India's fiscal health outshines the West as government debt decreases

- In Reports

- 12:15 PM, Feb 09, 2024

- Myind Staff

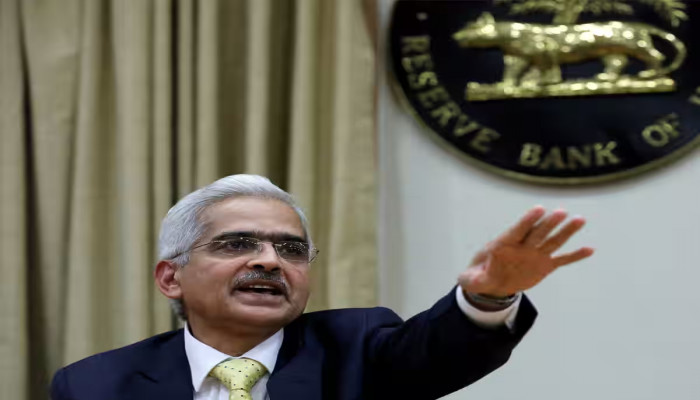

Reserve Bank of India Governor Shaktikanta Das has stated that the country's debt is anticipated to decrease gradually due to fiscal consolidation and optimistic growth prospects. Presently, India's debt-to-GDP ratio, at the general government level, stands at over 81%.

The government has established a fiscal consolidation path aimed at reducing the deficit to below 4.5% of the GDP by the fiscal year 2025-26 (April-March). In the Interim Budget for 2024-25 presented on February 1, the finance ministry underscored its commitment to this goal by forecasting a fiscal deficit for the next year lower than anticipated, standing at 5.1% of the GDP, and revising this year's target by 10 basis points to 5.8% of the GDP.

The government manages its fiscal deficit and addresses prior debt obligations through debt receipts. Consequently, effective control over the fiscal deficit enables the government to manage its future debt more efficiently and accelerate the repayment of existing debt.

"It (debt-to-GDP ratio) has already come around 81% or so. By 2028, according to the IMF's (International Monetary Fund's) fiscal monitor, it is expected to be around 80%," Das said.

In December, the International Monetary Fund (IMF) raised concerns about the long-term risk to the Indian economy regarding debt sustainability. The multilateral agency indicated that India's debt could surpass 100% of the GDP in the medium term if the country encounters shocks that it has historically experienced.

The Fifteenth Finance Commission has recommended that the government bring down the debt-to-GDP ratio under 60%, with the central government's debt below 40% and that of states below 20%. However, Finance Secretary T.V. Somanathan recently said the commission's target needs reconsideration. "It (40%) is a figure that was set before (the) COVID (pandemic), its relevance today is something that has to be looked at afresh," he said.

Due to the impact of the COVID-19 pandemic, India's fiscal deficit surged to 9.2% in the financial year 2020-21. As a consequence, the government's market borrowing saw a significant increase, doubling to 15.43 trillion rupees on a gross basis in the current financial year, compared to 7.1 trillion rupees in the pre-pandemic year of 2019-20.

On Wednesday, Finance Minister Nirmala Sitharaman stated that the government is aware of the country's debt-to-GDP ratio and is implementing measures to address and manage it.

Compared to the advanced economies, India is placed better in terms of debt, Das said. "The debt-to-GDP of advanced economies is much higher than the debt-to-GDP level of emerging market economies," the head of the central bank said. "There are several advanced economies that have high fiscal deficit, in the range of 7% to 8%."

Governor Shaktikanta Das has expressed concern that debt sustainability may emerge as a new source of stress for the global economy, foreseeing the global debt-to-GDP ratio reaching 100% by the end of the decade. He said, "Amidst the current headwinds, elevated level of public debt is raising serious concerns on macroeconomic stability in many countries."

"The debt has to be sustainable for the long-term stability of the global financial system," Das said.

Image source: X

Comments