Combine Both Merchandise and Services Trade in Analyzing India’s External Sector Trends

- In Economics

- 09:11 PM, May 18, 2024

- Mukul Asher

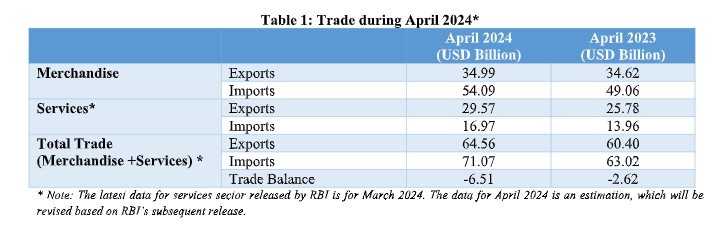

India’s external trade data for the first month, April, of the 2024-25 financial year has been recently released (Table 1).

Table 1 India’s External Trade for April 20241

Data in Table 1 suggest that while merchandise trade increased marginally over the corresponding period last year, the services exports exhibited a healthy growth of 14.7 percent. Moreover, while merchandise trade exhibited a deficit of USD 19.6 billion, services trade exhibited a surplus of USD 12.6 billion. Even then, the total external trade exhibited a deficit of USD 6.52 billion, larger than USD 2.62 billion last year. It is this overall deficit that is relevant for policy purposes.

According to the World Bank, India received USD 125 billion in remittances in 2023, and prospects for sustaining this flow are positive for 2024. Also, according to the Reserve Bank of India, India’s foreign exchange reserves were at a comfortable level of USD 644.15 billion as of May 10, 2024 so the overall trade deficit is very much manageable. This is a solid achievement given global volatility, and should be more widely recognized.

It should however be noted that the monthly figures usually do not represent a trend, and must be interpreted in a nuanced manner.

One other aspect regarding India’s external trade that is often overlooked by analysts is that the share of services trade in India’s external trade (at 45.8 percent in April 2024; and at 43.7 percent for 2023-24) is far higher than the global average of around 23 percent in 2023, half of services share for India. Analysts do expect a share of services in global trade to rise as the digital economy, and Artificial Intelligence (AI) based activities become more prominent.

In 2022, India’s share of merchandise exports in global exports was 1.82 percent, but in services, it was 4.38 percent, nearly two and a half times more. For imports, the respective shares were 3.82 and 2.81 percent respectively2.

It should also be noted that even as India is acquiring global capabilities in the selected manufacturing areas (e.g. electronics sector, defense sector, and pharma). It is acquiring even deeper and faster global capabilities in several service areas, including in global capability centres, and tourism (use of Indian airports as a transit hub is small but increasing). Plans are afoot for the development of ports and related logistics services, port modernisation, transshipment hubs in India, and port management capabilities abroad (The Chabahar port agreement with Iran and plans for ports in Sri Lanka are good examples) and space-related services.

On 13 May 2024, India signed an agreement with Iran to manage Chabahar port for ten years. For the first time, India will take over the management of a port overseas. This will provide India with better access to the Eurasian space3.

India’s Ports minister has indicated that India aims to replicate the Chabahar port model in other strategic locations and enhance maritime presence4.

India’s private sector Adani Group has become the first Indian port operator in Sri Lanka as construction of the Colombo Port's Western Container Terminal (WCT) is to be completed by 2025.

The group will have the majority stake in the West Container International Terminal Joint Venture (JV) which is valued at $700 million. US government agencies have partly funded this project by the Adani Group.

It will cater to growing economies in the Bay of Bengal, taking advantage of Sri Lanka’s prime position on major shipping routes and its proximity to these expanding markets.

The opportunity to capture transshipment cargo has prompted the Indian government to expedite its own mega project -- the Great Nicobar Port5.

India is a major global player in attracting GCCs (Global Capability Centres), which are offshore units of global companies and which require specialized talent, operational efficiencies, and cost competitiveness to attract.

India accounts for 45 percent of the GCCs in the world outside their home country, generates around USD 20 billion in revenue, and employs around 0.8 million professionals. GCCs in India are also moving up the value chain6.

India has made good progress in attracting data centre capability. India has reportedly surpassed such capacity in Asia Pacific (ex-China), overtaking Japan, Australia, Korea, and others. Moreover, its upcoming capacity during 2024-26 is also the highest among these countries. This could help in India’s service export competitiveness. India has 950 MW of installed capacity, with an additional 850 MW under development7.

The Main Message

The above analysis makes it abundantly clear that India’s monthly (and Annual) external trade data should not be analysed only from the merchandise trade perspective. Yet, sadly, nearly all mainstream print and TV media outlets emphasised only the increase in merchandise trade deficit in April 2024.

The media is strongly urged to view India’s trade data from a broader perspective as outlined above. Economic literacy levels of those reporting on economic news need substantial enhancement. In many cases, so does their mindset which views such news from a negative rather than a positive and constructive perspective. Unless this is done the media will continue to fall far short of fulfilling their responsibilities and will continue to not deserve public trust and credibility.

A Policy Suggestion

Given the importance of services trade for India, developing bilateral trade in services data, as is routinely undertaken for merchandise trade, with at least key trading partners such as the United States, United Kingdom, Japan, and Australia, merits serious consideration of the Indian policymakers and statistical agencies.

World Trade Organization (WTO) and the Organization for Economic Cooperation and Development (OECD) have jointly initiated collected of data on services, covering nearly three-fourth of the global trade in services. Indian agencies would thus have access to their methodology and data sources, though these would need to be adapted for the Indian context. Indian agencies should also aim to shorten the time period when such data are released.

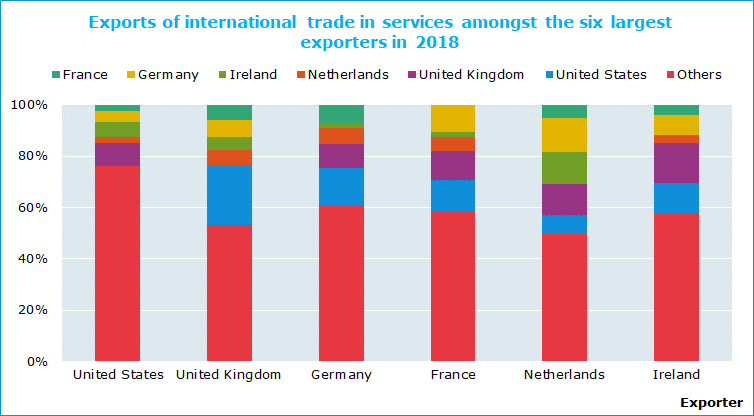

Table 2: Exports of International Trade in Services Among the Six Largest Exporters in 20188.

The six largest exporters of services are the United States, United Kingdom, Germany, France, and two countries with relatively small populations, the Netherlands and Ireland. This illustrates, the progress India needs to still makes in the services exports.

References

- https://pib.gov.in/PressReleaseIframePage.aspx?PRID=2020659#:~:text=India's%20total%20exports%20(Merchandise%20and,per%20cent%20over%20April%202023. -Accessed on May 15 2024

- https://www.wto.org/english/res_e/booksp_e/trade_profiles23_e.pdf -Accessed on 18 May 2024

- https://www.moneycontrol.com/news/business/india-to-ink-10-year-chabahar-port-management-pact-shipping-minister-sonowal-on-his-way-to-iran-12720557.html -Accessed on 18 May 2024

- https://economictimes.indiatimes.com/industry/transportation/shipping-/-transport/india-eyes-more-chabahar-like-pacts-ports-minister-sarbananda-sonowal/articleshow/110187093.cms?from=mdr-Accessed on 18 May 2024

- https://www.business-standard.com/companies/news/adani-s-colombo-port-terminal-gets-553-million-funding-from-us-dfi-123110801087_1.html-Accessed on 18 May 2024

- https://nasscom.in/about-us/what-we-do/industry-development/global-capability-centres -Accessed on 18 May 2024

- https://www.ibef.org/news/india-overtakes-australia-japan-and-singapore-in-data-centre-capacity-Accessed on 18 May 2024

- https://www.oecd.org/sdd/its/international-trade-in-services-statistics.htm -Accessed on 18 May 2024

Image source: Business Standard

Comments