India’s Exhibits Relatively Healthy and Resilient External Sector

- In Economics

- 04:33 PM, Jul 04, 2024

- Mukul Asher

The context

In its April 2024 World Economic Outlook, IMF (International Monetary Fund) projects that the forecast for global growth five years from now—at 3.1 percent annually—is at its lowest in decades. It notes that the lower predicted growth in output per person stems, notably, from persistent structural frictions preventing capital and labour from moving to productive firms.

The report states that India’s real GDP growth was 7.8 percent in 2023, and projects 6.8 and 6.5 percent growth for 2024 and 2025 respectively, implying it is expected to continue to grow at more than twice the rate of global average1.

India has also managed to control inflation at moderate levels. Thus, the RBI (Reserve Bank of India) projects headline inflation or the CPI for Q1FY25, Q2FY25, Q3FY25, and Q4FY25 at 5%, 4%, 4.6%, and 4.7%, respectively. The CPI, the Consumer Price Index, analyses the retail inflation of goods and services in the economy across 260 commodities. The CPI-based retail inflation considers the price changes at which the consumers buy goods. The data is collected separately by the Ministry of Statistics and Program Implementation and the Ministry of Labour.

This column argues that India’s healthy and resilient external sector will help India manage and navigate the volatile and uncertain global environment.

Select External Sector Indicators

- Healthy balance between foreign exchange reserves and external debt: According to the Reserve Bank of India (RBI), India’s foreign exchange reserves as of June 21 2024 were USD 653.7 billion, while its external debt as of March end 2024 was USD 663.8 billion (18.7 percent of GDP). This represents more than adequate capacity to service India’s external debt. India’s short-term external debt is about one-fifth of the total, providing a healthy cushion in external debt management.

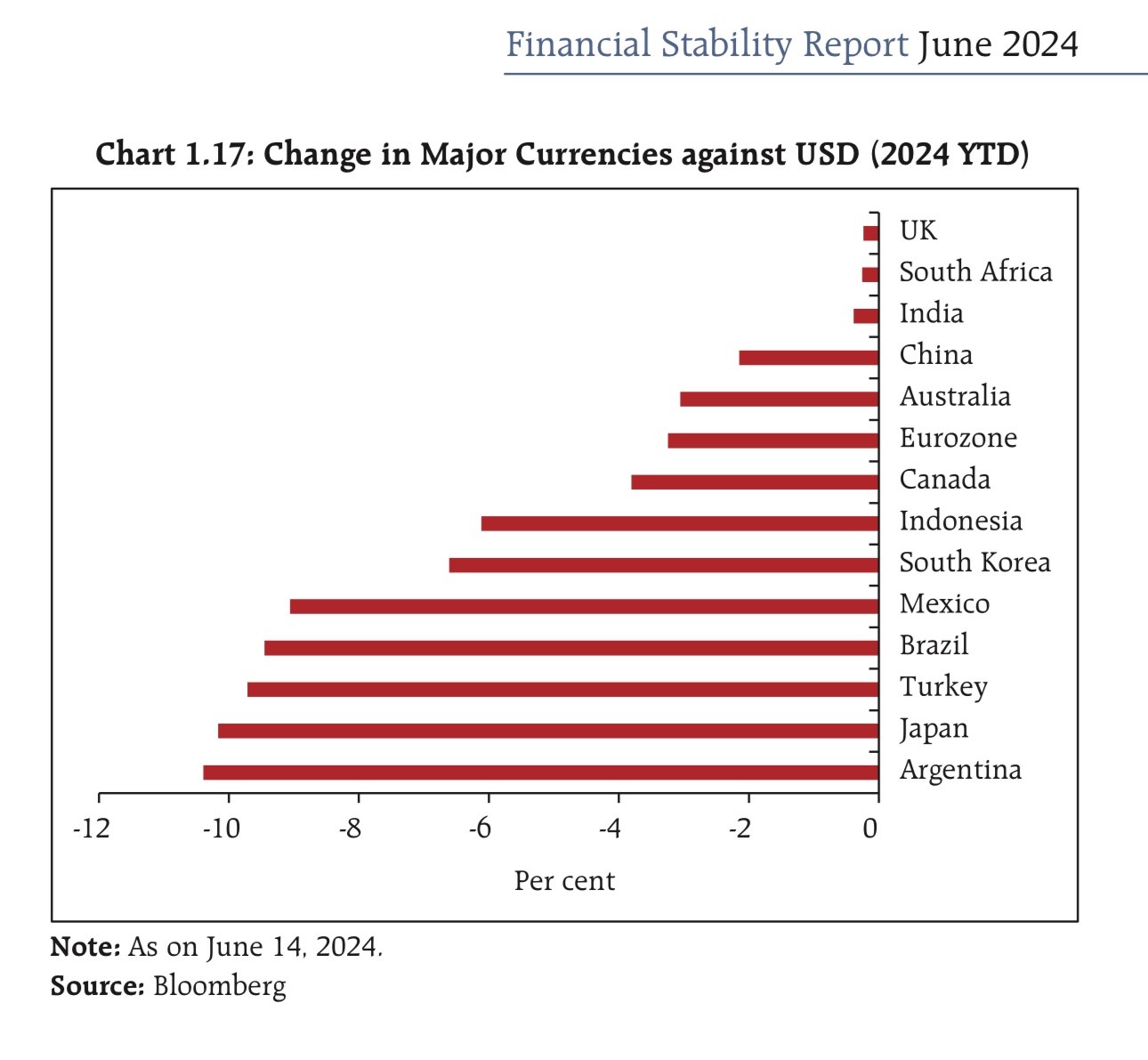

- Stability in India’s currency Value: India’s currency (INR) has exhibited stability in 2024 (till June 14) against the USD as compared to other countries as shown in Figure 1. It shows that in 2024, INR depreciated only slightly against the USD, while its peers such as Indonesia, Mexico, and Brazil exhibited much larger depreciation.

- India is taking measured prudent steps to increase the international role of its currency, with the goal of making it convertible.

Figure 1: INR value against USD compared to Select Countries

Secondary Source: Harsh Madhusudan on X (1 July 2024)

- Current Account Deficit: RBI has reported that-

- India’s current account deficit moderated to US$ 23.2 billion (0.7 percent of GDP) during 2023-24 from US$ 67.0 billion (2.0 percent of GDP) during the previous year on the back of a lower merchandise trade deficit.

- Net invisibles receipt was higher during 2023-24 than a year ago, primarily on account of services and transfers.

- During 2023-24, portfolio investment recorded a net inflow of US$ 44.1 billion as against an outflow of US$ 5.2 billion a year ago.

- India reported a current account surplus of $5.70 billion in Q4FY24, the first current account surplus since the June 2021 quarter. The last three current account surpluses were registered during the Covid-19 pandemic, so effectively, this is the first current account surplus in the last 18 years. This is a positive development.

- In the fourth quarter of 2023-24, Private transfer receipts, mainly representing remittances by Indians employed overseas, amounted to US$ 32.0 billion, an increase of 11.9 percent over their level a year ago. According to the World Bank data, India’s inward remittances were USD 125 billion in 2023, the largest globally2.

India’s relatively weak performance in 2023-24 was in FDI (Foreign Direct investment). RBI reports that the net FDI inflow was only US$ 9.8 billion during 2023-24 as compared with US$ 28.0 billion in 2022-23. Net FDI is the sum of equity capital, reinvestment of earnings, other long-term capital and short-term capital as shown in the balance of payments. This series shows net inflows (new investment inflows less disinvestment) in the reporting economy from foreign investors.

The UNCTAD (United Nations Conference on Trade and Development) January 2024 Report finds that the overall FDI landscape for developing countries in 2023 revealed a 9% decline, amounting to $841 billion. Developing Asian countries bore the brunt with a 12% decrease.

China reported an unusual 6% drop in FDI inflows but showed an 8% growth in new greenfield project announcements.

India saw a 47% drop in FDI inflows but remained among the top five global destinations for greenfield projects.

The Association of Southeast Asian Nations (ASEAN), traditionally an engine of FDI growth, recorded a 16% decline. Yet the region remained attractive for manufacturing investments with a remarkable 37% increase in greenfield project announcements in nations like Vietnam, Thailand, Indonesia, Malaysia, the Philippines, and Cambodia.

Conversely, FDI flows fell by a modest 1% in Africa and held steady in Latin America and the Caribbean, thanks in part to increases in Central America and 21% growth in Mexico, the region’s second-largest economy.

UNCTAD is cautiously optimistic about global FDI levels in 20243.

It may be useful to note that the cumulative amount of FDI inflow into the country stood at USD 990 billion and the cumulative amount of FDI Equity inflow into India was USD 678 billion during the period April 2000 to March 2024. The stock of inward FDI has been increasing at a healthy pace. India has been rapidly increasing its global competitiveness to increase the stock of FDI4.

India has also been attractive to foreign institutional and portfolio investors. India’s stock market capitalisation on 4 July 2024 was USD 5.3 trillion, with 180 million individual registered unique investors. In 2023, global stock market capitalization was USD 111.0 trillion, ranking India as the sixth largest stock market in the world5.

The foreigner’s share is around 18 percent in India’s stock markets.

India was added to JP Morgan’s emerging market bond index on June 28, 2024. India’s index weight will rise to 10 percent within a year. In the two sessions post India’s G-Sec inclusion in JP Morgan’s bond index, Indian markets recorded foreign inflows of INR 33.7 billion (USD 0.41 billion).

The expectation is for an inflow of USD 25 to USD 30 billion over the next few years6.

In the first two months of FY 2024-25, India’s total trade was USD 283.5 billion, with merchandise trade exhibiting a deficit of USD 42.9 billion, significantly offset by a surplus in services trade of USD 26.6 billion. It appears that in 2024-25, India’s current trade and current account deficits are likely to be in a manageable range7.

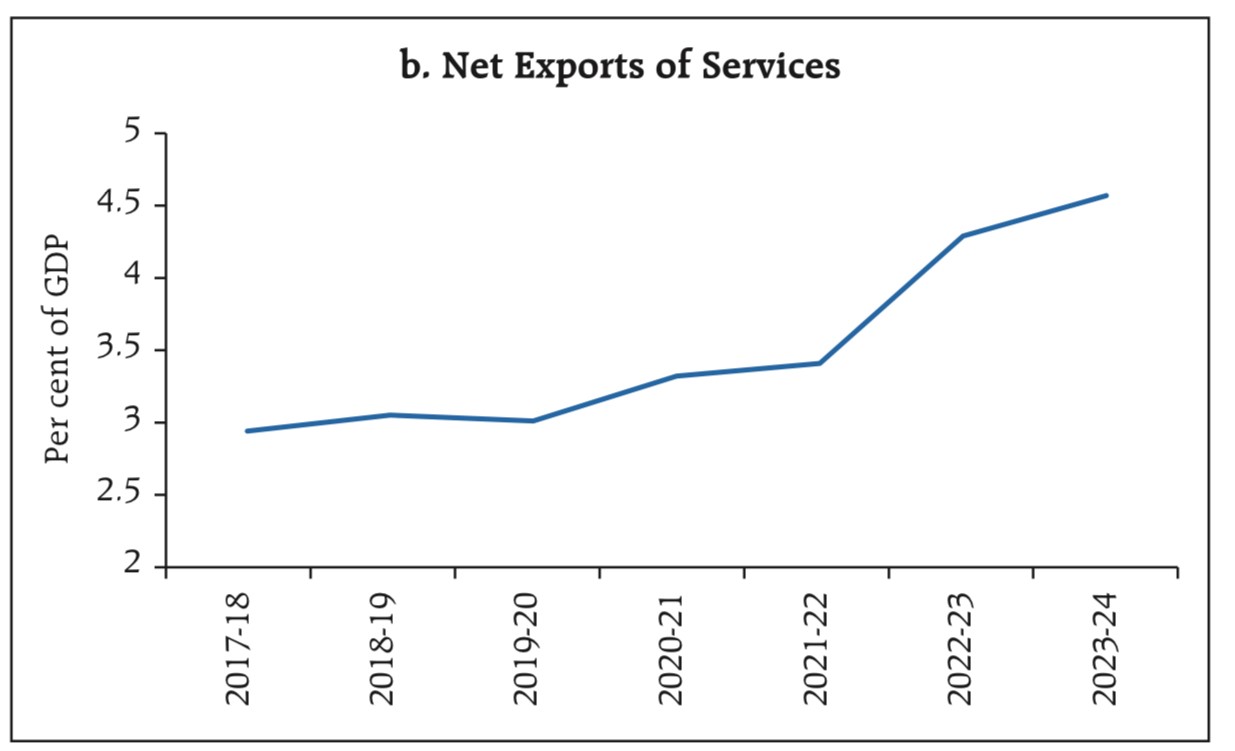

The rising surplus in India’s services trade has been observed in recent years (Figure 2). Services net exports have gone from about 3 percent to about 4.5 percent of GDP in six years (FY18 to FY24). This has substantially taken the pressure off the current account and allowed the central bank to build up comfortable foreign exchange reserves.

Figure 2 India: Net Export of Services

Primary Source: Reserve Bank of India; Secondary Source: Harsh Madhusudan on X (1 July 2024)

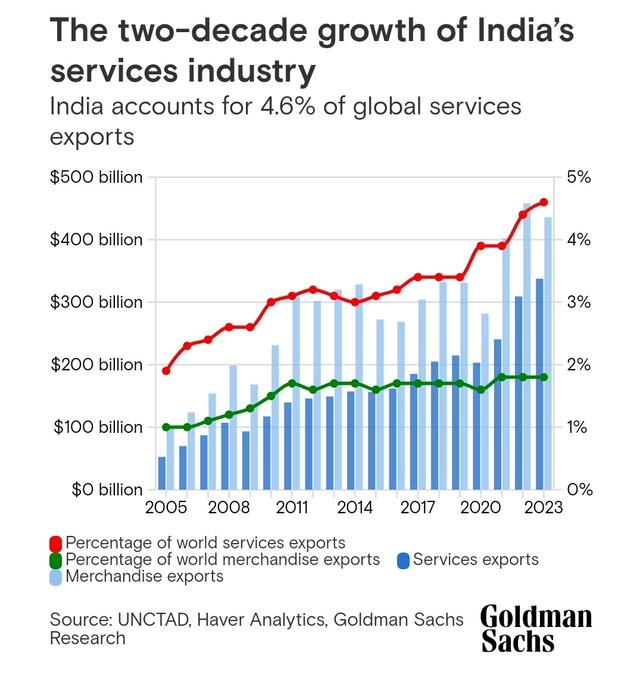

Figure 3 suggests that India’s share in global service exports has also been rising, reaching 4.6 percent in 2023. The share in global merchandise trade has risen at a much slower rate, reaching around 1.8 percent in 2023. Figure 3 strongly suggests the need to accelerate global competitiveness in manufacturing.

Figure 3: India’s Rising Share in Global Service Exports

India’s Select Measures to Expand Exports

India is taking initiatives to expand and diversify both merchandise and services exports. For merchandise exports, a key initiative has been the PLI (Production Linked Initiative) scheme. It applies to more than a dozen key sectors to help India-based companies achieve scale and scope to compete globally. The scheme focuses on incremental production value, exports, investment, and freight on board (FoB). The incentives comprise 4 percent to 6 percent of the incremental sales value for a period of five years.

One of the areas of policy focus is the electronics sector, including smartphones and semiconductors. In 2023-24, India’s smartphone exports were USD 15.6 billion (an increase of 40.5 percent), as compared to Vietnam (USD 26.3 billion (a decline of 17.6 percent), and USD 132.5 billion for China (a decline of 2.8 percent). This is good progress, but India needs more focus to increase its share of global smartphone exports8. There are reports that Foxconn is planning to produce AI servers in India, a welcome diversification.

It is reported that the Tata Group is to set up a semiconductor manufacturing plant in Assam's Jagiroad with an investment of ₹270 billion (USD 3.2 billion), with production reaching the market in 2025. This will be the second such plant by the Tata group, the first one being in Gujarat. The third plant is being set up by CG Power, in partnership with Renesas Electronics Corporation, Japan and Stars Microelectronics, Thailand will set up a semiconductor unit in Sanand, Gujarat9.

India is taking initiatives to address its relative underperformance in travel and transport services. As an example, in 2023, 0.45 million persons from Bangladesh visited India for Medical treatment. E-visa facility by India to Bangladesh, as planned, will help sustain such levels from Bangladesh. India aims to expand its share for those seeking medical treatment, helping sustain high-service exports. Space services are another area of focus in diversifying India’s service exports.

Concluding Remarks

In managing an uncertain and volatile global environment and progressing toward the goal of Viksit Bharat by the end of Amrit Kaal in 2047, India needs to create capabilities for a resilient and large presence in the external sector. This article has discussed India’s strong external sector indicators, and suggested areas where more effort is needed.

References

- https://www.imf.org/en/Publications/WEO/Issues/2024/04/16/world-economic-outlook-april-2024- Accessed on 1 July 2024

- https://rbi.org.in/Scripts/BS_PressReleaseDisplay.aspx?prid=58147#:~:text=India's%20current%20account%20deficit%20moderated,a%20lower%20merchandise%20trade%20deficit-Accessed on 1, July 2024

- https://unctad.org/news/global-foreign-direct-investment-grew-3-2023-recession-fears-eased -Accessed on 1 July 2024

- https://www.ibef.org/economy/foreign-direct-investment -Accessed on 1 July 2024

- https://www.statista.com/statistics/274490/global-value-of-share-holdings-since-2000/#:~:text=Equity%20market%20capitalization%20worldwide%202013%2D2023&text=The%20value%20of%20global%20domestic,world%20stocks%20as%20of%202023 -Accessed on 4 July 2024

- https://economictimes.indiatimes.com/markets/bonds/india-inclusion-in-jp-morgan-bond-index-from-friday-25-30-bn-flow-expected-what-it-means/articleshow/111311384.cms?from=mdr -Accessed on 4 July 2024

- https://commerce.gov.in/wp-content/uploads/2024/06/PIB-Release.pdf -Accessed on 2 July 2024

- https://x.com/AshwiniVaishnaw/status/1807626626815213752/photo/1 -Accessed on 1 July 2024

- https://www.livemint.com/companies/news/semiconductor-manufacturing-plant-in-assam-will-put-it-in-global-map-says-ratan-tata-11710929559625.html -Accessed on 2 July 2024

Image source: The Economic Times

Comments