Indian stock markets Poised for Greater Depth and Sophistication

- In Economics

- 10:45 AM, Mar 04, 2021

- Mukul Asher

This column argues that the Indian stock markets are poised for greater depth and sophistication. This is due to the underlying solid fundamentals supporting strong growth prospects, as well as policy initiatives, especially the decision to shift the economy’s balance towards greater role for the private sector, markets, and economic freedom to all the stakeholders including government enterprises.

The Indian Stock Markets: An Overview

India’s two stock exchanges are Bombay Stock Exchange (BSE), founded in 1875, and National stock exchange (NSE), founded in 1992. As of February 2021, BSE is listed, the shares of NSEs are traded, but it is expected to be listed in 2022.

NSE was the first exchange in the country to provide a modern, fully automated screen-based electronic trading system. Based on the statistics maintained by Futures Industry Association (FIA), a derivatives trade body, NSE was the world’s largest derivatives exchange in 2020 by number of contracts traded. NSE is ranked 4th in the world in the cash equities by number of trades as per the statistics maintained by the World Federation of Exchanges (WFE) for calendar year 2020.

As of end February 2021, the BSE had 62.5 million registered investors. The NSE has around 20 million registered investors, while its goal is to reach 50 million. As there is a lot of overlap between the two exchanges, the registered investors cannot simply be added.

This is also the case with market capitalization of the companies listed on the two bourses. AS on 2 March 2021, market capitalization of the companies listed on BSE was INR 206.5 Trillion (USD 2.79 Trillion, about 3.3 percent of the global total of USD 85 trillion).

The number of capital equity companies available for trade on BSE are around 3900 of which about four-fifths are traded. The number of companies with only debt capital listed in 412; and there are 21 Asset Management companies (AMCs) which are listed on the BSE.

In 2021 (as at end February), there have been eight Initial Public offerings (IPOs), one of which was on BSE SME (Small and Medium Enterprises) segment.

Both the stock exchanges are adding new products, instruments, and platforms. Thus, The NSE has recently launched futures and possibilities contracts for the Nifty Financial Services index (FINNIFTY). The NSE has introduced weekly futures for the stock index derivatives. The index derivatives will provide a new risk management tool to investors with exposure to the financial services sector

The Association of Mutual Funds in India (AMFI) is a non-profit government organisation in the Mutual Funds’ sector that acts as a primary regulator under SEBI (Securities and Exchange Board of India).

Average Assets Under Management (AAUM) of Indian Mutual Fund Industry for the month of January 2021 stood at INR 31.8 Trillion (USD $430 Billion).

The industry’s vision is to reach INR 100 trillion (USD 1.3 trillion) of AAUM, and increase investor base from around 20 million to 100 million by the end of the current decade1.

Promising Recent Developments

There are several recent developments which are likely to add depth and sophistication to India’s stock markets.

Vastly Enhanced Role of Private Sector, Markets, and Economic Freedom

In a historic decision, in the 2021-22 Budget of the Union Government has explicitly stated that henceforth the private sector will play a greater role. The and that public enterprises will be rationalized by focusing on contestability/competition, organizational improvement, individual incentives, and technology upgradation and infusion to improve public sector organizations.

This is a historic shift in economic policy. It is therefore worth quoting the Budget Speech (Annexure III) at length.

The Finance Minister Nirmala Sitharaman stated: “Highlights of Disinvestment/Strategic Disinvestment Policy

Objectives:

a) Minimising presence of Central Government Public Sector Enterprises including financial institutions and creating new investment space for private sector;

b) Post disinvestment, economic growth of Central Public Sector Enterprises (CPSEs)/ financial institutions will be through infusion of private capital, technology and best management practices;

c) Disinvestment proceeds to finance various social sector and developmental programmes of the government.

Policy features:

a) Policy covers existing CPSEs, Public Sector Banks and Public Sector Insurance Companies.

b) Various sectors will be classified as strategic and non-strategic sectors.

c) The strategic sectors classified are: i) Atomic energy, Space and Defence ii) Transport and Telecommunications iii) Power, Petroleum, Coal and other minerals iv) Banking, Insurance and financial services

d) In strategic sectors, there will be bare minimum presence of the public sector enterprises. The remaining CPSEs in the strategic sector will be privatised or merged or subsidiarized with other CPSEs or closed.

e) In non-strategic sectors, CPSEs will be privatised, otherwise shall be closed”

The above policy on the future role of public sector qualitatively changes the future dynamics of the balance between the public and private sectors, and augurs well for adding depth and sophistication to the stock markets.

For 2021-22, the Union government has set a disinvestment revenue goal of INR 1.75 trillion. The market capitalization of divested companies would be much higher.

Major public sector companies are to be divested and listed on the stock exchanges. As the Finance Minister in the 2021-22 Budget speech stated: “A number of transactions namely BPCL, Air India, Shipping Corporation of India, Container Corporation of India, IDBI Bank, BEML, Pawan Hans, Neelachal Ispat Nigam limited among others would be completed in 2021-22. Other than IDBI Bank, we propose to take up the privatization of two Public Sector Banks and one General Insurance company in the year 2021-22. This would require legislative amendments and I propose to introduce the amendments in this Session itself. 85.

In 2021-22 we would also bring the IPO of LIC (Life Insurance Corporation of India) for which I am bringing the requisite amendments in this Session itself.

To fast forward the disinvestment policy, I am asking NITI (National institution for Transforming India) to work out on the next list of Central Public Sector companies that would be taken up for strategic disinvestment.

To similarly incentivise States to take to disinvestment of their Public Sector Companies, we will work out an incentive package of Central Funds for States.

Idle assets will not contribute to AtmaNirbhar Bharat. The non-core assets largely consist of surplus land with government Ministries/Departments and Public Sector Enterprises. Monetizing of land can either be by way of direct sale or concession or by similar means. This requires special abilities and for this purpose, I propose to use a Special Purpose Vehicle in the form of a company that would carry out this activity. In order to ensure timely completion of closure of sick or loss making CPSEs, we will introduce a revised mechanism that will ensure timely closure of such units.”

Listing on the stock exchanges brings the organization under the Companies Act, and that in turn has the potential to improve governance and accountability of the public sector organizations.

The foreign equity limit in the insurance sector has been raised to 74 percent, which will positively impact on the stock markets.

By far the largest divestment proposed is that of LIC, India’s largest life insurance company, with market share of about 70 percent in first year premium income; gross income of INR 6.1 trillion in 2019-20; and total assets of INR 32 trillion as of March 2020. Its listing will add depth to the Indian stock markets.

Ahead of privatisation of Bharat Petroleum Corporation (BPCL), the board of the fuel-retailer-cum-refiner has authorized sale of the company’s 61.65 percent stake in Numaligarh Refinery (NRL). This is likely to realize about INR 50 Billion to the Union Government.

The above very explicit and far-reaching statement of the Finance Minister also urges state governments to divest some of their public enterprises. Some of these may also be listed on the stock exchanges.

The statement on land monetization is likely to mitigate one of the constraints in business expansion and formation, i.e., availability of land.

The Department of Public Enterprises estimates that on a historic cost, not market value, basis, the Government of India has land worth INR 3.75 trillion, and public enterprises own land worth 0.9 trillion2.

Such estimates also need to made for the state governments. Of course, not all of such land is surplus, or can be monetized. But easing land constraint for businesses and infrastructure by the Union government, and hopefully by at least some states, augurs well for growth and for the stock markets.

India’s Robust Start-up Eco-system

According to official sources, India has currently the third-largest start-up ecosystem in the world. It is home to 21 unicorns (start-ups valued above USD one billion) which collectively are valued at USD 73.2 billion. More than 50 start-ups might join the unicorn club as early as 2022.

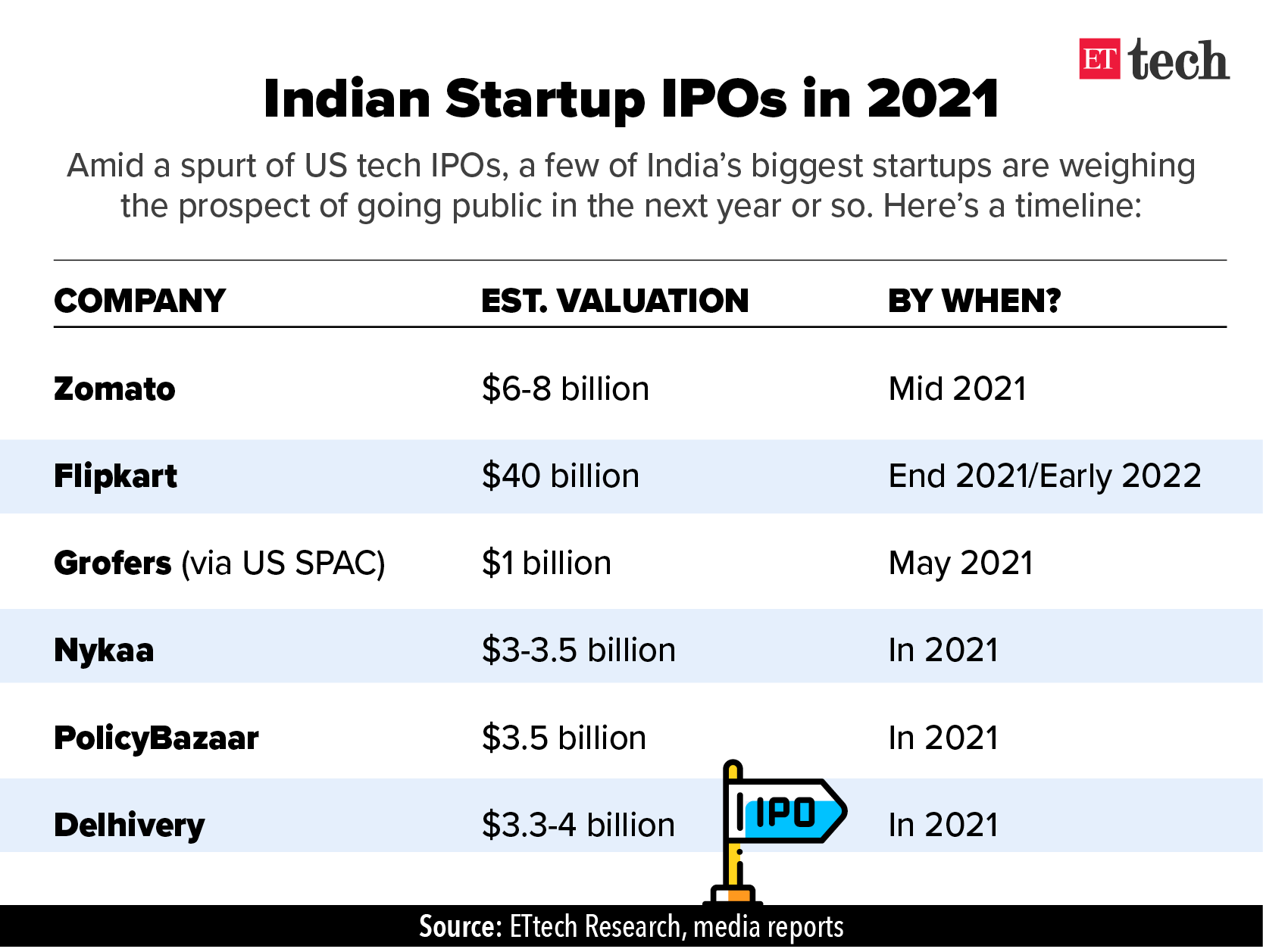

Many start-ups are planning IPOs on the stock exchanges as indicate in Figure 1.

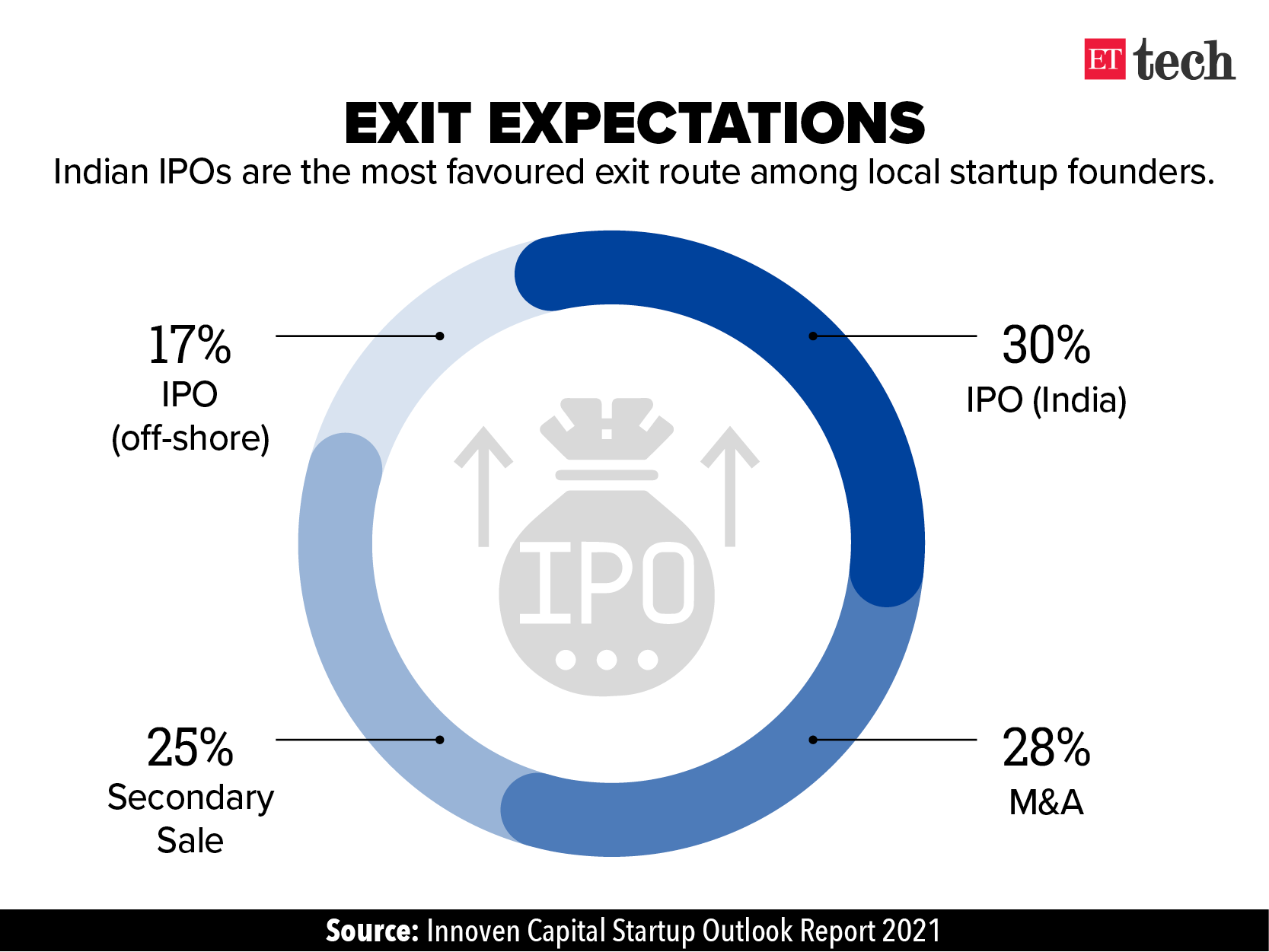

Among the local start-up founders, Indian IPOs are a favoured option as shown in Figure 2

To create an ecosystem which promotes innovation in the securities market, SEBI has promoted the concept of Innovation Sandbox where FinTech firms may test their applications effectively before introduction in live environment.

BSE, with a view to operationalizing the above-mentioned endeavour of SEBI, has setup an “Innovation Sandbox” web portal3.

The FinTech firms and individuals may use the environment for offline testing of their applications in a test environment. It is a workflow-based platform, where applicants will be able to access APIs, test data of Stock Exchanges, Depositories and Qualified Registrar and Share Transfer Agents (QRTAs).

This is a positive development for formation of more start-ups in Fin Tech, which can eventually be listed on the exchanges.

Inflows from Abroad

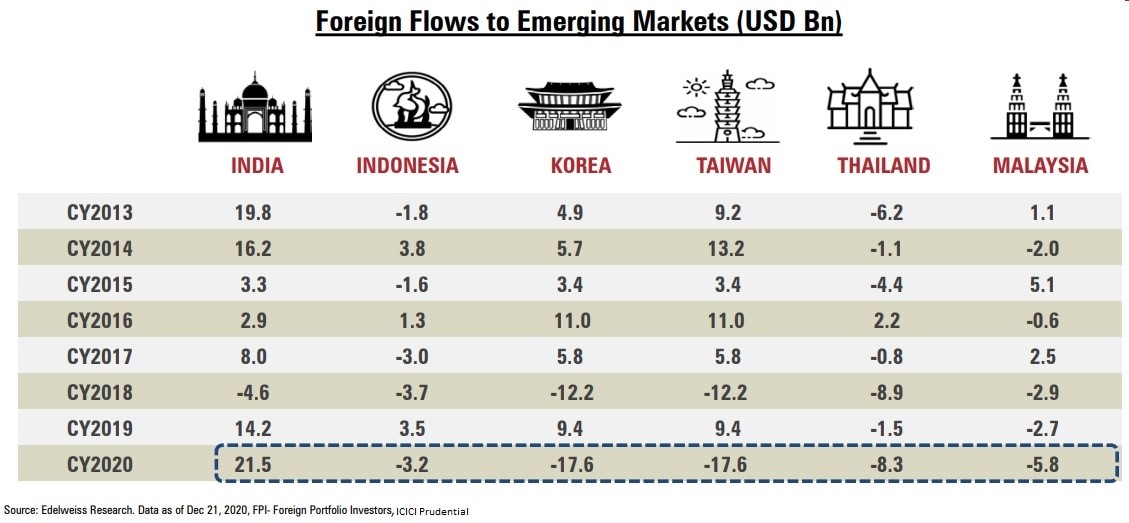

India has been attracting portfolio investment from abroad on a steady basis as shown in Table 1. Even in calendar year 2020, when Covid-19 pandemic was at its height, among the selected emerging markets, India alone attracted positive portfolio flows from abroad.

According to Care Ratings, till February 2021, the stock of total FPI inflows was USD 592.5 billion, USD 537.4 billion in equities and USD 51.38 billion in debt.

The prospects are continuing inflows of portfolio investment abroad due to continuing liberalization of FPO investments, and India’s strong fundamentals. This should lend support to valuation of the stock markets, and help deepen them.

Others

India International exchange (IIE), located in India’s IIFC (India International Financial Centre) in GIFT (Gujarat International Financial- Tech) CITY, is targeting listing of about USD 1 trillion (INR 74 trillion) of debt instruments during the decade ending in 2030. IIE is the preferred platform for listing of Bonds by the Indian corporates.

In addition, substantial amount of equity, REITs (Real Estate investment Trusts), Infrastructure investment funds, and others are also likely to be listed on IIE.

Under India’s Liberalised Remittance Scheme (LRS), resident individuals may remit up to USD 250,000 per financial year. This can also be invested in shares, debt instruments, and be used to buy immovable properties in overseas market. Individuals can also open, maintain and hold foreign currency accounts with banks outside India for carrying out transactions permitted under the scheme. The LRS is a major step towards convertibility of the Indian Rupee.

The role of IIFC is to increase the share of India’s international financial transactions to be undertaken from within India, including transactions under the LRS. This could add further depth and sophistication to India’s stock markets.

References

-

Shah, Alpesh, Amit Kumar, Ashish GARG, and Siddhant Mehta, 2019. UNLOCKING THE ₹ 100 TRILLION OPPORTUNITY ASSET MANAGEMENT INDUSTRY IN INDIA. Boston Consulting, AMFI- https://www.amfiindia.com/Themes/Theme1/downloads/BCG-Banner7.pdf -Accessed on 1 March 2021

-

https://www.business-standard.com/article/economy-policy/without-red-tape-plans-to-let-private-sector-manage-surplus-land-can-work-121022800910_1.html -Accessed on 2 March 2021

Image Source: The Economic Times

Comments