Challenges in Economic Management in Cambodia

- In Economics

- 10:14 AM, Nov 14, 2020

- Mukul Asher

Theme

Cambodia is a country located in southeast Asia, with a population of 16.25 million in 2018. Its nominal GDP (Gross Domestic product) in 2019 was estimated at USD 28.9 Billion. With per capita GDP of USD 1625.

This column discusses economic challenges which need to be addressed by Cambodia as it manages the Covid-19 Pandemic, global geo-political and geo-economic uncertainties, digital age, and disruptive technologies.

Total reported cases of covid-19 in Cambodia are very low. As of 12 November 2020, it had 301 total cases, or only 18 per million population (global average of 6747) and no deaths1.

The impact of Covid-19 pandemic on Cambodia arises from how the Pandemic has impacted its key trading partners.

Economic Structure of Cambodia

Cambodia is well integrated into the global economic, with external sector as an important engine of growth. For the 2015 -17 period, its trade per capita was USD 911, and trade as percentage of GDP Was 71.2.

Over 90 percent of Cambodia’s merchandise exports are labour intensive manufacturing goods, mainly textiles, and shoes, and recently electronics. In services exports, 82 percent is accounted for by travel services. In services imports, transport (about half), and travel (about one-third) are prominent 2.

World Trade Organization 2020. Trade Profiles for 2018.

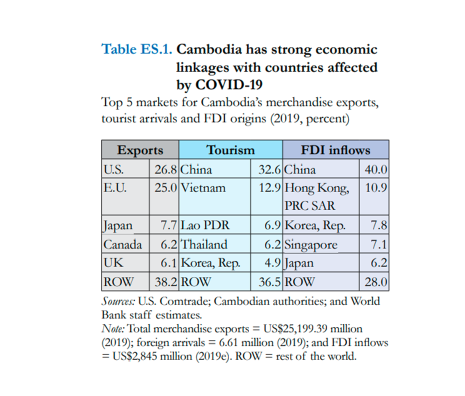

Cambodia has strong economic linkages with countries affected by Covid-19 pandemic as shown in Table 1.

Table 1

Source: The World Bank, May 2020, Cambodia in the time of Covid-193

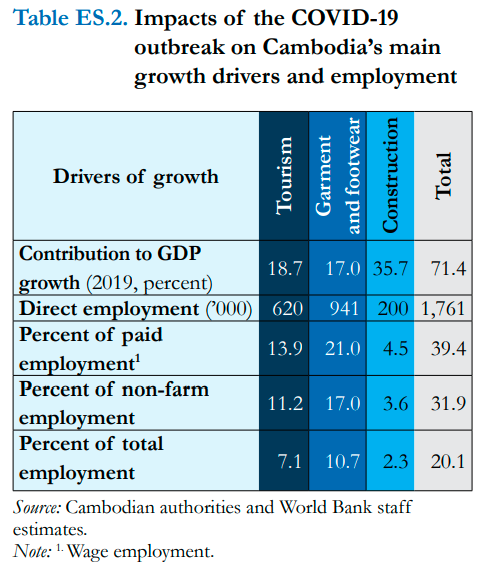

Table 2

Key points from Table 1 and 2 may be summarized as follows:

- Contribution to GDP growth from Construction in GDP is over one-third is high. So are contributions from Tourism, and garment and footwear. A visitor on the average stays for seven nights in Cambodia.

- The above three contribute nearly three-fourth towards GDP growth.

- At least 1.76 million jobs are currently at risk due to the COVID-19 outbreak. The collapse of the growth drivers has not only hurt economic growth but has also caused unemployment to potentially sore to nearly 20 percent4.

- Partial withdrawal of trade preferences for Cambodia by the European Union (it accounted for 45 percent of Cambodia’s exports in 2018) under EBA (Everything but Arms) scheme poses another challenge.

- IMF (November 2019) argues that this could “… have a large negative impact on exports and growth in the short-run…Suspension would lead to a permanent decline in garment sector output and employment in the long-run” 5.

Another challenge arises from high concentration of FDI. About two-thirds of FDI is from China and Hong Kong; and over half of FDI is in real estate, and quarter in tourism. This limits future diversification and growth.

- About half of Cambodia’s debt is owed to China, and a significant proportion to ADB. IMF’s Debt Sustainability Framework indicates that Cambodia remains at low risk of debt distress, despite an increase in both debt disbursements and Public-Private Partnerships (PPP) to finance needed infrastructure investment.

Short-term risks to public debt stem from the materialization of contingent liabilities, including from PPPs, and export and growth shocks

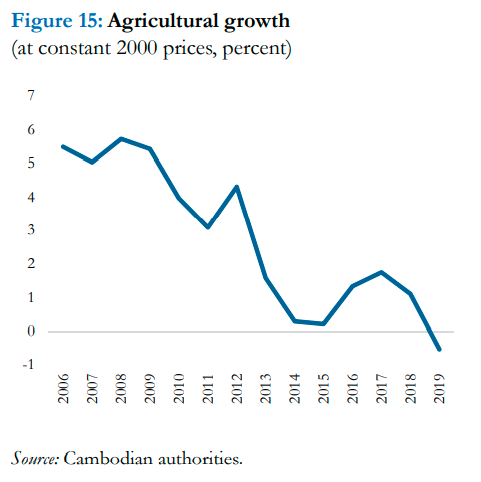

Contribution to agriculture in Cambodia which employs large proportion of population, is low. Its growth in constant terms has been declining for several years, and turned negative in 2019, before COVID-19 Pandemic (Figure 1). This has labour absorption implications. Moreover, agriculture sector is overdependent on rice as a crop.

Figure 16

The COVID-19 outbreak is hitting Cambodia’s revenue base. The export and construction sectors are the main sources of direct revenues and indirect (and international trade) revenues, respectively. The least affected agriculture sector is tax-exempt.

It is highly likely that revenue collection in 2020 will be significantly below the budget target. The overall fiscal deficit (including grants) is therefore projected to widen to 9.0 percent of GDP in 2020, down from a surplus of 0.5 percent in 2019; and will remain high at 7.6 percent of GDP in 2021. This makes fiscal sustainability a major challenge.

Cambodia’s government consumption declined by 9.1 percent in 2019; projected to increase by 6.7 percent in 2020, and projected to decline sharply by 16.7 percent in 2021.

The policymakers could consider protecting operations and maintenance expenditure on assets, so their quality does not deteriorate.

Gross Fixed Capital formation is projected to decline from 10.7 Percent In 2019 to 4.8 percent in 2020, before sharply increasing to 13.2 percent in 2021, before again decreasing to 7.4 percent in 2022. Fixed capital Formation is therefore expected to be volatile.

The ADB has argued that:

“A concern has been that COVID-19 could destabilize the financial industry or rapidly deplete foreign exchange reserves. The annualized current account deficit widened to the equivalent of 22.7% of GDP in the first quarter of 2020, but capital inflow ensured stable reserves.” The deficit is projected to remain at 17.8 percent of GDP in 20217.

A current account deficit happens when a country spends more money on what it imports compared to the money it receives for what it exports. That means there is more money leaving the country than what is coming in. The current account of a country is the money it receives and pays for goods and services, investments, and other things such as any money sent abroad.

Liquidity risks also remain elevated, as financial institutions rely on funding from abroad, including from parent banks (to banks). The concentration of FDI inflows in a few sectors (namely banking, construction and real estate) combined with bank lending primarily in construction and real estate creates an additional source of risk.

The risks stemming from an overleveraged financial sector are rising. Several financial sector vulnerabilities could exacerbate the COVID-19 shock. These vulnerabilities include high credit concentration, related party lending risks, lack of consolidated cross-border supervision and gaps in implementation of risk-based supervision.

The Covid-19 Pandemic is also likely to adversely affect Cambodia’s inflow of remittances from abroad.

In 2019, according to the World Bank, Cambodia received USD 1.6 Billion in Remittances from abroad, equivalent to 5.9 percent of GDP. This appears an underestimate as some put the inflow at 2.8 Billion USD. How Covid-19 pandemic affects this flow in 2020 and beyond need to be watched8.

Growth Projections

The growth projections show considerable variation.

IMF’s, World economic Outlook projects real GDP for 2020 at between negative 1.8 to negative 2.8 percent depending on policy responses. It projects a positive growth of between 6.8 and 8.0 percent for 2021.

Asian Development Bank (ADB) projects negative 4 percent for 2020; and positive 5.9 percent for 2021.

Both institutions assess that there is downside risk to growth. Thus, the ADB assesses that for Cambodia:

Downside risks to the forecasts include unexpectedly deep or persistent weakness in GTF (garments, travel goods, and footwear) or construction, poor harvests after deficient rainfall in June–July (2020) and further suppression of consumer demand as more households suffer financial distress. Monetary policy is limited by dollarization, as almost 90 percent of transactions within the economy are carried out in USD rather than the domestic currency, Riel7.

Priorities to Meet Economic Challenges

Based on the Reports of various multilateral institutions, and my own analysis, the following policy measures are suggested for Cambodia to help address the economic challenges.

- Cambodia needs to safeguard fiscal sustainability and promote inclusion. Continued strong revenue mobilization efforts and a prudent fiscal stance supported by restraining non-development current spending will enable additional spending to address development needs.

Expenditures should be oriented towards supporting inclusive growth through priority infrastructure investment, as well as health and education spending.

Fiscal governance should be further strengthened through reforms aimed at improving revenue administration, public financial management and spending efficiency.

Managing fiscal risks from contingent liabilities calls for strengthening the PPP (public private Partnership) Framework). Contingent liabilities are fiscal obligations contingent on the occurrence of particular events. But these obligations are not budgeted and accounted for, nor are they considered in conventional fiscal analysis.

- Cambodia needs to address macro-financial risks. Prompt actions are needed to address elevated financial sector vulnerabilities and to improve the external position through moderating credit growth and implementing targeted macroprudential policies.

This includes a prompt, broad-based policy response to address risks associated with the real-estate sector.

Enhancing regulation and supervision, promptly introducing a comprehensive crisis management framework and improving financial sector oversight, including through closing gaps in the AML/CFT regime, would help build financial resilience.

- Cambodia needs to better support progress towards the SDGs. (Sustainable Development Goals). Policies should be geared towards addressing sizeable spending needs to reach SDG targets in health, education and infrastructure, with support from the private sector and international donors.

Important challenges persist, and additional spending for SDGs is required. The quality and quantity of social services and physical infrastructure should continue to be improved.

The estimates indicate that total additional spending for SDGs needs amount to about 7½ percent of GDP in 2030. Education and health account for about two thirds. Spending needs to reach universal basic and safely managed access to water and sanitation seem manageable.

Universal access to electricity and road would require an additional annual spending of about 2½ percent of 2030 GDP but could be larger due to rehabilitation and maintenance costs.

This suggests need to create large additional fiscal space, around 10 percent of GDP between 2020 and 2030, or 1 percent of GDP per year, in Cambodia.

- Accelerated implementation of structural reforms is needed to remove structural constraints to growth, correct external imbalances, address governance and corruption weaknesses and promote sustainable and inclusive development.

- While steady progress has been made, additional efforts are needed to address data gaps, and improve data quality and transparency. This requires progress in improving the national statistical system.

Concluding Remarks

Cambodia has been making steady progress in generating growth and improving socio-economic indicators by integrating with the world economy and by improving its government systems and processes.

It however does face challenges in diversifying its economy and its trading partners, and in coping with the impact of Covid-19 Pandemic on its external sector partners.

A better understanding of its social and economic indicators would emerge as its national statistical system is modernized.

There are strong indications that the leadership of the country recognizes that continued economic progress is essential for realizing its own goals. This is a strong positive factor as Cambodia charts its policies.

References

- https://www.worldometers.info/coronavirus/?utm_campaign=homeAdvegas1?%22%20%5Cl%20%22countries -Accessed on 12 November 2020.

- https://www.wto.org/english/res_e/booksp_e/trade_profiles18_e.pdf -Accessed on 25 October 2020

- https://openknowledge.worldbank.org/handle/10986/33826 -Accessed on 20 October 20

- The World Bank, May 2020, Cambodia in the time of Covid-19, https://openknowledge.worldbank.org/handle/10986/33826

- https://www.imf.org/en/Publications/CR/Issues/2019/12/23/Cambodia-2019-Article-IV-Consultation-Press-Release-Staff-Report-and-Statement-by-the-48912 -Accessed on 23 October 2020

- Source: The World Bank, May 2020, Cambodia in the time of Covid-19, https://openknowledge.worldbank.org/handle/10986/33826 -Accessed on 23 October 2020

- Asian Development Bank (ADB), September 2020, Asian Development Outlook 2020 Update: Wellness in Worrying Times, https://www.adb.org/sites/default/files/publication/635666/ado2020-update.pdf -Accessed on 23 October 2020

- https://www.knomad.org/sites/default/files/2020-06/R8_Migration%26Remittances_brief32.pdf-Accessed on 24 October 2020

Image provided by the author.

Disclaimer: The opinions expressed within this article are the personal opinions of the author. MyIndMakers is not responsible for the accuracy, completeness, suitability, or validity of any information on this article. All information is provided on an as-is basis. The information, facts or opinions appearing in the article do not reflect the views of MyindMakers and it does not assume any responsibility or liability for the same.

Comments