India’s 2022-23 Budget: Sound Economic Reasoning and Social Policies, Consistent with Macro-Prudence and Future Orientation

- In Economics

- 01:09 PM, Feb 04, 2022

- Mukul Asher

Introduction

Unveiling of India’s Union Budget is the single most substantive economic event of the year. It is an occasion to take stock of the immediate past economic performance, to review macroeconomic and fiscal trends and scenarios, and explain India’s initiatives for future readiness.

Economic and social policy initiatives however are undertaken throughout the year. This should be taken into account in any budget analysis. Analysis of the Union Budget should also involve a whole set complementary documents presented with the Union budget1.

Economic Survey of India is presented in the Parliament the day before the Budget. This year, the 442-page survey was presented on 31 January 2022. The Survey usually has a specific theme. For 2021-22 Survey it is the “Agile” approach to addressing Covid-19 Pandemic challenges while reviving the economy. The Survey deserves to play greater role in policymaking and in academic teaching and research than has usually been the case in the past.

The “Agile” approach that informed India’s economic response is based on feed-back loops, real-time monitoring of actual outcomes, flexible responses, safety-net buffers and so on. Planning matters in this framework but mostly for scenario analysis, identifying vulnerable sections, and understanding policy options rather than as a deterministic prediction.

There is also a separate revamped Statistical Appendix designed to facilitate the “Agile” approach. The Appendix has five separate tables of High Frequency Indicators (HFIs), such as new subscribers to the employees’ Provident Fund; volume of e-way bills, monthly GST (Goods and services Tax) revenue, and domestic air traffic.

Besides the Survey, other budget documents include, Annual Financial statement, Finance Bill, The Macro economic Framework Statement, Medium Term Fiscal Policy cum Fiscal policy Strategy Framework, Output- Outcome Framework for Schemes, and implementation of Budget announcements. These are essential to make informed judgements about India’s budget and public financial management.

The Survey emphasises process reforms comprising simplification of the processes where government involvement is essential and designed to reduce transaction costs. This is different from deregulation involving significant reduction or ending government’s role in an activity. This emphasis on process reform is also prominently evident in the 2022-23 budget.

The survey estimates real GDP growth of 9.2 percent in 2020-21; and projects real growth of between 8.0 to 8.5 percent in 2022-23. Given volatility in energy prices and uncertain global environment, a range rather than a single number for the real GDP is appropriate. Even if the CSO (Central Statistical Organization) revises 2020-21 figures in a favourable direction, the fact that by March 2022, India’s GDP (and most other macroeconomic indicators) will be above the pre-pandemic levels, will remain unchanged.

Greater use of ranges in projection better reflects the probabilistic nature of the forecasts, and are consistent with the “Agile” approach to policymaking. The Survey cautions that managing imported inflation in 2022-23 would be a major challenge.

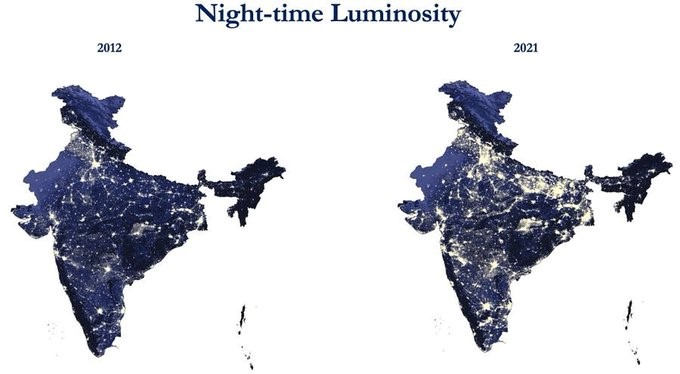

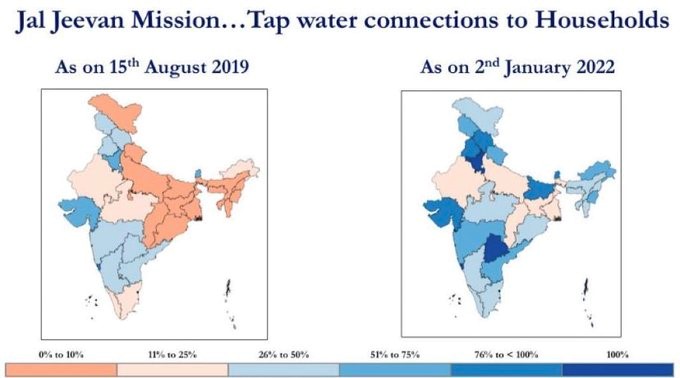

Chapter 11 of the Survey is titled “Tracking Development through Satellite Images and Cartography”, making use of new technologies to obtain accurate and timely data for policy making. Figures 1 and 2 provide examples from the Survey. This area could become another sector in providing economic opportunities, including for exports.

Figure 1

The Survey estimates that nominal GDP is set to increase from INR 197.4 trillion in 2020-21 to INR 232.4 trillion in 2021-22. If nominal GDP increases by 13 percent (8 percent real GDP growth plus 5 percent inflation), then in 2022-23, the nominal GDP would be INR 262.6 trillion. (USD 3.5 trillion). This suggests that reaching USD 4 trillion GDP by 2024-25 is very feasible.

In FY22, investment to GDP ratio was 29.6 percent, the highest in seven years. This ratio still needs to increase to around 33 percent.

Chief Economist of the State Bank of India, Dr. S. K. Ghosh reports that the total gross household financial savings jumped by a massive INR 7.1 trillion in FY21. Total liabilities increased by only INR 18,000 crores. This suggests that while household consumption has been less robust, financial position of the households as a group has improved.

Analysis of the 2022-23 Budget Proposals

The 2022-23 Union Budget may be characterized as exhibiting sound economic reasoning and social policies, consistent with macro-prudence and future orientation. This is elaborated below.

Macro and Fiscal Prudence:

The 2022-23 Budget continues the commendable practice of fiscal transparency of 2020-21 Budget for which the finance minister received well-deserved recognition, improving India’s Fiscal credibility. Such fiscal transparency is also evident in this year’s budget as evidenced by losses from Air India privatization being reflected in the 2022-23 fiscal accounts.

the total expenditure in 2022-23 is estimated at INR 39.4 trillion, while the total receipts other than borrowings are estimated at INR 22.8 trillion. The non-borrowing receipts are thus only 57.8 percent of expenditure. The implied per person Union expenditure and receipts are INR 28,551 and INR 16,522 respectively.

This ratio needs to be improved. The budget does seek to expand tax base by levying a 30 percent tax (without offsets) on virtual digital assets.

The overall fiscal deficit trends are however manageable. The revised Fiscal Deficit in 2021-22 is estimated at 6.9 per cent of GDP as against 6.8 per cent projected in the Budget Estimates. The fiscal deficit in 2022-23 is estimated at 6.4 per cent of GDP, which is consistent with the broad path of fiscal consolidation announced to reach a fiscal deficit level below 4.5 per cent by 2025-26.

Sound Economic Reasoning and Social Policies:

Select examples from the 2022-23 Budget are provided below.

- The Budget proposes a fund with blended capital, raised under the co-investment model to finance start-ups for agriculture and rural enterprise, relevant for farm produce value chain.

- The Budget extends the Emergency Credit Line Guarantee Scheme (ECLGS) up to March 2023 and its guarantee cover will be expanded by INR 50,000 crore to total cover of INR 5 lakh crore, with the additional amount being earmarked exclusively for the hospitality and related enterprises.

- This is both sound economic and social policy as the hospitality sector has still not attained the pre-Covid pandemic levels of activity.

- Another important initiative in the social sector concerns e-education in schools. Proposals include, expansion of one class-one TV channel’ programme of PM eVIDYA from 12 to 200 TV channels. This will enable all states to provide supplementary education in regional languages for classes 1-12.

- In vocational courses, to promote crucial critical thinking skills, to give space for creativity, 750 virtual labs in science and mathematics, and 75 skilling e-labs for simulated learning environment, will be set-up in 2022-23. 48 High-quality e-content in all spoken languages are to be developed for delivery via internet, mobile phones, TV and radio through Digital Teachers.

- The Budget proposes establishing a Digital University to provide access to students across the country for world-class quality universal education with personalised learning experience at their doorsteps. This will be made available in different Indian languages and ICT formats.

- While significantly reducing the number of Centrally Sponsored Schemes (CSS) where financing is shared with states, the Budget proposes a new CCS for health. The Budget states that “a new centrally sponsored scheme, PM AtmaNirbhar Swasth Bharat Yojana, will be launched with an outlay of INR 64000 crores over six years. This will help develop capacities of primary, secondary, and tertiary care Health Systems, strengthen existing national institutions, and create new institutions, to cater to detection and cure of new and emerging diseases. This will be in addition to the National Health Mission”.

- An important social sector initiative in the Budget is the recognition that mental health programs need to be accorded due recognition and resources as this has become an important health issue in India as well as globally. As the Budget notes, “the pandemic has accentuated mental health problems in people of all ages. To better the access to quality mental health counselling and care services, a ‘National Tele Mental Health Programme’ is to be launched. This will include a network of 23 tele-mental health centres of excellence”.

- The Budget proposes setting up AVGC (animation, visual effects, gaming, and comic) promotion task force, to facilitate livelihoods generation in these creative trades. This will widen the livelihood opportunities for the younger generation, and lessen pressure on traditional jobs.

- The proposal to increased customs duties on certain commodities such as umbrella, and imitation jewellery while decreasing duties on others such as cocoa beans, cut and polished diamonds is both sound economic and social policy as it will generate additional employment in these areas with enhanced domestic production.

- The Budget states that data exchange among all mode operators will be brought on Unified Logistics Interface Platform (ULIP), designed for Application Programming Interface (API). This will provide for efficient movement of goods through different modes, reducing logistics cost and time, assisting just-in-time inventory management, and in eliminating tedious documentation.

Most importantly, this will provide real time information to all stakeholders, and improve international competitiveness. Open-source mobility stack, for organizing seamless travel of passengers will also be facilitated.

The Budget plans developing one hundred PM Gati Shakti Cargo Terminals for multimodal logistics facilities during the next three years

A little noticed proposal in the Budget, already notified in the General Financial Rules (GFRs) 2017, is permitting use of surety bonds as security instrument in government procurements. This will reduce working capital needs, and result in wider access to government procurement.

E-passports to be introduced in 2022-23 with embedded chips. This will facilitate foreign travel and reduce transaction costs.

For smooth economic functioning both entry and exit of firms should be made efficient. The Budget proposes process reform for voluntary exit of corporate firms from current two years to six months. This will make creative destruction more efficient, and encourage new business formation.

Future Orientation

India’s 2022-23 Union Budget augurs well for the future generations. The following illustrate the future orientation of the Budget.

- The Budget seeks to lay the foundation and give a blueprint to steer the economy over the Amrit Kaal of the next 25 years – from India at 75 to India at 100. This reflects future-oriented mind set of the policymakers.

- The finance minister stated that “this Budget seeks to lay the foundation and give a blueprint to steer the economy over the Amrit Kaal of the next 25 years – from India at 75 to India at 100.”

- The 2022-23 Budget has continued the shift in balance between the private and public sector towards the former. Air India has been privatized and process to divest with public sector retaining control of LIC (life Corporation of India) and its listing are in the final stages, Budget helps to accelerate this shift.

Congress party’s Ripun Bora speaking on Motion of Thanks to President's address in Rajya Sabha noted that Prime Minister Rajiv Gandhi created 16 PSUs (Public Sector Enterprises), no divestment or privatisation, Prime Minister Atal Bihari Vajpayee created 17 PSUs, Prime Minister Manmohan Singh created 23 PSUS, only 3 divestment or privatisation, and Prime Minister Narendra Modi did not create a single PSU but divested or privatised 23 PSUs.

The above along with respect accorded to wealth creating entrepreneurs has altered India’s earlier political economy. This would facilitate technological change and efficiency enhancement which will lead to more sustainable prospects for the future.

- A major concrete initiative is the acceleration of capital expenditure, foundation to enhance India’s productive capacity.

- The 2022-23 Budget proposes INR 5.5 trillion capital expenditure, which is an increase of 35 percent over the Budget Estimate of 2020-21. Over and above this expenditure, the Minister has indicated that more than INR 2 lakh crores to States and Autonomous Bodies for their Capital Expenditure.

- Capital expenditure heavy budget is also designed to crowd—in private investment, as essential factor in enhancing future production capacities of India.

- India is getting rapidly urbanized but urban sector planning and expertise have so far not received due recognition and resources. The Government steps in for developing India-specific knowledge, five academic institutions will be designated as Centres of Excellence with an endowment fund of Rs 250 crore each for urban planning courses assisting the urban sector.

- The Budget reports that Indian armed forces spent 64% of their Capital outlay budget on Made in India equipment's in FY22. This figure used to be 28% in 2014.

- 25 percent of India’s defence R and D budget is being earmarked for private industry, start-ups, and academia is yet another initiative to network knowledge, technology, and management knowhow in the defence sector. This augurs well for India’s national security.

- India is set to issue sovereign green bonds for funding green infrastructure. This would help India meet its climate change goals, and enhance its productive capacity.

- In the 2022-23 Budget, data centre and energy storage system are accorded infrastructure status to provide easy financing to the sector. These areas are critical for India’s renewable energy goals.

- Another indicator of future orientation is the explicit statement that India’s future is digital. The Budget has proposals for Digital universities, drone farms, telemedicine, fin-tech sector and others.

- The budget has announced India’s first digital currency – Digital Rupee. This is consistent with emerging global practices and with increase efficiency of financial intermediation. Cost of issuance of Digital currency will likely be lower (no printing, security, transportation etc.), and with right decision seigniorage will be unaffected and costs will be lower for RBI and the economy as a whole.

- Seigniorage involves the estimate of the profit or loss made on producing a currency. For example, if the cost of printing an INR 2000 note in India is INR 5, then INR 1995 is the profit made on the production of the note. Banks earn this profit by putting the note into circulation.

- The Finance Secretary has assured that digital currency backed by RBI will never be in default. Money will be of RBI but the nature will be digital. Digital rupee issued by RBI will be a legal tender. Rest all are not legal tender, will not, and will never become legal tender.

- After successful exports of the BrahMos missiles produced in the Uttar Pradesh to the Philippines, India is also planning to export surface to air missile Akash, Astra, anti-tank missiles, radars, and torpedoes for future exports. India aims to be a major exporter of the products and services of the defense sector, helping to expand its geo-economic and geo-strategic space.

- The finance minister also announced that draft detailed project reports (DPRs) for five other river linking projects — Damanganga-Pinjal, Tapi-Narmada, Godavari-Krishna, Krishna-Pennar and Pennar-Kaveri — have been finalised. This is a future-oriented initiative.

Concluding Remarks

The Union Government’s 2022-23 Budget sets a benchmark for fiscal transparency, economic and fiscal projections which have high degree of credibility, sound economic reasoning and social policies evidenced in the proposals, and has future orientation. It sets a high benchmark against which the future Union budgets and the budgets of the state governments should be assessed.

It is essential that better accountability and transparency of the state governments in India becomes an integral part of policy relevant empirical and theoretical research and dialogue on public financial management.

Image source: PIB

Comments