Observations on Goods and Services Tax (GST) Collection in 2022 by States in India

- In Economics

- 01:23 PM, Mar 02, 2023

- Mukul Asher

The Context

The progress of India’s Goods and Services Tax (GST), based on taxing value-addition, introduced as a dual tax levied by both the centre and the states, in a short period since 2017 when it was introduced, has been commendable. The GST has helped India progress towards the vision of ‘one nation, one sales tax’; and has helped reduce transaction costs of businesses at all levels, while facilitating lower logistics costs toward greater global competitiveness. To implement GST, a Constitutional amendment was needed as in the then-existing Constitution, there was no provision for levying sales tax on goods by the Union government, and the states could not levy sales tax on services.

India is an indestructible Union of states which may be reorganized according to prescribed procedures. Dr B. R. Ambedkar, among the key persons involved in framing India’s post-independence Constitution, has noted that-

“The federation was not the result of an agreement by the states to join in a federation and that the federation not being the result of an agreement, no state has the right to secede from it”.

There are three innovations in the design and implementation of GST which merit brief mention. First, all the compliances and administrative processes for the GST are undertaken through the GST Network (GSTN), a software platform. GSTN is a not-for-profit company equally owned by the Union Government (50 percent share) and all states combined (50 percent share). This is a unique example of a shared services concept designed to economize on expertise, and on software costs.

The Second innovation is the GST Council. This Council is a constitutional body for making recommendations to the Union and State Governments on issues related to the GST. The Centre and the States each had to give up some tax sovereignty to the GST council which is empowered to decide on GST matters. This reflects the maturity of India’s political arrangements.

The decisions of the Council are taken at its meetings. One-half of the total number of members of the Council is the quorum for conducting a meeting. Every decision of the Council is to be taken by a majority of not less than three-fourths of the weighted votes of the members present and voting at the meeting.

The decision is taken in accordance with the following procedures:

(i) The vote of the central government has a weightage of one-third of the total votes cast in the meeting.

(ii) The votes of all the state governments combined have a weightage of two-thirds of the total votes cast in that meeting.

Since its inception, there have hardly been occasions when a decision was made by voting. The consensus among all parties in arriving at the decisions has been the norm, reflecting the working of cooperative federalism in the Council. The Central Government has never had to use its veto till now, i.e., as of February 2023.

The third innovation concerns implementation through digital technology on the scale. As an example, an e-way Bill, an electronic way-bill for the movement of goods has been introduced. This Bill has to be generated on the e-way Bill portal. A person registered under GST cannot transport goods in a vehicle without an e-way Bill if the value exceeds INR 50,000. Till 26th June 2022, around 2780 million e-Way bills have been generated since its introduction in April 2018.

An e-way Bill ensures that the goods are transported in line with GST norms and the relevant data is uploaded before the commencement of transportation of goods. This is designed to track the movement of goods and avoid tax evasion.

The outcome has been a significant increase in the number of GST-registered businesses, including an increasing number of micro-small-medium-enterprises (MSMEs). Thus, when the GST started functioning in July 2017, only 0.47 million migrated from the old tax regime. But as of April 2022, the number of businesses registered for GST was 1.38 million1.

The above has helped in greater formalization of the economy; and in spite of tax reductions in GST leviable goods and services revenue has been increasing in a healthy, though unevenly across the country, manner.

GST Revenue at the Centre

In the 2023-24 Budget of the Union Government, gross tax revenue is estimated at INR 33.6 trillion (11.1 percent of GDP), to which the highest contributor is GST (28.6 percent), followed by the Corporation Income Tax (27.4 percent), and Personal Income Tax (26.8 percent). The actual GST collection in 2021-22 was 25.8 percent of gross tax revenue. The GST revenue for 2023-24 is equivalent to 3.31 percent of GDP. If the GST revenue of the States is added, national GST collection will approach 6.0 percent of GDP2.

It should be noted, that India’s overall tax-to-GDP ratio would be around 20 to 22 percent of GDP if state tax revenue is also included. This suggests that assessing India’s tax effort by taking into account only the Union government’s tax collection would lead to erroneous conclusions.

GST Collection by the States

Reliance of the states in India on state-level GST is over two-fifths of their own tax revenue collection. Taxes on petroleum and on alcohol products are other two significant sources of own tax revenue for the states3.

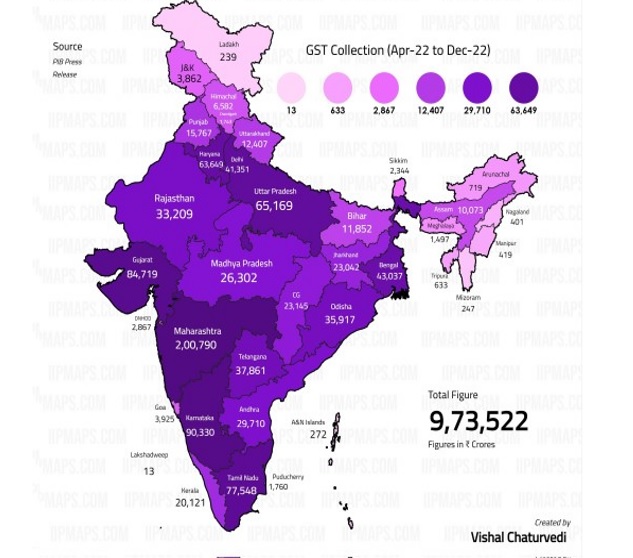

Figure 1 provides official data on GST collection by states from April 2022 to December 2022, on the basis of which the following observations may be made.

GST (Goods and Services Tax) Collection by States, April 2022- December 2022 (INR Crores)

(1 crore=10 million)

First, the total GST collected during the period is reported at INR 9,73,522 crores, of which the State of Maharashtra accounts for little more than one-fifth of the total, by far the highest in the country. Maharashtra is an economically well-diversified state, and its commercial city Mumbai is also the commercial city of the country. One of the contributory factors for its high share is that many businesses get registered in Mumbai, though their business activities are all over the country as well as abroad.

Relatively high GST revenue for Delhi (4.2 percent), and Telangana (3.9 percent) may also be partly explained by companies preferring to register in Delhi and Hyderabad respectively.

For 2022-23, GSDP (Gross State Domestic Product) of Maharashtra was estimated at INR 35.81 trillion (USD 437 billion), the highest in the country4.

Maharashtra appears to have an edge among various states (such as Karnataka, Gujarat, and Uttar Pradesh) aiming to reach GSDP of USD 1000/ billion, especially as it embarked on major infrastructure investments which will create more growth nodes in the state.

Second, Karnataka (9.3 percent of the total), and Gujarat (8.7 percent of the total) are a distant second in GST collection after Maharashtra. As these two states begin to attract company registrations, the difference between them and Maharashtra may moderately narrow.

Third, the GST collection of Tamil Nadu was at 8.0 percent of the total, the fourth highest in the country. The contribution of Uttar Pradesh at 6.7 percent is too low relative to its large population of around 240 million persons as shown in Figure 2. However, with a thrust towards infrastructure spending to make the state more business-friendly, and towards good governance practices, including vastly improved law and order conditions, the performance of Uttar Pradesh is expected to improve significantly in the next few years.

Fourth, the contrast in GST collection between Haryana and Punjab, two neighbouring states in the Northern part of India, is stark. Haryana’s GST collection is four times that of Punjab.

While Gurugram’s key position in the National Capital Region, which many companies registered there, has contributed to Haryana’s performance, arguably public policies and quality of governance in the two states are also likely to have played a role. Punjab’s evident reluctance to reimagine its economy away from taxpayer-subsidized agriculture is a major constraint in its GST collection.

Finally, to sustain GST revenue growth, less uneven across Indian states, and the emergence of many more growth nodes, will be needed. Efforts underway to develop the Northeast region of the country by the current government are commendable in this context.

GST collection per person in 2022

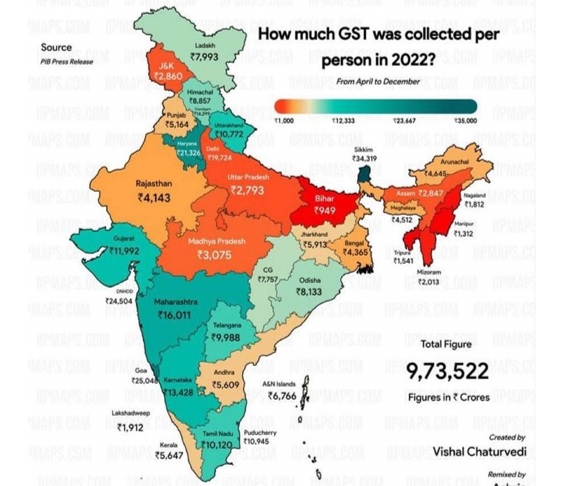

Figure 2: GST collection per person by States in 2022

In broad terms, the ranking in terms of GST collection per person is similar to those of total GST collections. There are however some observations that merit consideration.

First, a stark difference in per person GST collection between Andhra Pradesh (INR 5609), and Kerala (INR 5647) on the one hand and the neighbouring states of Karnataka (INR 13,428), Tamil Nadu (INR 10120), and Telangana (INR 9988) on the other is striking. Again, public policy choices made, and the quality of governance are likely to be significant explanatory factors. It is up to the policymakers in the two lagging states to reimagine themselves if their goal is to improve household welfare in their states.

Second, GST per person in West Bengal, a leading industrial state at the time of independence, at INR 4365 is considerably below that of neighbouring Odisha (INR 8133). Unless, West Bengal makes its governance more business-friendly, inspires confidence to retain talent, and makes large investments, its relative position will continue to worsen.

Third, the pathetic GST revenue collection of Bihar (only INR 949 per person) exemplifies its poor governance over the decades. In contrast, per person, GST revenue of Jharkhand (INR 5913) and Chhattisgarh (INR 7767), both of which were part of Bihar till the year 2000, is several times more than that of Bihar. If the misgovernance of Bihar continues, that will constrain India’s rise, and that of Gangetic plain, where India’s population density is very high.

Fourth, while Assam exhibits by far the highest total GST collection (INR 10,073 crore as shown in Figure 1), its per capita GST collection remains relatively low at INR 2847. Further efforts to develop Assam, Northeast’s largest economy, are likely to bring positive results for GST collection.

Concluding Remarks

Good progress in the implementation of GST is facilitating the emergence of India as one unified internal market, with attendant major benefits in terms of ease of doing business and reduction in logistics costs. Innovative use of digital economy tools on the scale is assisting in expanding the number of GST taxpayers, further facilitating the formalization of the Indian economy.

With the GST firmly rooted, India now has the foundations of a modern tax system, with income tax on corporations and on individuals, and the nationwide sales tax in the form of GST. If a consensus could be reached to bring agriculture income under the income tax, the foundations of India’s tax system will become even stronger.

An analysis of GST collection by the states strongly suggests that to further improve the collection, while perhaps lowering the tax rates, the focus of the Union government, and especially the states should be on policies which help achieve higher broad-based growth, with many more growth nodes created in all states and regions the country and furthering a business-friendly environment. In the current global and domestic environment, the importance of intangibles such as Niyat (intent), and trust in government and institutions cannot be over-emphasized.

References

- https://old.cbic.gov.in/resources//htdocs-cbec/gst/Five%20Years%20Of%20GST%20-%20GST@5.pdf -Accessed on 28 February 2023

- https://www.indiabudget.gov.in/doc/Budget_at_Glance/bag5.pdf-Accessed on 28 February 2023

- https://prsindia.org/files/policy/policy_analytical_reports/State%20of%20State%20Finances%202022-23.pdf-Accessed on 28 February 2023

- https://prsindia.org/budgets/states/maharashtra-budget-analysis-2022-23 -Accessed on 1 March 2023

Image source: The Indian Express

Disclaimer: The opinions expressed within this article are the personal opinions of the author. MyIndMakers is not responsible for the accuracy, completeness, suitability, or validity of any information on this article. All information is provided on an as-is basis. The information, facts or opinions appearing in the article do not reflect the views of MyindMakers and it does not assume any responsibility or liability for the same.

Comments