Adani Ports cancels $553 million DFC loan for Colombo Terminal, opts for self-funding

- In Reports

- 09:40 PM, Dec 11, 2024

- Myind Staff

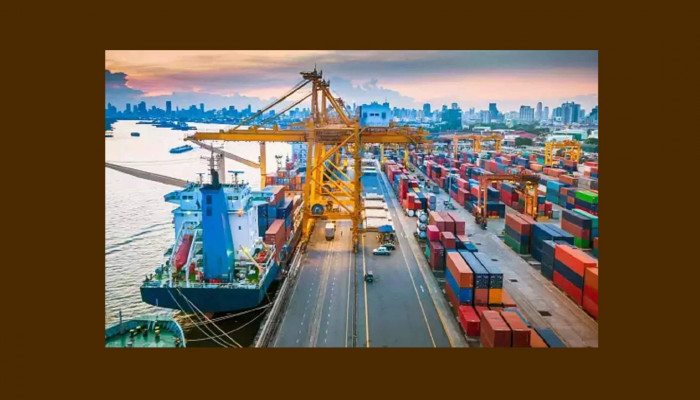

Adani Ports has cancelled a $553 million DFC loan for the Colombo Terminal project. The loan was intended for the development of the Colombo West International Terminal project in Sri Lanka.

In an official statement, the company announced that it would instead utilise its internal resources to fund the project, aligning with its broader capital management strategies.

Following this announcement, Adani Ports’ shares witnessed a marginal decline of 0.80%, trading at ₹1,238.60 at the time of reporting. This strategic move underscores APSEZ’s focus on financial flexibility while continuing its expansion efforts in critical global markets.

In a regulatory filing on Tuesday, Adani Ports said the Colombo project remains on schedule to be operational by early 2025. "We would like to inform that CWIT project in Sri Lanka is progressing well and is on track for commissioning by early next year. The project will be financed through the company’s internal accruals and capital management plan. We have withdrawn our request for financing from the DFC," Adani Ports said in its exchange filing.

Last year, the US International Development Finance Corporation (DFC) agreed to extend $553 million in financing to support the development, construction, and operation of the Colombo West International Terminal in Sri Lanka.

The terminal project is being executed through a consortium that includes Adani Ports, John Keells Holdings Plc, and the Sri Lanka Ports Authority (SLPA), with Adani Ports holding a majority stake of 51% in the venture.

The decision by Adani Ports and Special Economic Zone Ltd (APSEZ) to cancel a $553 million loan from the US International Development Finance Corporation (DFC) for the Colombo West International Terminal project comes amid strategic, operational and legal complexities.

The DFC loan, initially viewed as part of a US effort to counter China’s expanding influence in the Indian Ocean Region, encountered delays due to amendments requested in the agreement between Adani Ports and the Sri Lanka Ports Authority (SLPA). These amendments underwent a review by Sri Lanka’s Attorney General. With the terminal nearing completion, Adani Ports chose to proceed without external funding, citing confidence in its ability to finance the project internally. Reports suggest the company’s decision was influenced by delays in finalising the loan.

Adani Ports signed the deal for the Colombo terminal in September 2021, committing over $700 million to develop Sri Lanka's largest and deepest container terminal. Designed to accommodate Ultra Large Container Vessels (ULCVs) with capacities of 24,000 TEUs, the terminal will feature a quay length of 1,400 meters and a depth of 20 meters. Once operational, it is projected to handle over 3.2 million TEUs annually, addressing the high utilisation rates of the Port of Colombo, which currently operates at over 90% capacity.

The project, which aims to bolster Sri Lanka’s position on global shipping routes and support economies in the Bay of Bengal region, is progressing toward completion. Phase 1 of the Colombo West International Terminal is expected to become operational by the first quarter of 2025, meeting the growing demand for efficient transhipment services in the region.

The self-funding decision also coincides with ongoing legal challenges faced by the Adani Group. In November, the US Department of Justice charged Adani Group Chairman Gautam Adani, his nephew, and others with conspiring to pay $265 million in bribes to secure solar power contracts in India. These allegations have cast a shadow on the company as it advances its international projects.

By leveraging its internal resources, Adani Ports signals its commitment to completing the Colombo project while navigating the broader challenges associated with regulatory and legal scrutiny.

The Adani Group has firmly denied allegations of bribery as "baseless" and has vowed to exhaust all legal remedies to defend its position. These allegations, which surfaced in November, led the US International Development Finance Corporation (DFC) to announce a review of the situation. Notably, no funds from the DFC had been disbursed to Adani Ports as part of the $553 million loan agreement.

Despite the legal challenges, Adani Ports continues to demonstrate robust financial health. As of September 30, 2024, the company held cash reserves of $1.1 billion and reported an operating profit of $2.3 billion over the previous 12 months. This strong financial footing has enabled the company to proceed with the Colombo West International Terminal project using internal resources, aligning with its long-term capital management strategy.

Adani Ports’ decision to self-finance the terminal underscores its operational resilience and commitment to advancing key infrastructure projects while addressing external challenges.

Comments