India’s 2021-22 Budget: Facilitating India’s Rise

- In Economics

- 12:59 PM, Feb 12, 2021

- Mukul Asher

Introduction

The 2021-22 Budget is India’s first paperless Digital budget. Hope this practice continues.

The Central Government Budget is the prime economic event of the year. But economic and other policies, some very major, are undertaken throughout the year. This is likely to continue.

Some examples are the major reform of Corporate Income Tax (CIT) structure in September 2019; agriculture law reforms. Labour code reforms, and accelerated positive organizational transformation of India Railways.

Since the Budget, it is reported that NITI (National Institution for Transforming India) Aayog has asked for a study to be conducted on the economic impact of judgments delivered by the Supreme Court, High Courts, and quasi-judicial bodies such as the NGT (national Green Tribunal) set up in 2010.

There is huge scope to enhance economic reasoning skills of the above bodies, and their judgements have been considered to have adversely affected India’s progress, even as their transparency and accountability remains low. Such a study is therefore long overdue.

It is the steady stream of activity, sector, organization specific seemingly small reforms on a continuous basis which cumulatively lead to major transformation of the economy.

A small, but significant example from the Budget is that for the first time since independence, the Kerosene Subsidy is recorded as Zero.

Reform process must always be on going as new challenges, new bottlenecks, and new priorities emerge.

India’s 2021-22 Budget has been constructed under very unusual circumstances of global Wuhan Pandemic (COVID-19); significant geo-economic shifts and geo-strategic risks; and acceleration of digital economy, accompanied by financialization of the global economy.

Many analysts have argued that after the Pandemic, an altered world order will emerge, in which India will be able to position itself more advantageously.

United States State Department spokesperson commented that “We welcome India's emergence as a leading 'Global Power' and its role as a net security provider in the Indo-Pacific region.

Indian economy was experiencing a growth slowdown even before the COVID-19 Pandemic became evident in February -March 2020.

This budget comes amidst sharp contraction in GDP in 2020-21, laying foundations for broad-based high growth a priority.

The budget Speech must be read with accompanying documents for a more rigorous analysis. Examples are: Economic Survey; Budget at a Glance; Finance Bill; The Macro Economic Framework; Medium Term Fiscal Policy and Strategy Statement; Output- Outcome Framework for Schemes 1. For the 2021-22 budget analysis, the Report of the 15th Finance Commission (FC) is also relevant.

The Context

Before the Budget presentation, some positive economic indicators were evident.

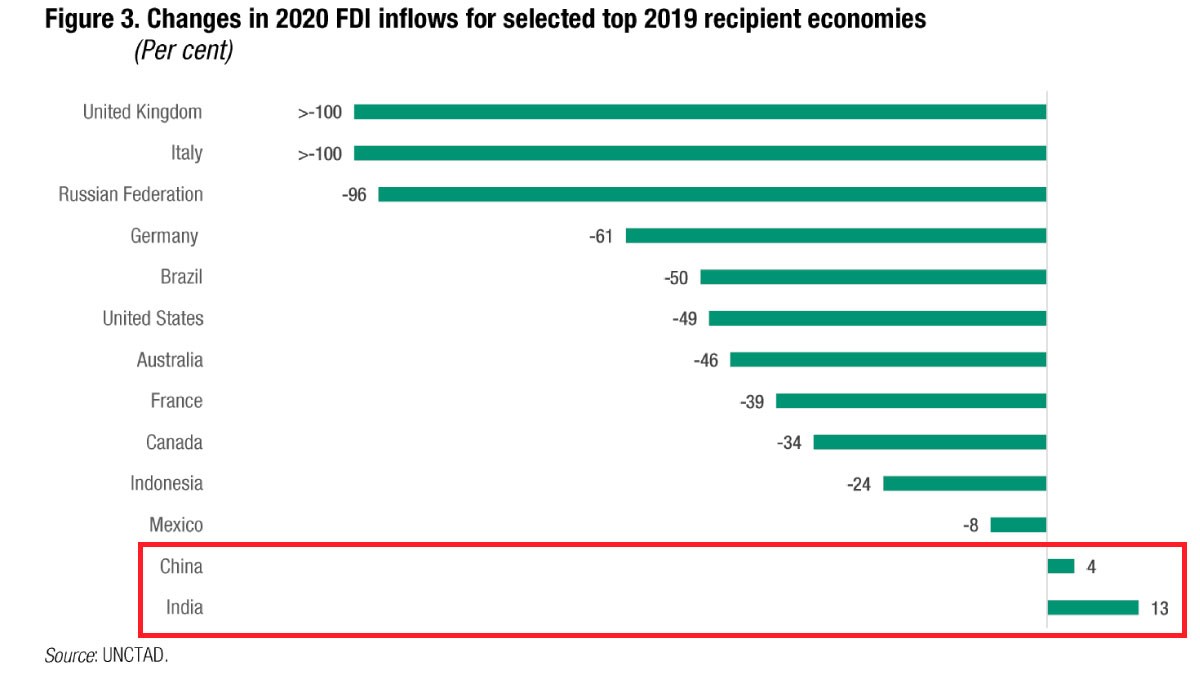

In 2020, India exhibited the largest positive change in FDI inflow, when most countries registered an outflow as shown in the figure below.

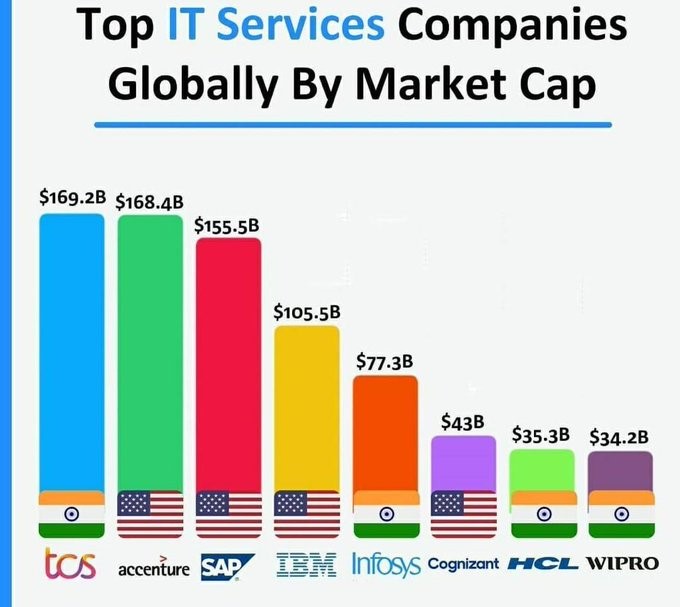

As shown in the Chart 1, four Indian IT companies figured in the list of those by Market capitalization, with TCS ranked number one with USD 169.2 Billion. The ranking and the values will fluctuate, but with the policies to develop global scales in several sectors, Indian companies will perform well in other sectors, such as pharma.

Chart 1

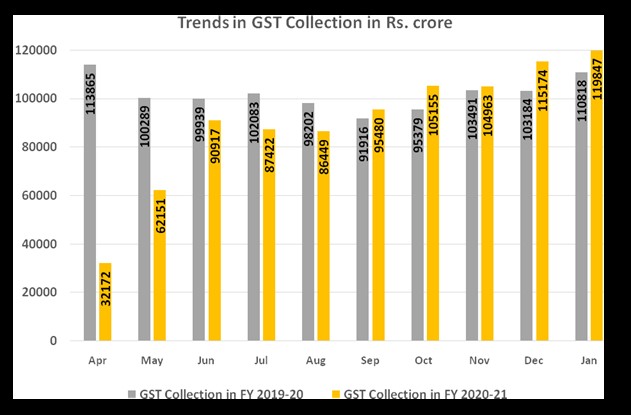

As shown in Chart 2, GST (Goods and Services Tax) collections have also been improving, with January 2021 registering highest even collection of INR 1.20 trillion. This trend is expected to continue supported by administrative reforms, and increased economic activities.

Chart 22

Three key ideas from the Economic Survey 2020-21 are reflected in the Budget. They are:

- Bet on growth to check both poverty and inequality

- Emphasise Capital expenditure rather than consumption to stimulate demand, and enhance capacities for future growth;

- augment skills-sets

Arvind Virmani has suggested dividing India’s economic response to the Pandemic since March 2020 into:

Survival: It is widely acknowledged that overall, India has competently managed the survival phase (though some states such as Kerala and Maharashtra) could have managed much better.

India is currently administering world’s largest vaccination drive within the country.

India has (as of February 11 2021), agreed to supply vaccines, some donated, some on commercial basis, to the following 16 countries, spread across the globe. Afghanistan, Bangladesh, Seychelles, Barbados, Dominica, Mauritius, Morocco, Maldives, Sri Lanka, Bahrain, Bhutan, Algeria, Kuwait, Brazil, and Mexico. It is reported that request of some high-income countries, such as Canada, is under consideration (as of 11 February 2021).

Revival: 2021-22 is the revival year. From a low base, high growth has been widely expected.

Re-Growth: This refers to the period of three to four years from 2022-23 fiscal year.

Re-growth requires both continuing reforms, and stimulative fiscal and monetary policies.

As may be expected, there were very large number of suggestions on many macro and micro activity/sector specific suggestions for the Budget. Most are self-interest pleas, but some are from larger public policy and public interest perspective. Both types receive attention of the policymakers.

Focusing on faster growth, special focus on hard-hit service sub-sectors, rationalizing poverty targeted programs and schemes, public health related expenditure, and expenditure on key priorities such as Jal Jeevan Yojna, and PM Awas Yojna, received mention by the analysts.

The Finance Minister had raised expectations by noting that the “… forthcoming Budget for the financial year 2021-22 (FY22) will be like no other in the past and will help India emerge as the engine for global growth”.

Macro-Economic Projections

IMF (International Monetary Fund) in its January 2021 report made following projections for real GDP growth, with an upward bias.

2020 India -8.0 % World -3.5 %

2021 India 11.5 % World 5.5%

2022 India 6.8% World 4.2%

Three-year simple average: India: 3.43%; World :2.07%

For the full fiscal, the Economic Survey 2021 projects a contraction in real GDP of 7.5% in 2020-21, and positive growth of 11% for 2021-22, both with upward bias.

For nominal GDP, inflation must be added to the above figures.

2021-22 nominal GDP is projected to grow by 14.4%, with upward bias. This will mean nominal GDP of INR 222.9 trillion (USD 3.05 Trillion) in 2021-22, while it is projected to be INR 194.8 (USD 2.67 Trillion) in 2020-21.

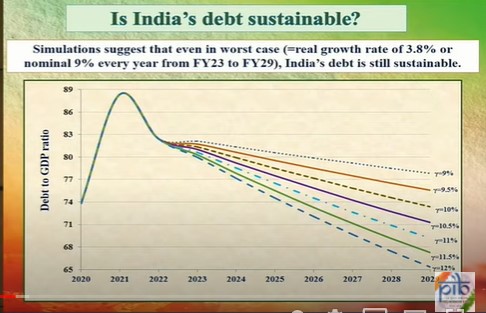

The Economic Survey projects an optimistic scenario for India’s government debt sustainability (Chart 3). The key economic relationship for debt to be sustainable is that nominal growth in GDP must exceed the interest paid on public debt to precent debt to GDP ratio from rising.

Chart 3

Assessing the 2021-22 Budget Proposals

India’s 2021-Budget is organized around six themes. They are: Health & Well-Being; Physical and Financial Capital and Infrastructure; Inclusive Development for Aspirational India; Reinvigorating Human Capital; Innovation and R&D; and Minimum Government- Maximum Governance.

That Health and Well Being comes first, even though it is largely a state subject under the Constitution. This reflects the new reality that the Wuhan Pandemic (technically COIVD-19) Pandemic, has made robust public and private health care system, and its governance essential for sustained economic growth and for national security. There are proposals to shift health care to a Concurrent list.

The budget proposals, and subsequent statements in the Parliament strongly suggest that India can not afford a status quo, and change in thinking, behaviour, and governance outcomes have become an imperative.

The 2021-22 Budget is expansionary, whole simultaneously laying solid foundation for future broad-based good quality sustainable growth, enhancing ease of living and prospects or meeting citizen aspirations.

Expenditure: The government proposes to spend INR 34.8 Trillion (15.7% of realistically projected 2021-22 GDP) in 2021-22.

As per the revised estimates, the government spent INR 34.5 Trillion in 2020-21, (17.7% of GDP), 13% higher than the budget estimate.

Sharp increase in capital expenditure, mainly for infrastructure, is a significant feature of this budget

Receipts:

The receipts (other than borrowings) are expected to be INR 19.8 Trillion in 2021-22, (8.9% of realistic GDP projection for 2021-22) which is 23% higher than the revised estimates of 2020-21.

In 2020-21, revised estimates for receipts were 29% lower than budget estimates. Given the impact due to COVID-19, it is useful to see the growth from 2019-20, an annual increase of 6 percent

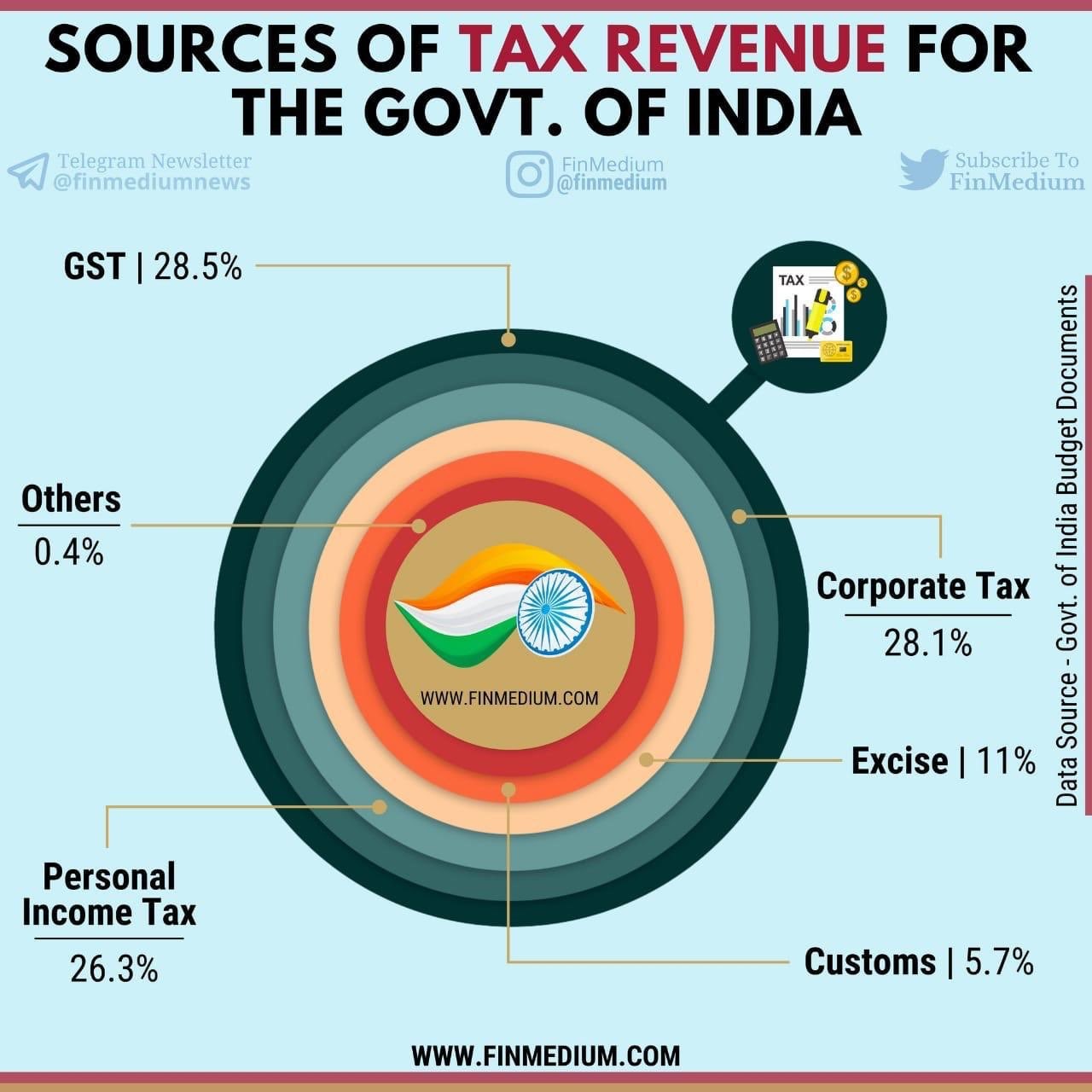

Chart 4

Chart 4 provides composition of tax revenue. A notable feature is the narrowing of the tax share from corporate income tax (28.1%), and personal income tax (26.3%). In most high-income countries, the share of the latter significantly exceeds the share of the former. India is moving towards that outcome.

The Chart also indicates that the GST at 28.5% is the single largest source of tax revenue. It is estimated that Taxes subsumed under GST were 6.3% of GDP in the pre-GST period (2016-17).

Budget Deficits: Revenue deficit is targeted at 5.1% of GDP in 2021-22, which is lower than the revised estimate of 7.5% in 2020-21 (3.3% in 2019-20). Fiscal deficit is targeted at 6.8% of GDP in 2021-22, down from the revised estimate of 9.5% in 2020-21 (4.6% in 2019-20).

The government aims to steadily reduce fiscal deficit to 4.5% of GDP by 2025-26.

There appears to be some rethink on deficit targets as a major indicator guiding fiscal policy. This could lead to rethinking of the content of FRBM (Fiscal Responsibility and Budget Management) Acts overtime.

Ministry allocations: Among the top 13 ministries with the highest allocations, the highest annual increase over 2019- 20 is observed in the Ministry of Jal Shakti (64%), followed by the Ministry of Consumer Affairs, Food and Public Distribution (48%) and the Ministry of Communications (31%). ercenptive commenW

A shift towards private enterprise and Wealth Creators: Another long overdue feature of the 2021-22 Budget is the

Shifting the balance away from public sector ownership towards encouraging private sector to play a more prominent role, while focusing on contestability/competition, organizational improvement, improving individual incentives, and technology upgradation and infusion to improve public sector organizations.

A concrete example of such reforms is provided by the Parliament passing the Major Ports Authority Bill, 2020. The new law supersedes a 1963 Act governing the country’s 12 major ports.

Shipping and Waterways Minister Mansukh argued that the new Act was not intended to privatise major ports but aimed at boosting their decision-making powers in order to compete with private ports.

The major-port sector has not exhibited the required level of fixed assets creation to pare the country’s high logistic costs owing to legacy issues, including the TAMP’s (Tariff Authority for Major ports) archaic regulatory grip. Every port will now be governed by a Port Authority (board) which will have the powers to fix reference tariffs for various port services, as well as the terms for private developers who team up with them.

More such reforms in the power sector, aviation, urban development and others are being planned. Prime Minister Modi in the Budget Debate in the parliament strongly argued for private sector involvement and need to increase the number of wealth creators, which is unprecedented, and reflects the serious intent to bring about a shift away from over-reliance on the public sector.

It is in this context that the process to list LIC (while raising foreign equity limit to 74% in insurance sector), divest Air India, and others should be viewed.

Listing on the stock exchanges bring the organization under the Companies Act, and that has the potential to improve governance and accountability.

Improving Fiscal Transparency, Accountability

Anantha Nageswaran, a member of the Economic Advisory Council to the Prime Minister has argued that “MOF (ministry of Finance) Team ensured that the budget gave a fair and accurate representation of public finances at the level of the Union Government.

They made realistic assumptions on next year’s growth rate, i.e., for 2021-22. They made reasonable assumptions for revenue buoyancy. They did not budget for big dividends from The Central bank or income from spectrum sale.

Their revenue projections for the current year are more likely to be exceeded than fall short. Their revenue projections for 2021-22 are even lower than the original budget estimates for 2020-21 while the GDP would end up almost at the level originally projected for 2020-21 by the end of the financial year 2021-22.

The number of documents they had uploaded on the budget far exceeded anything seen before. That suggests a willingness to disclose rather than hide. It is a huge goal for transparency and accountability.

It is very likely that all of these would be understood and appreciated by market participants over time and that would result in a meaningful decline in the India country risk premium.

That is the biggest contribution to sustainable growth that MoF could make and they have made it.”3

The 15th Finance Commission Proposals

The 2021-22 Budget needs to be analysed in conjunction with the recommendations of the 15th Finance Commission (FC) headed by N K Singh. The 15th FC Report is quite long and complex. Only few areas are highlighted here. The full Report is available at 4

Devolution Criteria: The criteria for distribution of central taxes among states for 2021-26 period is same as that for 2020-21. The Commission has used 2011 population data for determining the share of states during its entire award period. To reward efforts made by states in controlling their population, the Commission has used the Demographic Performance criterion. States with a lower fertility ratio will be scored higher on this criterion.

Grants-in-aid: The Commission has recommended grants from the center to states and local bodies worth Rs 10.3 lakh crore for the 2021-26 period. These include: (i) revenue deficit grants to 17 states, (ii) grants to urban and rural local bodies, (iii) disaster management grants, (iv) grants for eight sectors including health, education, and agriculture, and (v) certain state-specific grants.

Funding of defense and internal security: A dedicated non-lapsable fund called the Modernization Fund for Defense and Internal Security (MFDIS) will be constituted to primarily bridge the gap between budgetary requirements and allocation for capital outlay in defense and internal security. The fund will have an estimated corpus of INR 2.4 Trillion over the five years (2021-26). Of this, Rs INR 1.5 Trillion will be transferred from the Consolidated Fund of India. Rest of the amount will be generated from measures such as disinvestment of defense PSUs and monetization of defense lands.

Such an allocation is unprecedented, and it also reflects the stress on capital expenditure in defense modernization.

GST Reform: The 15th Finance Commission has suggested that the 12% and 18% rates under the GST be merged into one standard rate, and GST be rationalized to a three-rate structure, complemented by the 5% merit rate and 28-30% de-merit rate.

If adopted by the GST council, it will further simplify the GST design.

The current rate structure of GST and the items under each rate is provided in Chart 5.

Chart 5: GST Structure and Items

On behalf of the 15th Finance Commission, the International Monetary Fund assessed that the effective tax rate under GST currently stands at 11.8%. This is close to Reserve Bank of India’s estimate of 11.6%. This is considerably lower than the nominal rates.

IMF estimates that GST Collection efficiency is the ratio of GST collections to the product (c*r) of final consumption expenditure in the economy (c) and the standard rate (r), and is a summary measure of efficiency of GST.

The Report of the 15th FC notes that collection efficiency is below 50%. It could be raised to around 60%, which will be around benchmarks of high-income countries.

The FC report also highlighted that about 70 per cent of gross GST revenue goes to states due to sharing and devolution. With many taxes subsumed under it, GST accounts for 35 per cent of the gross tax revenue of the Union and around 44 per cent of own tax revenue of States.

It suggested that the inverted duty structure needs a change, as it might be the reason behind the high share of tax liability being paid using input tax credit. This was also mentioned by the Finance Minister in the Budget Speech.

Concluding Remarks

This column has highlighted several distinguishing features of the 2021-22 Budget, which will facilitate India’s rise in the global economy, as well as enhance ease of living and help meet aspirations of Indian citizens.

The Budget has provided indications for several additional fiscal reforms. These are:

- GST Reform: As noted, the 15th GC has recommended it, and the Budget Speech also suggested GST reform. This reform will be led by the GST Council, in which Finance ministers of the union Government, and of all states are members.

- Reforming Direct Taxes Code: The budget contained relatively few proposals on income tax, though there were proposals to broaden the personal income tax base, and incentives for single person companies. The current Direct Taxes Code is that of 1961, a very different era. The process of reforming this code needs to begin by next fiscal year.

- Customs duties: The Budget has proposed rationalizing customs duties to align with India’s emphasis on developing global scales for certain sectors, and with strategic Concepts of Atmanirbhar Bharat and Be-Vocal-for Local.

- Accounting Reforms: There are indications that accounting reforms will continue; and so, will shift toward greater transparency of fiscal accounts. Indian Railways, the largest organization of the Central government, is in the process of moving from cash to accrual accounting method; and more such initiatives may be expected.

- Continuing to get better societal outcomes from budgetary outlays.

References

- https://www.indiabudget.gov.in/

- https://pib.gov.in/PressReleseDetailm.aspx?PRID=1693779 -Accessed on 1 February 2021

- https://thegoldstandardsite.wordpress.com/2021/02/02/why-does-the-indian-budget-deserve-praise-not-for-the-reasons-you-think/

- https://fincomindia.nic.in/ShowContentOne.aspx?id=9&Section=1

Image Source: Jagran Josh

Comments