How does Yield Curve Control (YCC) work?

- In Economics

- 12:25 PM, Oct 14, 2022

- Mohal Joshi

Today one would be hard-pressed to find someone who is not aware of inflation and not affected by it. However, in the not-so-distant past (roughly ~18-21 months ago) it was far from most people’s minds. Like how many had foreseen inflation becoming a big problem back in early 2021 (including me) the next big macroeconomic phenomenon in the future is going to be called YCC (Yield Curve Control). There have been few signposts since the beginning of the pandemic (I had highlighted this back even in 2020/21: 1 2 3) that the end game for many central banks will be YCC. To understand what that means first we need to look at how bonds: bond prices and bond yields work.

Bond Prices/Yields

A bond is simply a loan/security which is taken out by an issuer (be it a private company or a government or a municipality) to raise capital. The issuer of the bond (i.e., the borrower) gets money from investors who buy its bonds. In return, the borrower pays interest to the investors for lending money to them. The borrower pays the interest at predetermined intervals (usually annually or semi-annually) and returns the principal on the maturity date of the bond. The yield is the rate of return received from investing in the bond. Bond price and bond yield are inversely correlated. If the price of a bond goes up, the yield decreases and if the price of a bond goes down the yield increases.

When interest rates fall, it causes a fall in the value of the newly issued bonds. This is because the older bonds that have been issued in the past will keep paying the older higher interest/coupon rate (set at the time of issuing the bond). This will now make the older bonds more attractive (as they will be paying a higher rate) and investors will therefore pay a “premium” for these older/higher-paying bonds.

But conversely, when interest rates rise, newer bonds will pay investors better interest rates than older bonds. So, the older bonds which are less attractive will need to drop their prices “to compensate” for their lower coupon/interest rates.

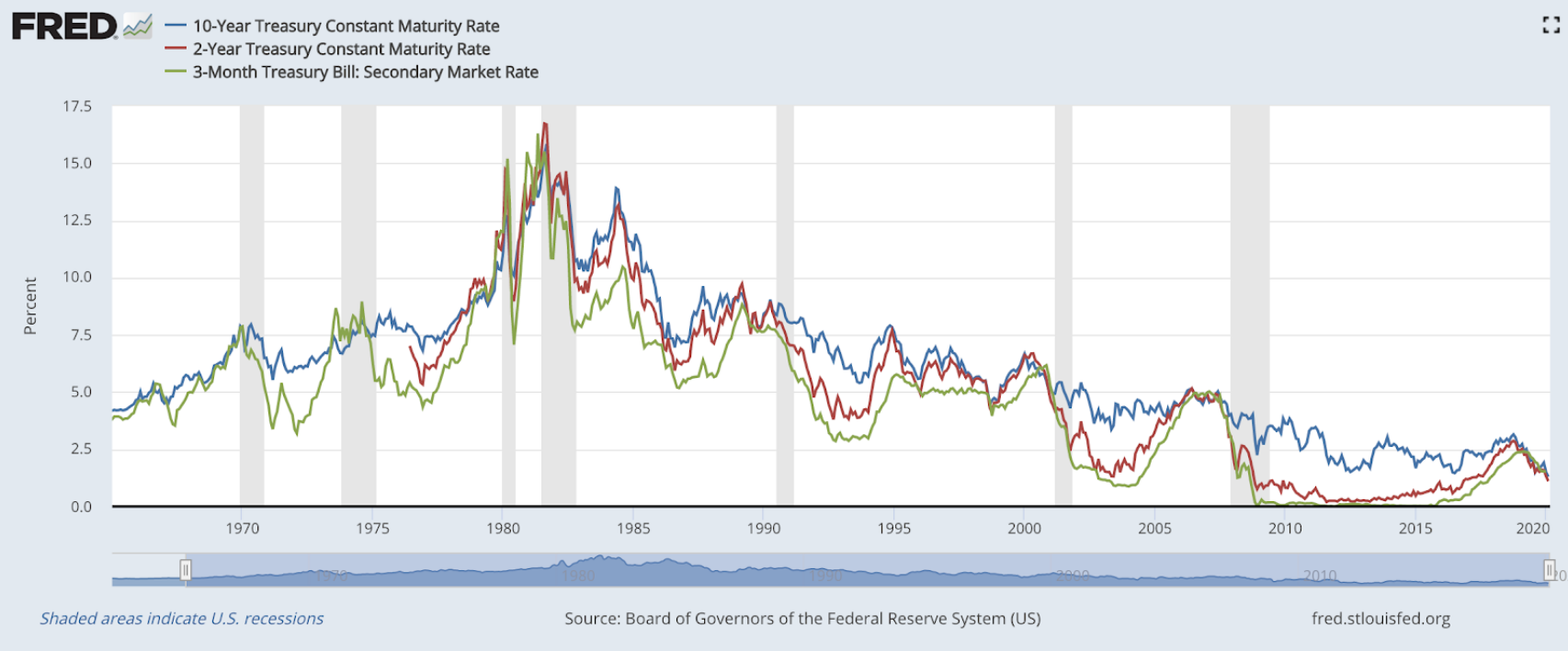

For the past 40 years, interest rates have continuously fallen on a long-term basis. The bondholders have enjoyed very good returns on their bond holdings over this time as the central banks around the world have resorted to keeping interest rates low to stimulate higher growth. With every economic crisis, the central banks did a new round of rate cuts to ensure that recessions were kept as short and as less severe as possible. During the aftermath of the 2008 GFC (Global Financial Crisis) eventually, many central banks bottomed our near zero: Federal Reserve (USA) at 0% and in ECB’s (European Central Bank) case at a shocking negative 50 basis points: -0.5%!

Quantitative Easing (QE)

Post the 2008 GFC crisis, central banks were looking at ways to boost economic growth. Faced with long term structural headwinds such as declining demographics there were challenges on how to produce sustained growth while avoiding another financial downturn. They wanted to keep the interest rate and borrowing costs lower for companies (and also for the government). Due to a large amount of stimulus printed by the government, it was not possible to have enough private buyers to buy all the government debt. Hence to keep the yields from rising (and by extension borrowing costs for both private and public entities) the central banks started buying billions of dollars of government debt to push the yields lower. This was referred to as QE (Quantitative Easing). The central banks bought assets through the primary dealers (banks and financial firms that buy government bonds/securities directly from the government) with the intent of selling them to other entities like the central banks. In effect, the central banks put government bonds on their balance sheet and vastly expanded the balance sheet over the next decade.

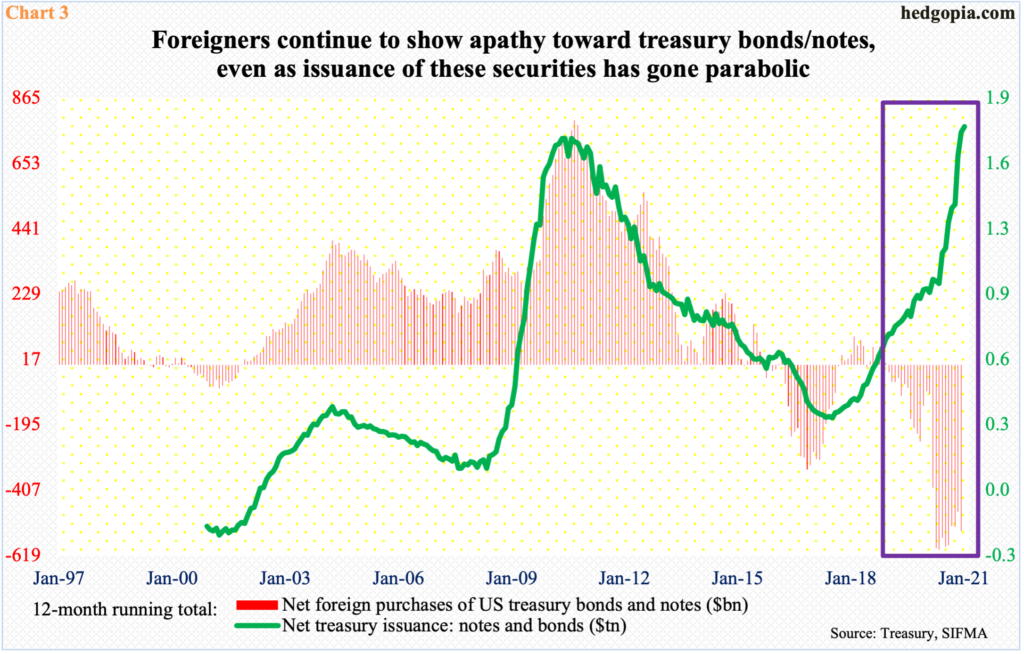

US since the beginning of the US petrodollar system which I had covered in my previous article was used to foreigners buying US Treasuries (debt). This helped the USA to keep the borrowing costs lower while racking up more debt as the years went by. However, for the past 7+ years, foreigners have been net sellers of US Treasuries (vs being net buyers pre-2015). This creates more headaches for the Federal Reserve how to prevent the yields from rising too high, they must purchase more of the debt issued by Treasury/US Government.

Image courtesy: Hedgopia.com

Inflation conundrum

The central banks were able to get away with massive amount of printing since the 2008 GFC crisis in part because inflation was never a serious problem. Pre-pandemic the Fed wanted 2% inflation but could hardly ever get the economy to achieve that on a sustained basis. Now in the present day with most of the world facing a severe inflation issue, this now creates a conundrum for the central banks. Staying put at lower interest rates means inflation runs hotter than expected for a long period of time causing pain for the common man.

To crush inflation the central banks, must raise interest rates and do QT (Quantitative Tightening: which is becoming a net seller of government bonds i.e., diametrically opposite of what QE does). Each hike increases the borrowing cost for the government itself. With a gigantic amount of stimulus handed out during the covid pandemic, the debt burden has gone up significantly. When the time is due for this debt to be refinanced (unlikely it is going to be paid off in full) the interest due on this will be much higher during this refinancing due to the now higher interest rates. Unless there are massive improvements in productivity or economic growth the debt burden will continue to grind higher in this case.

QT (Quantitative tightening) brings its own unique challenges as to finding enough willing private buyers to absorb all the debt that the central banks want to offload from its balance sheets. Many participants would want a lower price (i.e., higher yield) for these bonds which would drive up the cost of this newly issued debt.

YCC: History and Present

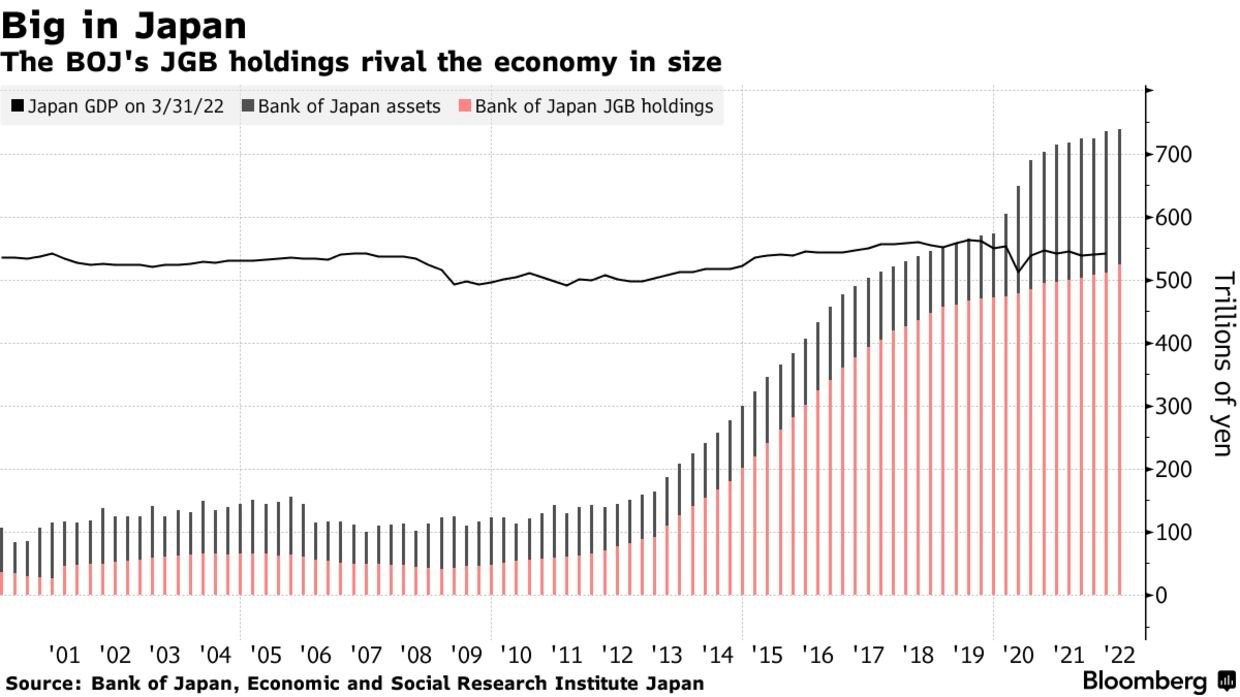

Japan today has an astronomical 250+% debt to GDP which is the highest among developed nations across the world. The Japanese central bank (BOJ: Bank of Japan) balance sheet was estimated (even in the pre-pandemic times) to be bigger than the entire country’s GDP! By the middle of this year, it is estimated that BOJ owns more than half of all the JGB bonds (Japanese government bonds/public debt).

Image courtesy: Bloomberg

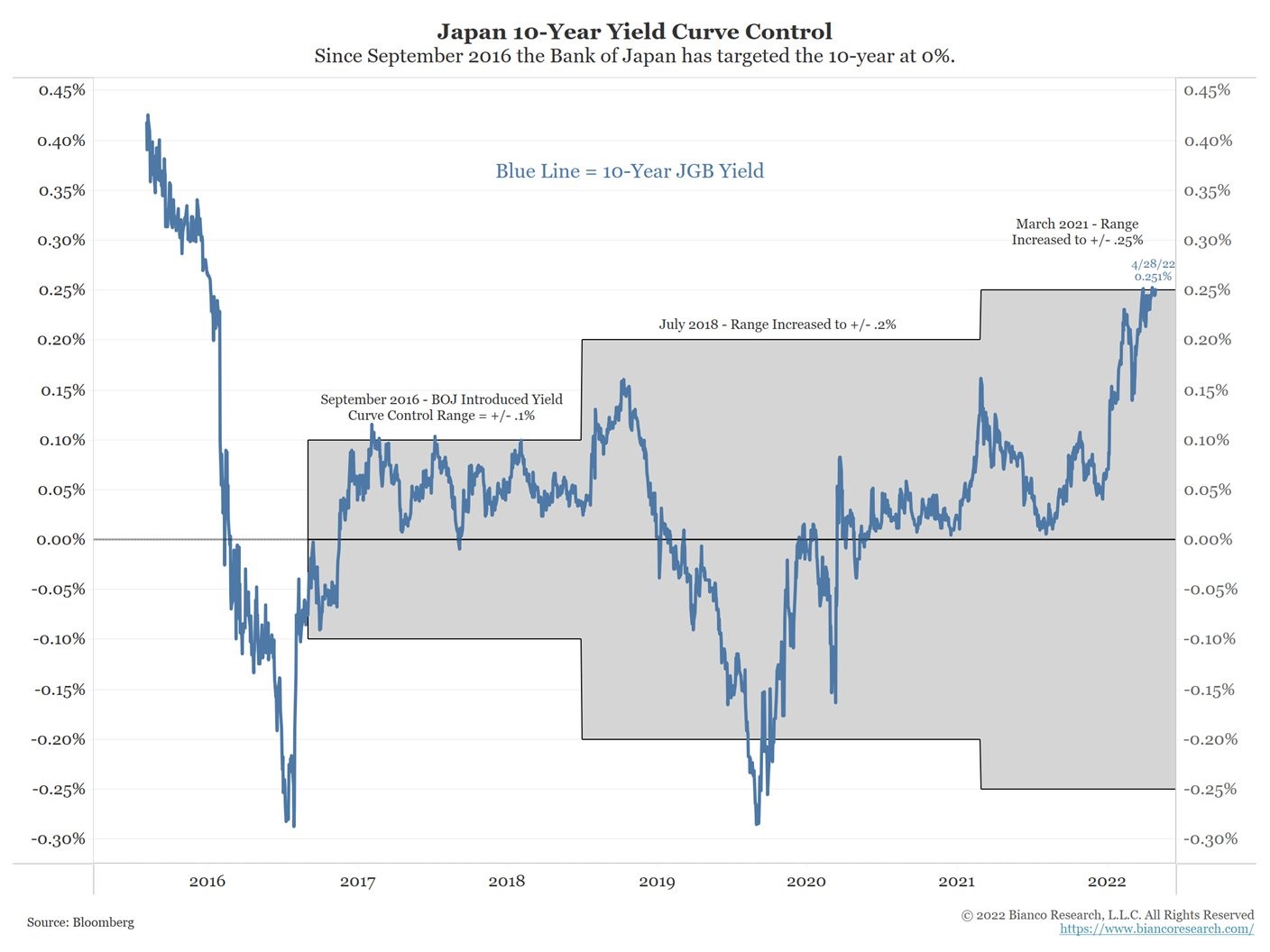

BOJ has engaged in what is referred to as YCC [Yield Curve Control] since September 2016. What in essence that means that BOJ has capped the yields at certain range. BOJ has fixed the yield on the JGB within a desired range.

Image courtesy: Bloomberg

If the yields drop below that range, it will sell JGB’s to bring the yields back up and if the yields go above its target range it will step in to buy JGB’s from the institutional/foreign/private players to again bring back the yield within the desired band. To achieve this BOJ must get more money from the Japanese government (i.e., print more money) to buy these bonds.

YCC in effect informs the market of where the proverbial “line in the sand” is. Private players now know that to defend the yield the BOJ is committed to buying every single bond above a certain yield. In times like these when inflation is running hot and private entities want more in return for the JGB bonds they could, in theory, sell every bond they possess and the JGB would be forced to purchase every single one of them to maintain the rate (if no other private players step in).

So, the central bank and by extension the government to defend these yields might just be forced to print an unlimited amount of money to buy these bonds in defense of the yield. This vast amount of money printing has caused their local currency: Yen to weaken against other currencies such as the USD (US Dollar). The Japanese Yen has devalued by almost 25% against the USD in the last 7 months. This keep in mind is not some global south/poor country that experiences big currency swings but rather we are talking about a G-7 nation that has the 3rd largest economy in the world.

The BOJ is caught between a “rock and hard place”. They can protect interest rates/yields or the yen but not both.

Yield Curve Control (YCC) while an extraordinary measure is not unprecedented. During World War 2, Federal Reserve helped the US Treasury finance the cost of the war by implementing YCC. From middle of 1942 to around 1947 they capped the short-term T-Bills at 0.375% and long-term US Treasuries at 2.5%.

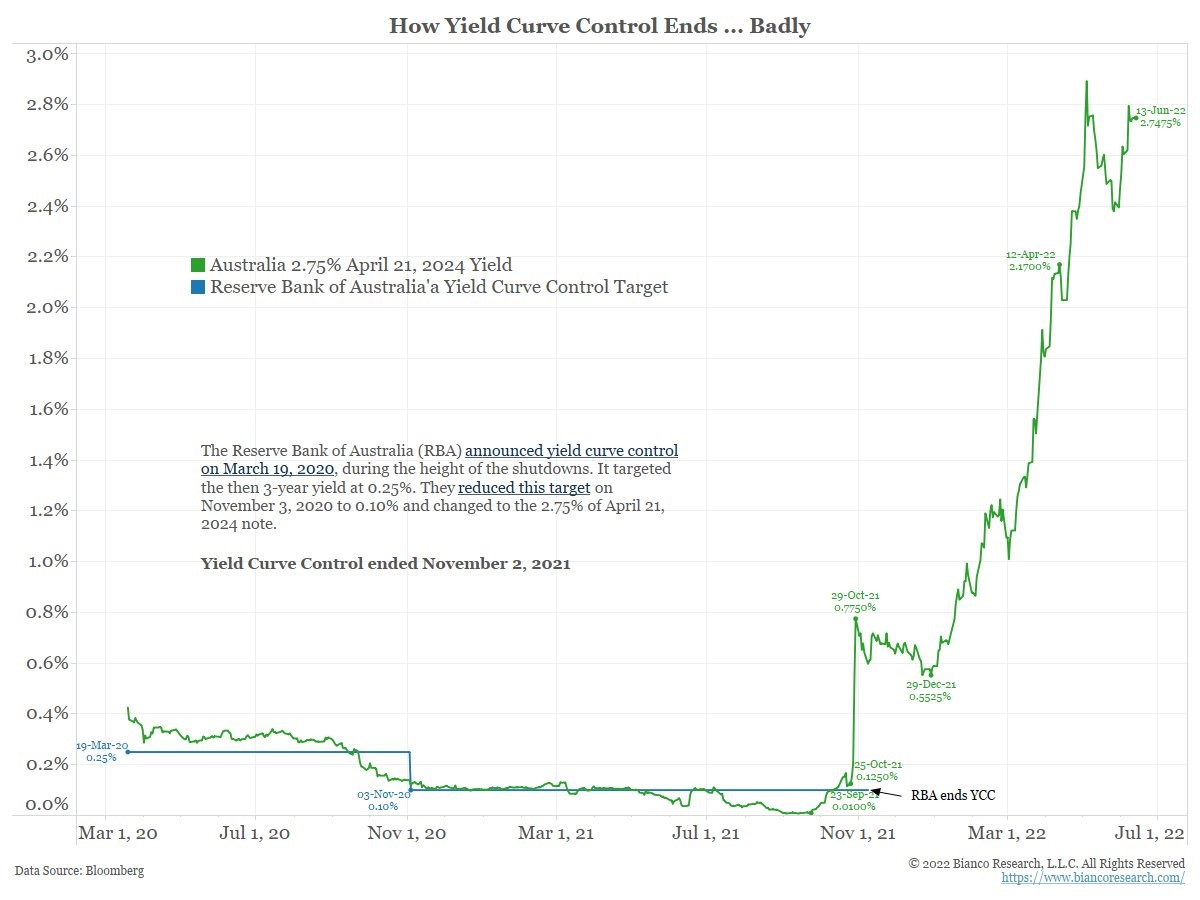

More recently Australia tried to do yield curve control on their 3-year yields during the pandemic.

Image courtesy: Bloomberg

While the policy worked well for a while eventually the (RBA) Reserve Bank of Australia started losing control as the bonds started hitting the upper limit of their range. Sensing “blood in the water” bond investors dumped Australian bonds causing the yields to skyrocket eventually forcing the RBA to abandon YCC.

Europe today is experiencing highest ever inflation in decades. This is due to variety of factors including high natural gas prices (imported from Russia) due to its sanctions on Russia over its invasion of Ukraine. To bring very high inflation under control ECB (European Central Bank) has to raise interest rates which are going to put upward pressure on yields.

In parallel, many European countries to provide relief to their citizens who now face gargantuan energy bills are putting price caps on energy bills. Few European nations are looking at nationalizing the private energy providers to keep them from going under. The cost of the difference in the energy bill paid by the consumer and what the electricity costs plus the nationalization of these energy providers will have to be made up by the government. While wealthier European nations which have budget surpluses can weather this storm many others will be forced to look at selling more government bonds to fund this. This new round of borrowing given the rising inflation concerns might mean that yields for some of these heavily indebted European nations will start to spike.

ECB has unveiled an anti-fragmentation tool this summer. Called the Transmission Protection Instrument or TPI, which lets ECB buy up bonds from indebted countries such as Italy to cap any excessive rise in their borrowing costs, helping limit financial fragmentation within the Euro Zone. After raising their rates for the 1st time in 11 years few months ago ECB again few weeks ago raised their interest rates by 75 bps. ECB on one hand is committed to further hikes to stamp out inflation but on the other hand might be forced to print more to save the yields from excessively rising in weaker European nations.

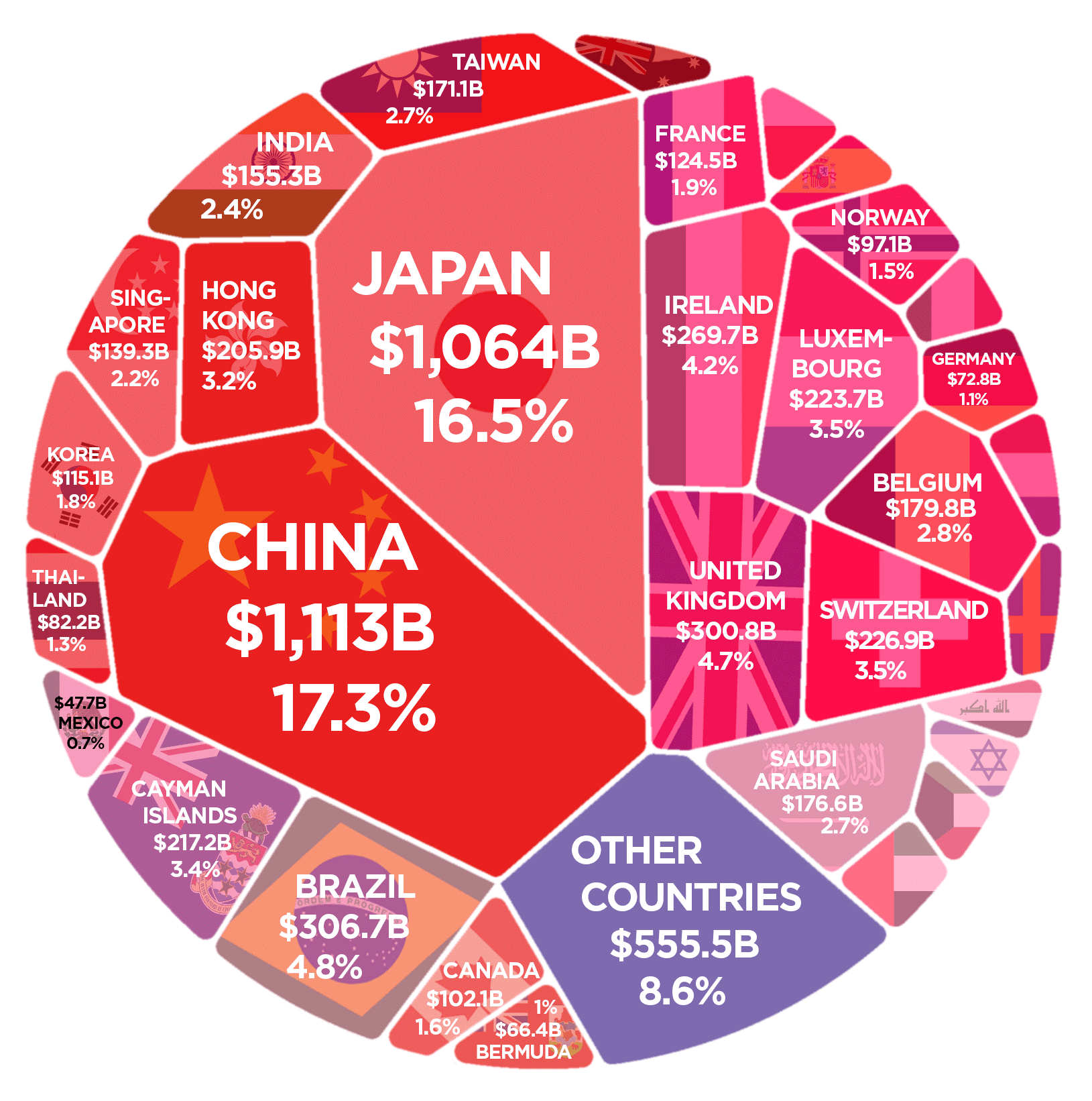

United States like many Western nations also has a massive inflation problem. The Federal Reserve has already hiked the interest rate 4 times this year and Fed chairman Jerome Powell has appeared very hawkish on more rate hikes to come over the next few months. He also has put the Fed (Federal Reserve) on a path to do 90B of QT (Quantitative Tightening) every month [ i.e., sell US Treasuries on a net basis] to reduce the enormous Fed balance sheet. These steps are not only causing yields to spike but also the QT process is dumping US Treasuries on the private market. The private market given the tough financial conditions and the volume being sold might not be able to absorb all these Treasuries which again puts upwards pressure on the yields (as there are not enough buyers). Foreign buyers have not been net buyer of Treasuries since 2015 (rather been a net seller). The biggest holders of US Treasuries have been Japan and China with a $1+T of treasuries each. Both in theory could absorb these extra Treasuries but right now both are selling US Treasuries.

Japan with the Yen in free fall is using its dollar-based assets including US Treasuries to shore its local currency Yen against further depreciation. China after having seen Russian assets frozen post-Ukraine invasion is more skittish to investments with US exposure. With an impending showdown with US and the West over Taiwan, China is also looking to sell US investments including US Treasuries to reduce risk before they make any possible moves on Taiwan. Many other nations seeing their currency depreciate against the US Dollar have also engaged in selling US Treasuries which means that there are fewer foreign buyers to absorb the Treasuries being offloaded by the Fed as part of QT.

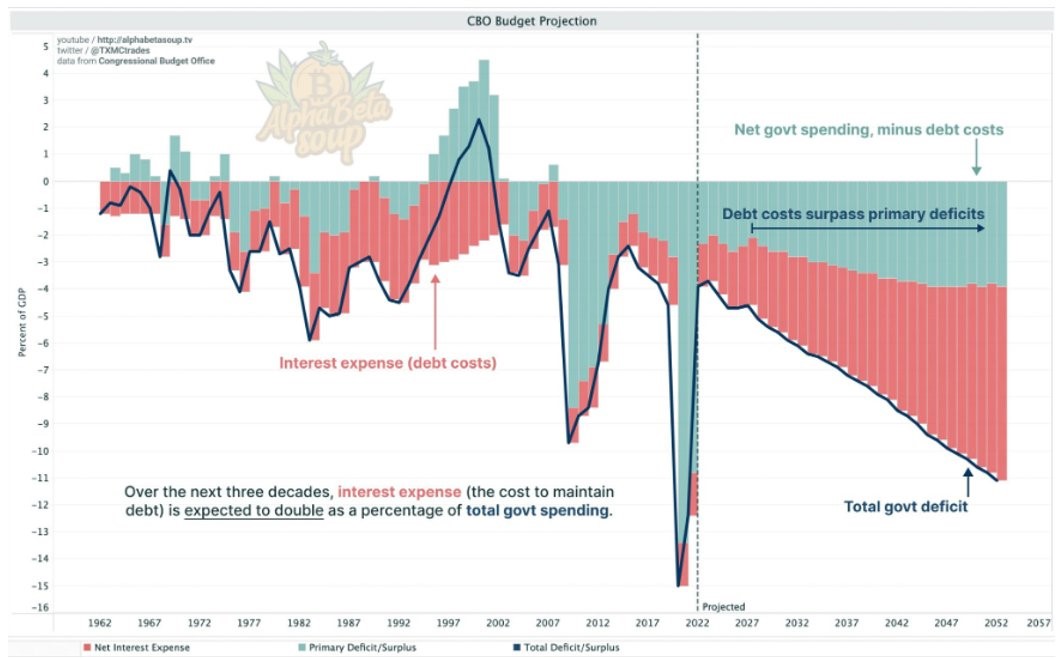

The higher interest rates means that US federal government has to spend more on interest expenses to service the debt. As older debt comes due it needs to be refinanced at a higher cost due to higher interest rates. Wall Street Journal reported that by end of May the interest costs had already risen to $666B . This on current trajectory with more interest rate hikes along the way to go north of $1T. CBO (Congressional Budget Office) which is a non-partisan forecasts the interest expenses to triple over the next decade (from already high current levels)

These high borrowing costs that Fed rate hikes imposes on the US government are not sustainable in the long run. To cover the increased borrowing costs government in theory can increase taxes and/or cut spending. It is doubtful that any government will make deep enough spending cuts or tax increases to fully cover these burgeoning deficits. These changes if passed by politicians will be unpalatable for most voters.

In today’s age of populism, no politician will risk their chances of getting re-elected (with highly unpopular tax increases or spending cuts). Fed might just have to cap the yields (with YCC) on the long-term interest rates to ensure that servicing of the debt does not create an unsustainable debt spiral or lead it towards an unlikely but a potential situation where they have to default on their debt.

Epilogue

Today the central banks are caught in a no-win situation. Raise rates and yields explode higher. Debt maturing in the future that needs to be refinanced and/or newly issued debt will become more expensive. Drop rates inflation runs hotter while purchasing power of its citizens gets eroded. Since lot of the debt is on the balance sheet of the central banks around the world, raising rates has additional headache of hurting their own investments. Not only the private bond holders get hit, even the central banks themselves have to take on losses.

The way out of it would be something what Japan is doing with YCC (Yield Curve Control) where the rates are capped. This does come at a cost of the currency taking a big hit as seen in Japan but that might be the “best of several bad choices”. Whichever nation does YCC will most likely lose the value of its currency (depreciation) as now in theory unlimited amount of money will have to be printed to cap the yields (to purchase in theory unlimited number of bonds).

Satsuki Katayama, the ruling Liberal Democratic Party's (LDP) head of a research commission on financial affairs, said Japan lacked effective means to combat the yen's fall. This shows that while pursuing YCC they are unable to do much about the fall of the Yen by themselves. As the currency loses value people will first flock to other stronger currencies like the US Dollar (as in case with Yen vs USD right now). When multiple nations pursue YCC all these fiat currencies will be inflated away, and people will exit fiat currencies to save their purchasing power. They will move into hard assets such as Gold, Real Estate, Bitcoin which either have a fixed supply or have a small steady new supply and thus cannot be inflated away like fiat currencies.

When former Fed chair Paul Volker in 1980’s jacked up interest rates to 20 percent the debt to GDP ratio was around 30 percent so he could do so without causing a massive headache of higher borrowing costs. Now with the US debt to GDP near the 125% range, they simply can’t afford very high-interest rates, or it risks crashing the system with too much debt that is very hard to pay back.

Europe and Japan similarly have very high levels of debt due to very loose monetary policy especially since the Global Financial Crisis (2008), They are also stuck in the same crisis of having to raise rates to curb inflation but not too much to break themselves with higher interest payments and big losses for the bondholders. World today with $300T worth of debt which is 3.5x the world GDP of $85T is currently on an unsustainable path. Many folks including legendary investor Ray Dalio have called today’s time as nearing the end of the long-term debt cycle. While some nations might adopt it willingly others might be pulled in forcibly by their own circumstances. Eventually, most of them will get there to YCC (Yield Curve Control) in one way or another.

Image source: The Hindu Business Line

Note: This article was originally published on Crowd Wisdom on September 17, 2022.

Comments