IMF’s April 2020 Global Reports: Implications for India

- In Economics

- 11:26 PM, Apr 26, 2020

- Mukul Asher

International Monetary Fund (IMF) releases three semi-annual publications, World Economic Outlook (WEO), Fiscal Monitor (FM) and Global Financial Stability Report (GFSR), in April and October each year. In April 2020, during its virtual spring meeting, IMF released these three reports.

These are long, technically complex, and data intensive reports. The focus in this column is providing selected highlights of the report, with emphasis on implications for India. All three reports and their briefing uniformly highlight extraordinary uncertainty underlying the projections.

The Reports were released against the backdrop of the global pandemic of Wuhan-China virus (technically known as Covid-19 virus) which has spread to 210 countries and territories (by April 20, 2020), has taken a heavy toll on human lives and on the economies. The issues relating to the virus thus take a centre stage in these reports.

As of April 24, 2020, globally there were 2.72 million cases of the virus, with 0.75 million recoveries (rate of 27.6%), and mortality of 0.19 million (rate of 7.0%). U. S. A., Spain, Italy, and France, are among most severely affected countries 1.

As of April 24, 2020, India had 23039 cases (17 per million population as compared to the global average of 349); 5012 recoveries (rate of 21.8%, as compared to global average of 27.6%); and 721 deaths (0.5 per million population as compared to global average of 24.5). India’s mortality rate is 3.1%, as compared to the global average of 7.0% 1.

There are indications that the growth curve of Wuhan-China virus is flattening in India, though continued persistent efforts to contain virus and perseverance with socially responsible behaviour must continue. As on April 22, 2020, the active cases in India were doubling every 10 days, good improvement over the pre-lockdown period, when they were doubling in around 4 days.

As of April 19th, 325 of India’s 736 districts had not reported a single case. 46 percent of all cases were restricted to 18 districts 2.

Among the states, Arunachal Pradesh, Goa, Manipur, Sikkim, and Tripura, have become Wuhan-China virus free as of April 25th, 2020. This suggests that the response to the virus needs to be nuanced and in many areas of the country, some economic activity could resume.

India’s efforts to contain the virus would have been even more effective had one irresponsible, callous, and malicious Tablighi Jamaat Islamic group, whose leader has been appropriately charged with manslaughter charges, not deliberately spread the Wuhan-china virus across the country; and then its members not only refused to cooperate in getting treatment, but also engaged in brutal violence against the corona warriors.

India’s Ministry of Health estimates that overall about 30 percent of the Wuhan-China virus cases can be traced to the Tablighi Jamaat Islamic group, with the proportion being much higher in some states such as Tamil Nadu (84%), Delhi (63%), Andhra Pradesh (81%), Telangana (71%) and Uttar Pradesh (59%).

In addition to usual limitations surrounding the Wuhan-China virus data, which is aggregated from different countries using varying methods, the global figures are widely believed to be significantly understated due to lack of credibility of the reported figures from China and some other countries, such as North Korea.

The Reports

Of the three reports, the WEO 3, is the one which is more widely followed, the other two being for specialists in the financial and fiscal fields.

The WEO projects that in 2020, the global output will decline by 3%, as compared to positive 3.6% growth for 2020 projected in IMF’s January 2020 Report, signifying the suddenness, depth, and severity of the global economic impact from the China-Wuhan virus crisis.

The WEO estimates that in 2020, over 170 countries will exhibit negative per person income growth, with concomitant sharp drop in employment and livelihood opportunities.

The WEO projects that the global growth will rebound sharply to 5.8% (from low-base) in 2021 from a low base, with probability of downward bias.

In 2020, Advanced economies, that are bearing the major burden of the Wuhan-China virus, are expected to exhibit a negative growth of 6.1%, with Euro area output declining by 7.5%. The Emerging and Developing Asia region, and Low-Income Countries are projected to exhibit growth of 1.0%, and 0.4% respectively.

In 2020, India is projected to be among the most rapidly growing major economies with a growth rate of 1.9%, followed by China at 1.2%. In 2021, the WEO projects sharp growth recovery of 5.8% globally, from a low base. India is projected to grow at 7.4%, China at 9.2%. These projections have significant downward risk.

The WEO projects that in 2020, the world trade volume of goods and services will decline by 11%, increasing by 8.4% in 2021. This has severe implications for those highly trade reliant economies.

India’s annual merchandise exports fell to USD 314 billion in 2019-20, 5% lower than the USD 331 billion in the previous year. In 2019-20. merchandise trade deficit at $152.9-billion is lower than USD 176.4 billion in the previous year.

The World Bank projects India’s remittance inflows to decline from USD 83 Billion in 2019 to USD 64 billion in 2020, with some Indians working abroad returning to India. Some states such as Kerala may face more acute challenges than others.

It is not just the growth rates, and international trade volumes, but employment and livelihoods are also being severely impacted globally. Advanced countries with most of the labour force in the formal sector, have a severe challenge of supporting jobs and livelihoods.

Those countries such as India, with agricultural sector and related activities providing more than half the number of livelihoods to India’s around 540 million officially counted as economically active population, and to many more who are not counted as such; construction sector with significant proportion of labour force without formal contracts, small shopkeepers and those depending on micro and small enterprise, the revival of economic activity requires different approach.

India has already opened up agriculture and many related activities, including production and distribution of agricultural inputs. Despite the lockdown amid the COVID-19 pandemic, as of third week of April 2020, 67% of wheat crop sown in winter (rabi crop) has been harvested. It is reported that there is "minimal or no disruption" in harvesting rabi crop and sowing of summer crop during the lockdown. Summer crop sowing is 14% higher over corresponding period last year as on April 17th, 2020.

The above along with the decision to allow all shops outside municipal limits and standalone shops within municipal limits to open though malls are to remain closed, will help protect livelihoods. India is considering setting up INR 100 Billion fund of funds for the micro-small-medium enterprises. The measures to bear provident fund costs of companies for a period have been announced.

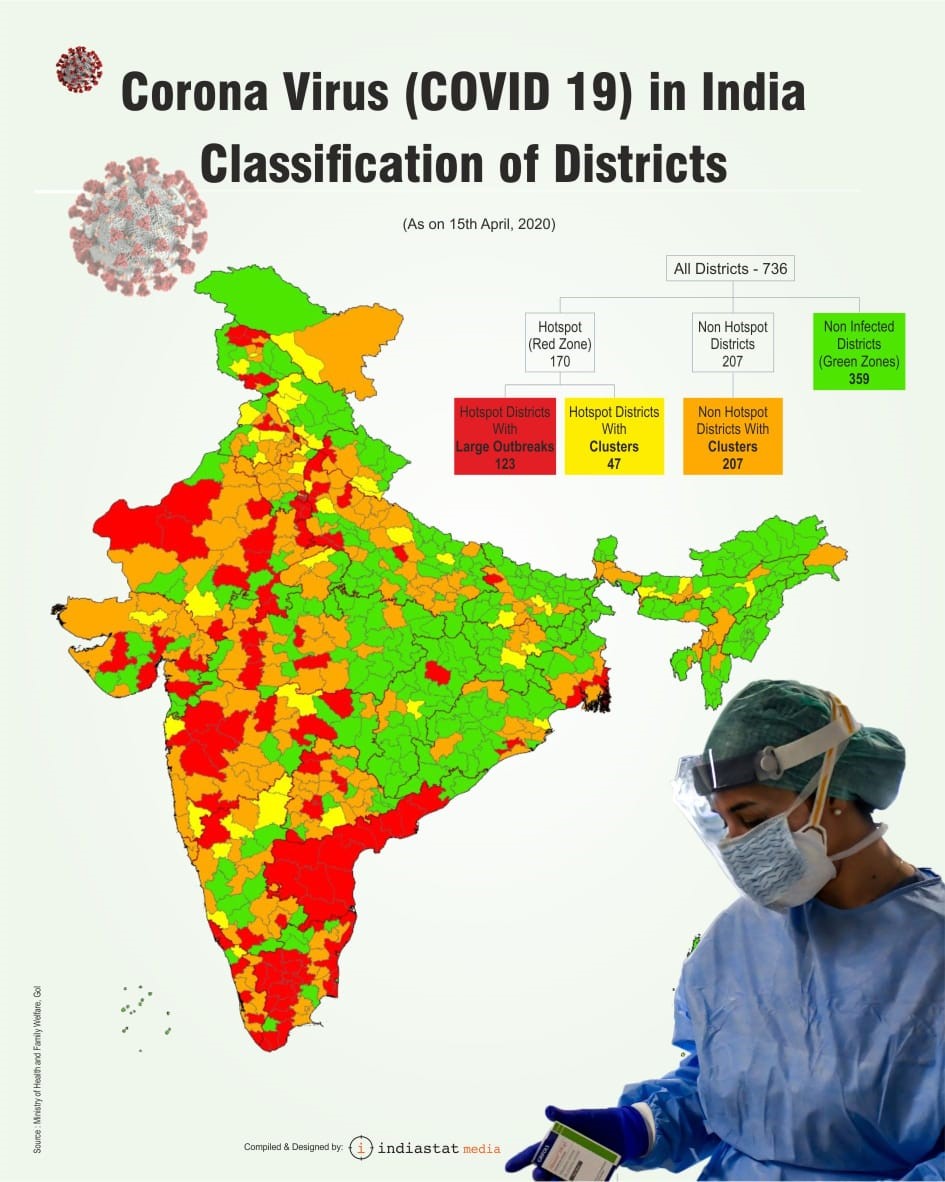

As shown in the Figure, India has classified its 736 districts into Green (non-infected Districts), 359 (49%); Yellow, non-hotspot districts, 207 (28%); and Red, hotspot districts, 170 (23%). Different degrees of relaxations in economic activities are to be provided in each category, with conditions laid down to shift from one to the other category.

But this opening does pose greater risk spread of Wuhan-China virus, a cruel trade-off which must be managed.

The Fiscal Monitor (FM)4

This report assesses fiscal impact of the Wuhan-China virus crisis. As may be expected it warns that “…The size of the impact of COVID-19 on public finances is highly uncertain at this time and will depend not only on the duration of the pandemic but also on whether the economic recovery is swift or the crisis casts a long shadow”.

Nevertheless, the Monitor in its Executive summary assesses that:

“The COVID-19 outbreak and its financial and economic consequences will cause a major increase in fiscal deficits and public debt ratios compared with previous projections. As output drops, revenue will fall even more sharply (revenue is projected to be 2.5% of global GDP lower in the baseline scenario for 2020 than what was projected in the October 2019 Fiscal Monitor). The necessary health expenditure and the tax and spending measures to support people and firms will also have direct fiscal costs, currently estimated at $3.3 trillion globally. In addition, although public sector loans and equity injections ($1.8 trillion) and guarantees and other contingent liabilities ($2.7 trillion) can support financial and nonfinancial enterprises, they also create fiscal risks”.

Based on policy responses to date, fiscal balances in 2020 are expected to deteriorate in almost all countries, with sizeable estimated expansions in the United States, China, and several European and other Asian economies. Although a sizeable increase in deficits this year is necessary and appropriate for many countries, the starting position in some cases presents vulnerabilities (global public debt was 83% of GDP in 2019).

The situation is more concerning for emerging markets and developing economies that face multiple shocks that include the pandemic, an abrupt worsening in financing conditions, weak external demand, and (for commodity exporters) lower commodity prices. Even after the global community’s efforts to alleviate such financing constraints, these countries will need to reprioritize expenditure toward the health sector while safeguarding key public services (transport, energy, communications) and social protection.”

The above suggestions are quite generic. Reprioritizing public expenditure in a crisis in a macroeconomically sustainable manner is indeed a challenging task.

As far as India is concerned. The Monitor estimates India’s general government fiscal deficit to be 7.4% of GDP in 2019 and in 2020, as compared to the average of Emerging Market and Middle-Income Countries of 4.8% of GDP in 2019, and 9.1% of GDP in 2020. In 2020, China (11.2%), Saudi Arabia (12.6%), and South Africa (13.3%) are projected to have exceptionally high general government sector deficits.

This suggests that fiscal stimulus must be carefully planned, and with stimulus benefits going into bank accounts of individuals through Direct Benefit Transfers (DBTs) to minimize leakages and maximize economic support and impact.

As compared to the average for Emerging Markets and Middle-Income Economies, India’s general government debt to GDP at 71.9% of GDP in 2019 (as compared to the average of 53.2%), and 74.3 percent in 2020 (average of 62.0%) is rather high. But India’s debt is predominantly internal, with relatively longer maturities, and it has well developed government debt markets, which is attractive for foreign investors.

The above figures do not include off-budget transactions of government, debt of public enterprises, government guarantees, and fiscal contingent liabilities. If these were included, the deficit, and debt levels, including for India will be significantly higher.

The high-income countries, adopting stimulus packages ranging from 3 to 8% of GDP through fiscal policies, and through central bank providing liquidity, including essentially printing money, have tax to GDP ratios in the range of 35 to 50% of GDP.

In contrast, India’s tax to GDP ratio of the Union and State government’s combined is around 18% of GDP. The Union government’s tax to GDP ratio, net of constitutionally mandated transfers to the states, is about 10%. So large fiscal stimulus package (above a package of around 1.2% of GDP already implement targeted at lower income groups; and injection of large liquidity by the Reserve Bank of India), is economically not feasible, particularly as future shocks affecting the economy and the fiscal and monetary systems may well occur.

The states, whose share of revenue and expenditure as a percent of the combined total of Union and State government is higher than of the union government, must do more to stimulate their economies, leveraging their balance sheet, particularly assets more competently; while seeking escape clauses from the Fiscal Responsibility and Budget Management Act (FRBM) imposed limits on deficits and debt.

There is a strong case for each state to urgently set up a small group, but with needed skills and expertise, to advise on revival of the state economy. This group must have strong support from the Chief Minister, and the state bureaucracy.

Global Financial Stability Report (GFSR) 5

Executive Summary of the April 2020 GFSR makes the following key points:

• The outbreak of COVID-19 has dealt an unprecedented blow to global financial markets.

• Risk asset prices have plummeted and borrowing costs have soared, especially in risky credit markets.

• Emerging and frontier markets have experienced the sharpest portfolio flow reversal on record.

• The priority is to save lives and to support the people and companies most affected by COVID-19.

• Fiscal, monetary, and financial policies should be used to support economies stricken by the pandemic. Central Banks are continuing aggressive monetary easing and asset purchases

• International cooperation is essential to tackle this extraordinary global crisis.

India has been taking several measures to maintain financial stability, and manage external sector. As RBI governor has stated, India has deliberately opted for a step-by-step feedback loop-based approach that is different from the big-bang approach of some countries.

In mid-April 2020, RBI announced a package which has targeted relief for banks, NBFCs (Non-Bank Financial Companies), and state governments in a cautious and prudent manner. The package promises that more will be done if needed.

Concluding Remarks

IMF’s Managing Director, Kristalina Georgieva, has outlined four global policy priorities arising from the April 2020 Reports and other studies.

First, improve quality of public and private health systems, their accessibility, and affordability in each country, with global coordination and support.

Second, protect livelihoods by monetary, fiscal, regulatory, organizational and institutional measures and reforms.

This leads to judgements about when and how to make trade-offs between health concerns and livelihood concerns in a particular context.

Third, prepare for recovery and for facing fiscal, human-resource, technological and other challenges, including the probability that the viruses may be recurring.

As may be expected, these policy priorities are fairly generic. They need to be applied in a nuanced and disaggregated manner, with appropriate trade-offs and sequencing in a context-specific manner.

Indian policymakers have indeed calibrated their response to Wuhan-China virus to suit the Indian context, particularly taking into account large population, federal structure, and economic, fiscal, and institutional capacities, conditions, and psychology of the Indian people. Fiscal, monetary, regulatory, and other measures have been sequenced and structured accordingly.

As India begins gradual relaxation of the lockdown to get the economy and society moving again, the outcomes exhibited in addressing the Wuhan-China virus so far give rise for cautious optimism.

Prime Minister Narendra Modi has indicated that the virus crisis has taught India, its people and institutions at all levels of government to be even more self-reliant. How India approaches this goal while preserving economic efficiency and prudent diversification will be a key component impacting on India’s future economy and society.

- https://www.worldometers.info/coronavirus/ Accessed on April 24, 2020

- http://timesofindia.indiatimes.com/articleshow/75243248.cms?utm_source=contentofinterest&utm_medium=text&utm_campaign=cppst ( accessed on April 24th, 2020)

- https://www.imf.org/en/Publications/WEO (accessed on April 20th,2020)

- https://www.imf.org/en/Publications/FM (Accessed on April 20,2020)

- https://www.imf.org/en/Publications/GFSR Accessed on April 20,2020

Image Credits: Business Today

Disclaimer: The opinions expressed within this article are the personal opinions of the author. MyIndMakers is not responsible for the accuracy, completeness, suitability, or validity of any information on this article. All information is provided on an as-is basis. The information, facts or opinions appearing in the article do not reflect the views of MyindMakers and it does not assume any responsibility or liability for the same.

Comments