CK Hutchison begins arbitration after Panama court cancels port licences

- In Reports

- 05:14 PM, Feb 04, 2026

- Myind Staff

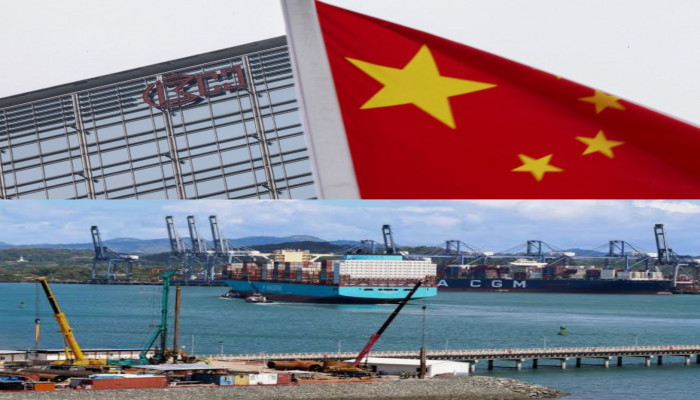

Hong Kong-based conglomerate CK Hutchison has launched international arbitration proceedings against Panama after the country’s Supreme Court annulled the company’s licences to operate two major ports linked to the Panama Canal. The company confirmed on Wednesday that its Panama Ports Company unit has officially started the arbitration process, a legal move that could take several years to settle.

The decision comes after Panama’s Supreme Court ruled last week that the contracts allowing CK Hutchison to operate the ports violated the country’s constitution. The court ruled that the agreements were unconstitutional because they granted the company exclusive privileges and tax exemptions.

Although arbitration has now begun, it remains uncertain how long the proceedings will take. Analysts said the legal dispute could drag on for a long time due to the complexity of the issue and the political sensitivity between the United States and China.

“This is an example of the increasing interconnection between international trade, geopolitics and law,” said Jason Karas, an international disputes specialist and managing partner of Karas So LLP in association with Mishcon de Reya.

The arbitration filing has increased uncertainty over the future ownership of the two ports, which CK Hutchison has been operating for nearly three decades. It also creates further doubt over the company’s planned $23 billion deal to sell its global port businesses.

In its statement to the Hong Kong Stock Exchange, CK Hutchison said, “The board strongly disagrees with the determination and corresponding actions in Panama.”

The company also added, “The group continues to consult with its legal counsel and reserves all rights, including recourse to additional national and international legal proceedings in the matter.”

Panama’s government did not immediately respond to a request for comment.

Ja Ian Chong, an associate professor of political science at the National University of Singapore, said arbitration cases often take years and depend on the willingness of governments to follow the ruling.

“Panama can just ignore CK Hutchison ... I think that’s apparent to CK Hutch. They probably want to show shareholders that they are doing all they legally can,” he said.

He further added that the company might also be trying to show the Beijing and Hong Kong governments it is taking all possible steps to avoid being blamed in the middle of U.S.-China tensions.

On Wednesday, CK Hutchison shares rose 2% in early trading, even as the Hang Seng Index fell 0.4%.

Meanwhile, China has strongly criticised Panama’s court ruling. On Tuesday, China warned Panama that there would be “heavy prices” to pay for the decision, calling it “absurd” and describing it as “shameful and pathetic”.

The two Panama Canal ports are key assets in a $23 billion buyout bid being led by BlackRock and Mediterranean Shipping Company (MSC). The deal involves CK Hutchison’s 43 ports spread across 23 countries. BlackRock and MSC did not immediately respond to a request for comment.

After Beijing criticised the deal, CK Hutchison said in July that it was discussing the inclusion of a Chinese “major strategic investor” in the consortium.

Sources said the investor was COSCO, and it was seeking a large stake in the consortium. However, other members reportedly wanted COSCO to remain a minority shareholder, and this difference became a major issue in negotiations.

The Supreme Court ruling in Panama has now raised questions about whether the deal can move forward. However, some analysts believe the transaction could still be completed without including the two Panama Canal ports.

“The deal may continue with the remaining ports. The twist is that with the two key ports' situation crystallised by the Panama Supreme Court, actually, the ports deal may have a clearer path to completion, from the legal perspective,” said Winston Ma, an adjunct professor at New York University School of Law.

Ma added that CK Hutchison could use the arbitration process to seek damages and compensation due to the cancellation of the contracts.

The dispute has also intensified broader tensions between the United States and China, as both countries compete for influence over major global trade routes. CK Hutchison’s Balboa and Cristobal ports are seen as strategically important locations in the Panama Canal, which is one of the main seaborne trade routes into the United States.

Balboa is located at the canal’s Pacific entrance, while Cristobal sits at the Atlantic entrance.

Some U.S. lawmakers welcomed the Panamanian court ruling and called it a “win for America.” U.S. President Donald Trump, who earlier supported the proposed $23 billion sale, has since said the United States should “take back” the Panama Canal due to concerns about Chinese influence.

In response to the uncertainty, APM Terminals Panama, a subsidiary of Maersk, said on Friday that it would be willing to temporarily operate the Balboa and Cristobal terminals to ensure there is no disruption to regional and global trade.

Comments