to GDP ratio is used, highly stressed states are Bihar, Rajasthan, Punjab, Uttar Pradesh, Kerala, and Madhya Pradesh2.

That many of the same states appear as highly stressed under different criteria is noteworthy. Different states also are classified as stressed under different criteria. The overall strong inference is that states in the above lists should be focusing on fiscal consolidation, improve public financial management, including better expenditure management, and refrain from any policy measures that adversely affect fiscal space.

Corporate Debt: Among the sample countries, the most highly leveraged corporate sectors, measured by debt to GDP ratio, are China (157 percent), Japan (117 percent), South Korea (115 percent), and the European Union (110 percent). China appears vulnerable to slow growth due to its high corporate debt.

In the current global environment, highly leveraged corporations will face challenges in continuing with high-leverage policies. India’s ratio at 54 percent appears manageable, provided strong corporate financials are maintained.

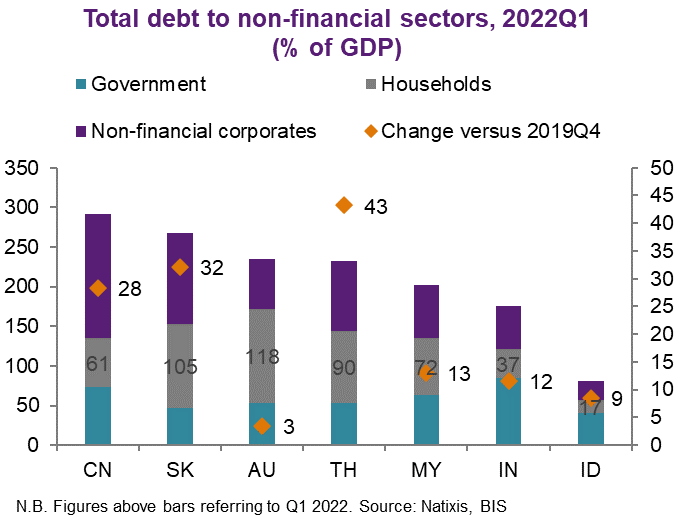

Figure 3 Change in Total Debt to GDP ratio, Select Countries, between 4th Quarter 2019 and First Quarter 2022

Data in Figure 3 suggest, that during the Covid-19 Pandemic period, Thailand added the most debt, 43 percent of GDP, followed by South Korea (32 percent), and China (28 percent). Australia added the least (3 percent), due to its corporate deleveraging, but the government added to its debt stock. Indian households and corporates deleveraged, but the government added significantly to its debt stock. The change in managing high government debt in India has been discussed earlier.

Concluding Remarks

It is essential to examine household, government, and corporate debt trends to assess a country’s total debt profile and design specific policy measures. In this sample, many high-income countries, and countries in East Asia exhibit elevated debt profiles. If there is a prolonged period of slow growth in GDP, a subdued rise in wages and salaries, and a modest rise in corporate earnings, significant adjustments will be required in these countries.

In general, Indonesia and India have a relatively low total debt-to-GDP ratio. They also have added only moderately to their debt during the Covid-19 Pandemic. But India’s government debt to GDP ratio requires a focus on fiscal consolidation, improving expenditure management, and focusing on high growth. Several states in India are highly stressed and they need to pursue even more fiscally responsible policies.

References

1. https://w.ww.imf.org/en/Publications/WEO- Accessed by November 19,2022

2. Mukherjee, Atri, Sharma, Somnath, Seth, Bichitrananda, Agarwal, Rahul, Solanki, Rachit, Khandelwal, Aayushi, and Behera, Samir. (2022). State Finances: A Risk Analysis. Reserve Bank of India. (PDF) State Finances: A Risk Analysis* (researchgate.net) Accessed on 21 November 2022

Image source: ORF

Comments