China overtakes US to grab top spot in list of richest countries

- In Reports

- 05:43 PM, Nov 17, 2021

- Myind Staff

According to the research arm of consultants McKinsey & Corporation, the Global wealth has tripled over the last two decades with China overtaking the United States for the top spot worldwide.

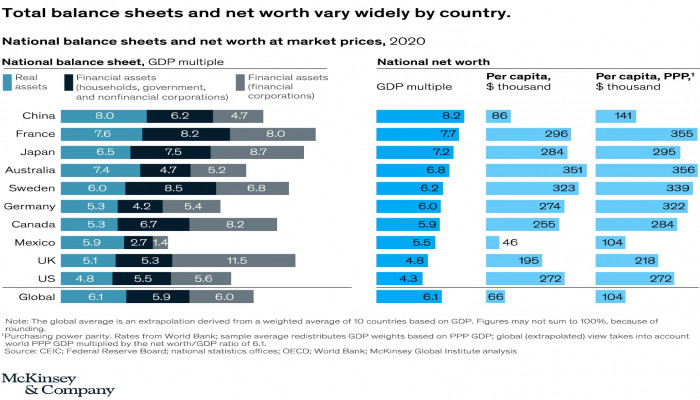

The study says, the global net worth worldwide rose to $514 trillion in 2020, from $156 trillion in 2000. McKinsey & Corporation examines the national balance sheets of ten countries representing more than 60% of world income. It includes countries like Australia, Canada, China, France, Germany, Japan, Mexico, Sweden, the United Kingdom, and the United States.

“We are now wealthier than we have ever been,” said Jan Mischke, a partner at the McKinsey Global Institute in Zurich.

Among the ten countries, China accounted for 50 percent of the growth in net worth, or wealth, from 2000 to 2020, followed by the United States, at 22 percent. Japan, which held 31 percent of the ten economies’ wealth in 2000, held just 11 percent in 2020.

According to the study, China accounted for almost one-third of the increase. Its wealth skyrocketed to $120 trillion from a mere $7 trillion in 2000, the year before it joined the World Trade Organization, speeding its economic ascent. Whereas the US saw its net worth more than double over the period to $90 trillion.

In both countries more than two-thirds of the wealth is held by the richest 10% of households, and their share has been increasing.

As computed by McKinsey, 68% of global net worth is stored in real estate. The balance is held in such things as infrastructure, machinery and equipment and, to a much lesser extent, so-called intangibles like intellectual property and patents. Financial assets are not counted in the global wealth calculations because they are effectively offset by liabilities.

The rise in net worth over the past two decades has outstripped the increase in global gross domestic product and has been fuelled by ballooning property prices pumped up by declining interest rates, according to McKinsey.

It found that asset prices are almost 50% above their long-run average relative to income. That raises questions about the sustainability of the wealth boom.

“Net worth via price increases above and beyond inflation is questionable in so many ways,” Mischke said. “It comes with all kinds of side effects.”

Therefore, according to the study, an ideal resolution would be for the world’s wealth to find its way into more productive investments that expand global GDP.

Image Courtesy: McKinsey

Comments