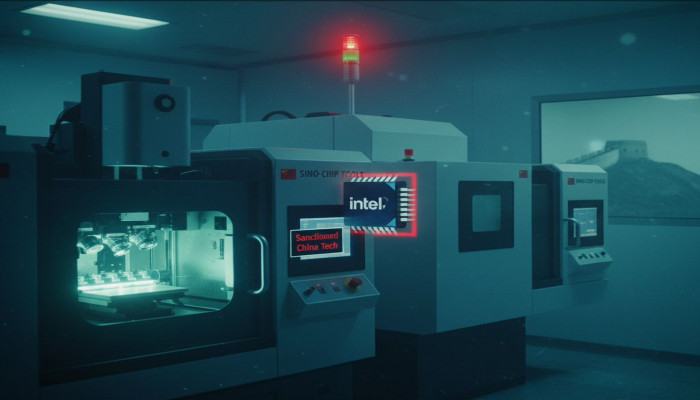

Intel tests chip-making tools from company with links to blacklisted Chinese entities

- In Reports

- 07:21 PM, Dec 13, 2025

- Myind Staff

Intel is once again facing scrutiny over its technology choices after reports revealed that the US chipmaker tested semiconductor manufacturing equipment from a company with close links to China. According to a report by Reuters, Intel evaluated chip-making tools in 2025 supplied by ACM Research, a US-based firm whose overseas units have previously been targeted by US sanctions. The development has raised concerns in Washington, particularly because Intel is now partially owned by the US government and is central to America’s push to rebuild domestic chip-making capacity.

The Reuters report, citing two sources with direct knowledge of the matter, said Intel tested two wet-etch tools manufactured by ACM Research. These tools were assessed for compatibility with Intel’s highly advanced 14A manufacturing process, which is scheduled to be introduced in 2027. The 14A node is considered critical to Intel’s future, especially its ambition to become a major global foundry that manufactures chips for external customers.

Concerns stem from the fact that in 2024, two ACM Research units located in Shanghai and South Korea were barred from accessing US technology. US authorities had accused these units of supporting China by supplying advanced chip-making tools and commercial technology that could have military applications. ACM Research has denied these allegations.

Reuters said it could not confirm whether Intel has decided to use ACM’s tools in its production lines, and there is no evidence that Intel has broken any US regulations by testing the equipment. Testing tools from multiple suppliers is common practice in the semiconductor industry, as companies regularly compare performance, cost and reliability before making purchasing decisions.

However, the issue has attracted attention due to Intel’s strategic importance. With partial US government ownership and substantial federal support, any potential use of tools connected to sanctioned Chinese-linked operations raises national security questions. This is especially sensitive given ongoing US efforts to limit China’s access to advanced semiconductor technologies.

The stakes are particularly high for Intel’s 14A process. The company has previously indicated that the future of this node depends on securing at least one major external customer. Without such a customer, Intel has suggested it could delay or even cancel the 14A project, making the success of this technology a make-or-break moment for its foundry business.

Adding another layer to the controversy is the involvement of Walden International, a venture capital firm founded and chaired by Intel CEO Lip-Bu Tan. Walden International invested in ACM Research in 2019. While no wrongdoing has been alleged, the connection has drawn attention amid the broader debate over governance, transparency and national security.

ACM Research responded to the Reuters report by saying it could not comment on “specific customer engagements.” However, the company confirmed that “ACMR’s US team has sold and delivered multiple tools from our Asian operations to domestic customers.” ACM also said it had shipped three tools to a “major US-based semiconductor manufacturer,” which are currently being tested, and added that some of these tools have already passed performance tests.

In its second-quarter earnings report released in August 2025, ACM Research stated, “We are making important strides in our global expansion efforts, with several tool deliveries planned to the US during the third quarter.” The company has consistently maintained that it does not pose a national security risk. In statements to Reuters, ACM said its US operations are “bifurcated and isolated” from the sanctioned Shanghai unit. It added that US customers are supported directly by American staff, with strong protections in place to safeguard trade secrets and sensitive information.

Wet-etch tools, like those tested by Intel, use liquid chemicals to remove material from silicon wafers. While effective for certain processes, wet etching removes material in all directions, which can widen chip features. Dry etching, by contrast, uses ionised gases for more precise, directional removal but is more complex. Modern semiconductor fabs typically use both techniques. Other major suppliers of etching tools include Applied Materials, KLA, Lam Research and Tokyo Electron.

Cost is another factor driving interest in alternative suppliers. Dan Hutcheson, Vice Chair of TechInsights Inc., told Reuters that tools from ACM Research and some Chinese competitors are “20% to 30% cheaper” than those made by established players like Applied Materials and Lam Research. This pricing advantage creates pressure on traditional suppliers and makes lower-cost options attractive to chipmakers.

Comments