India’s Rs 7000 crore push to boost rare earth magnets manufacturing

- In Reports

- 07:55 PM, Nov 03, 2025

- Myind Staff

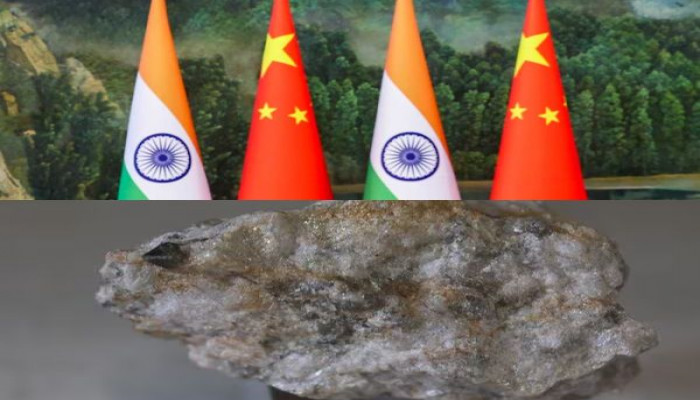

India is planning to triple its incentive programme for making rare earth magnets to over Rs 7,000 crore, or about 788 million dollars, as part of a major effort to reduce its dependence on China, which dominates the global market for these critical materials, Bloomberg reported.

The proposal, which still awaits cabinet approval, marks a sharp increase from the earlier $ 290 million scheme aimed at securing rare earth supplies needed for electric vehicles, renewable energy projects, and defence production. People familiar with the plan told Bloomberg that the final amount could still change.

The decision follows China’s move in April to tighten its export controls on rare earths, which alarmed global automakers and exposed the risks of relying too heavily on a country that processes about 90 per cent of the world’s rare earth materials. Prime Minister Narendra Modi has cautioned against “weaponising critical minerals” and has been calling for more diversified and secure global supply chains.

India’s new plan is similar to efforts by other countries trying to counter China’s control over the sector, but the challenges are significant. The country still struggles with limited funding, a lack of technical expertise, and the environmental complexities of mining rare earths, which often produce radioactive waste.

According to the report, the government plans to support about five companies through production-linked incentives and capital subsidies to help build the industry. However, even though China has recently issued rare earth import licenses for Indian use, none have gone to Indian-origin companies yet.

India is also investing in research to find alternatives that do not rely on rare earths. The government is funding studies on synchronous reluctance motors, a technology that could reduce the use of rare earth materials in electric powertrains.

Interest from global suppliers is growing as well. Several international producers are exploring the Indian market, where demand for rare earth oxides is expected to reach 2,000 tons a year, a volume that foreign suppliers can easily meet.

State-owned companies are leading the effort to form mining partnerships abroad since domestic production is still not financially viable without government subsidies.

Experts have warned that India’s progress could face setbacks if China extends its recent easing of export restrictions, currently available to the United States and the European Union, to India. Such a move could flood the market with cheaper Chinese magnets and discourage investment in India’s emerging supply chain.

Comments